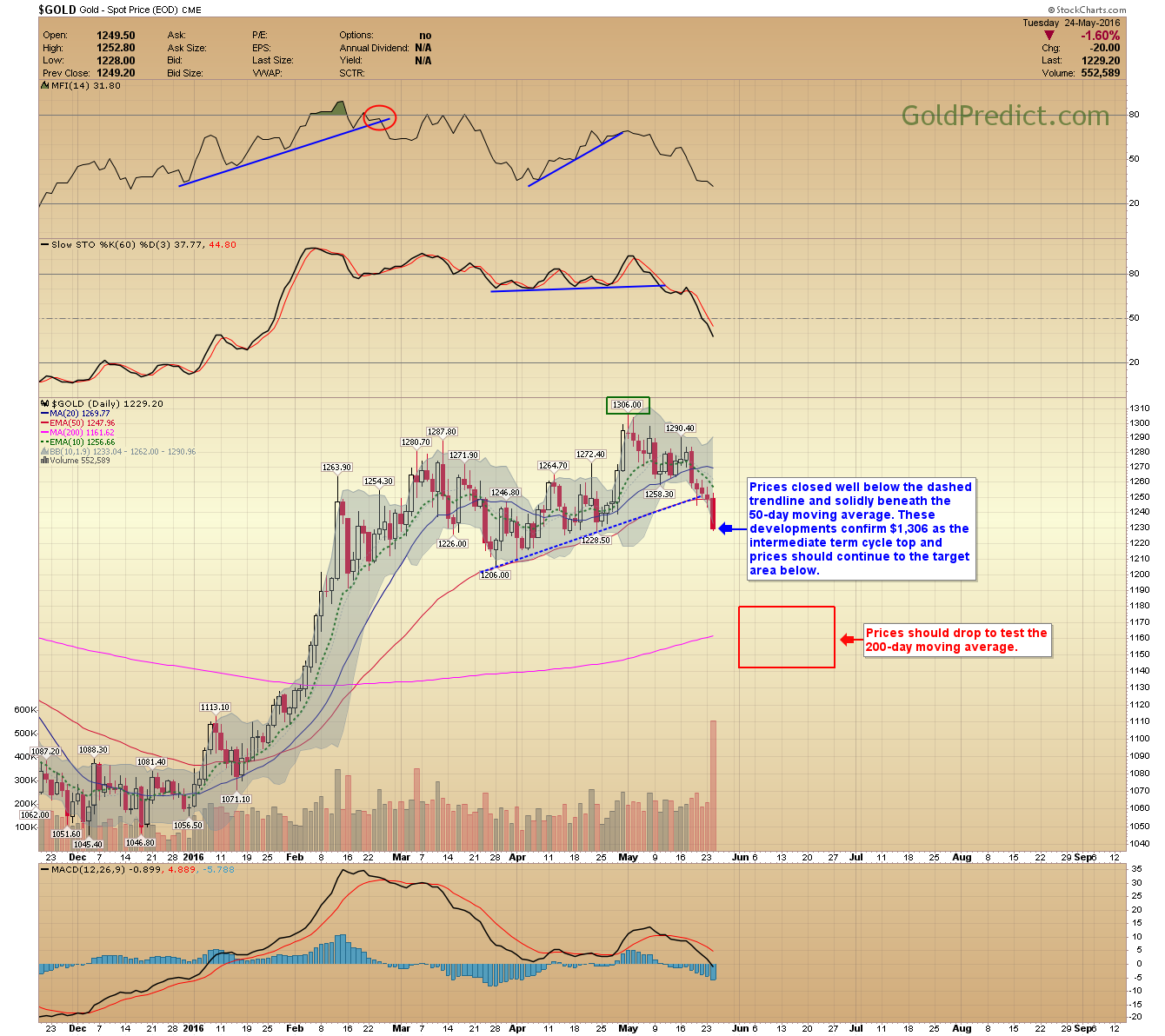

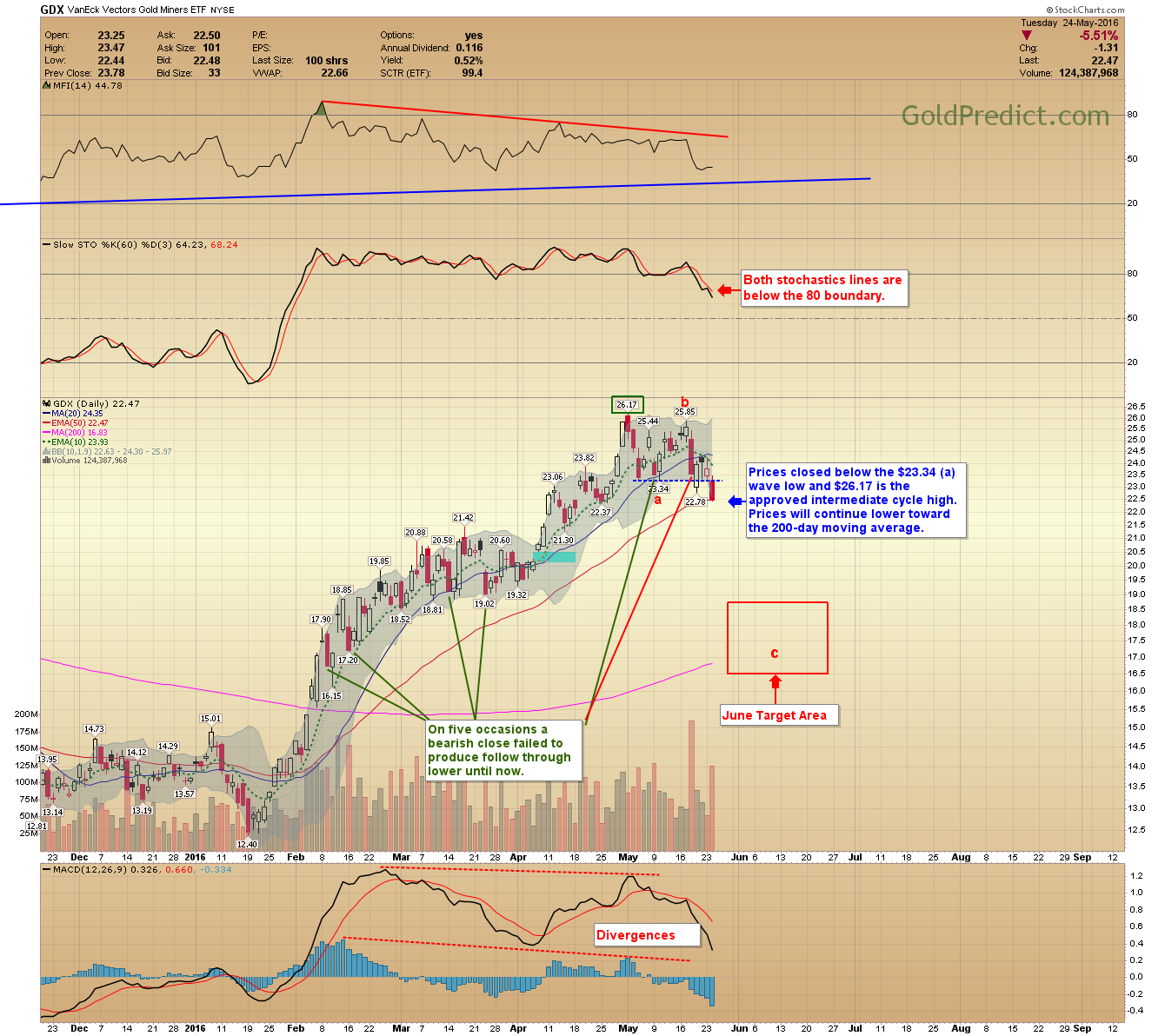

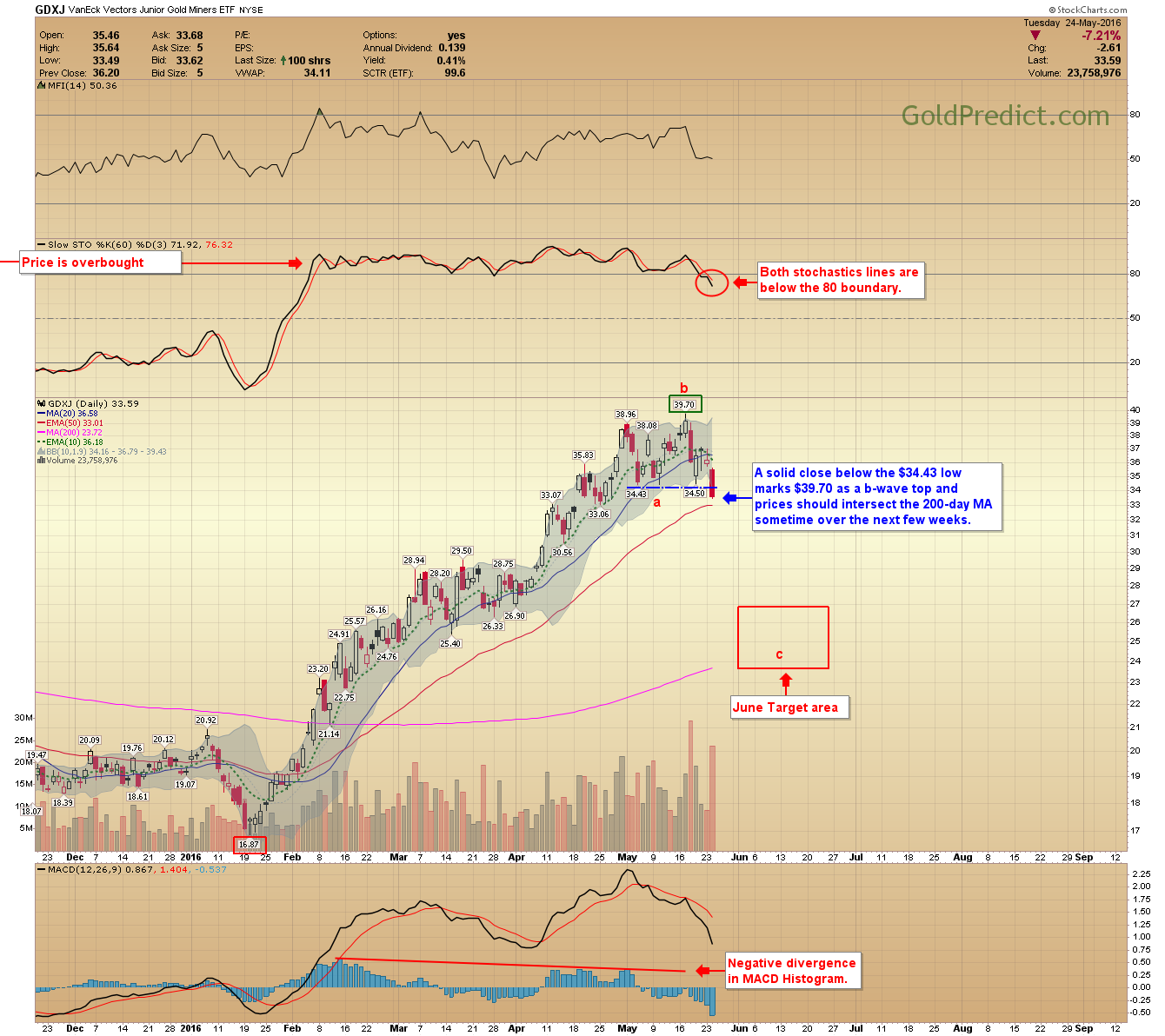

Prices dropped enough to confirm intermediate cycle tops in ALL metal sectors today. We expect prices to descend further into a June low and that bottom will form the next 6-month cycle low.

US DOLLAR - The dollar consolidated three days in a sideways manner; prices should rally to the 200-day moving average next.

GOLD - Prices closed well below the dashed trendline and solidly beneath the 50-day moving average. These developments confirm $1,306 as the intermediate term cycle top and prices should continue to the target area.

SILVER - Prices are rapidly approaching the target area, and $18.06 is indeed the 6-month cycle top.

VanEck Vectors Gold Miners (NYSE:GDX) - Prices closed below the $23.34 (a) wave low and $26.17 is the accepted intermediate cycle top. Prices will continue lower toward the 200-day moving average. Note: Both stochastics lines are decisively below the overbought (80) boundary.

VanEck Vectors Junior Gold Miners (NYSE:GDXJ) - A solid close beneath the $34.43 temporary low marks $39.70 as the b-wave top, prices should converge with the 200-day MA over the next few weeks.

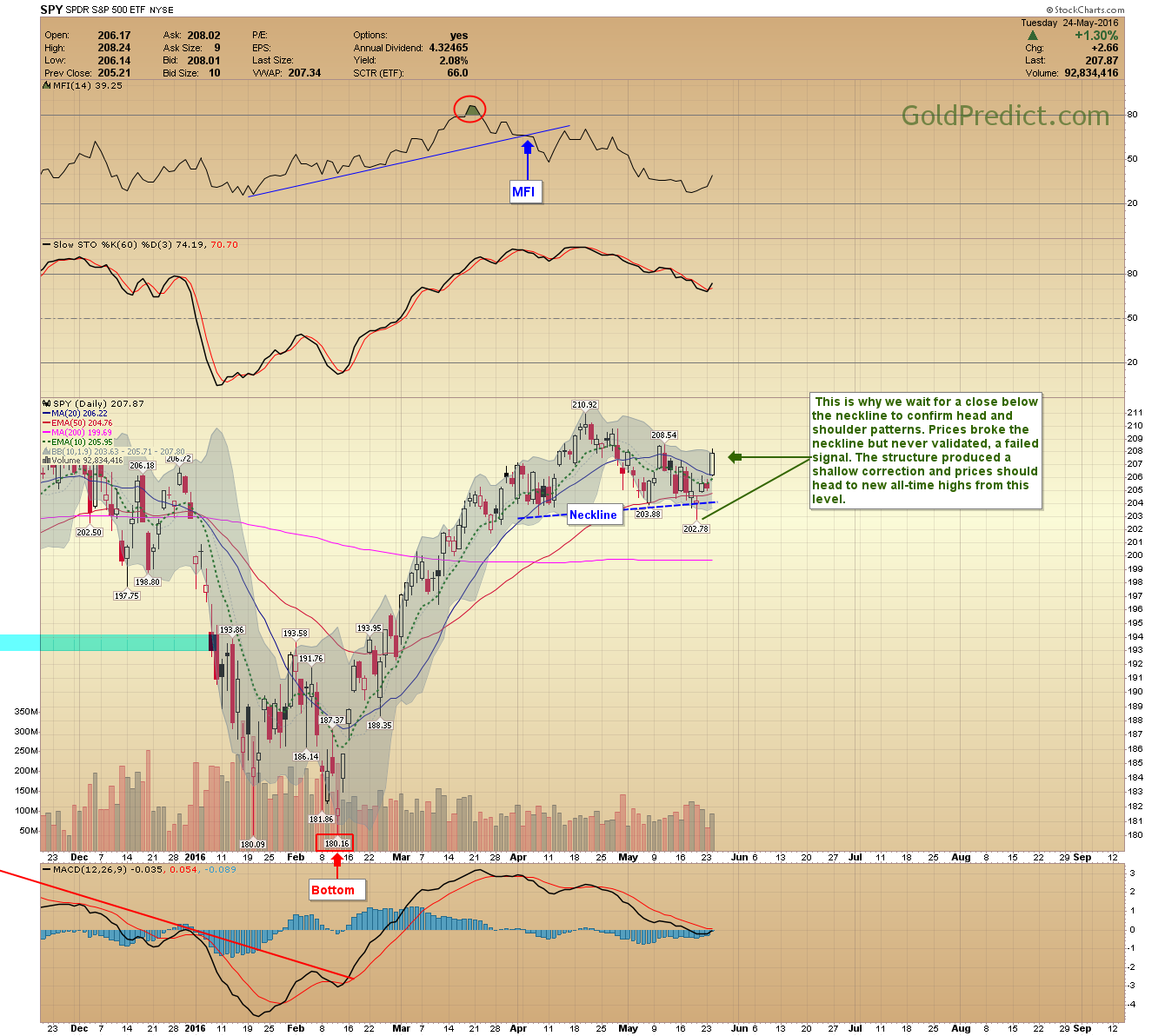

SPDR S&P 500 (NYSE:SPY) - This is why we wait for a close below the neckline to confirm head and shoulder patterns. Prices broke the neckline but never validated, a failed signal. The structure produced a shallow correction and prices should head to new all-time highs from this level.

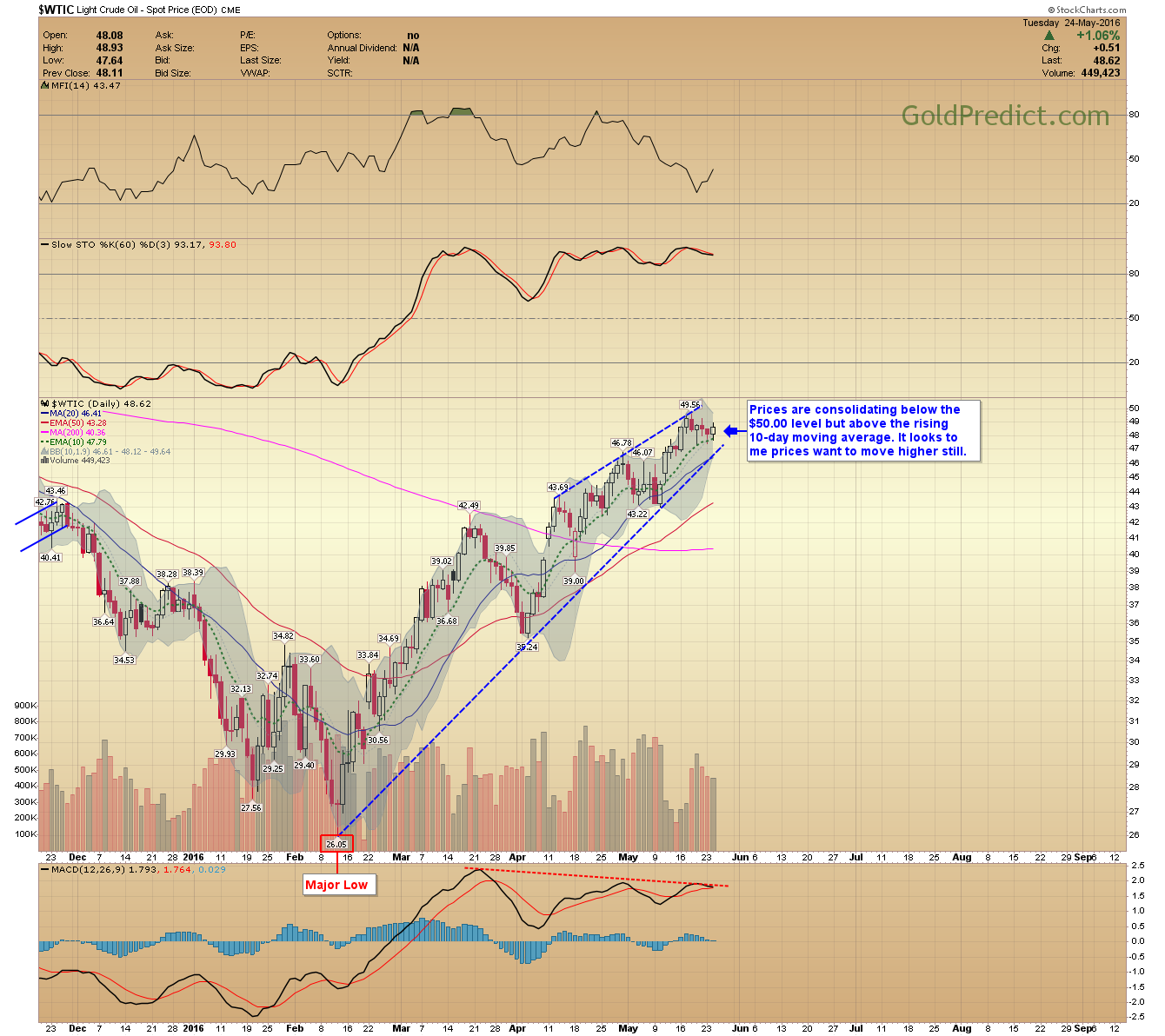

WTIC - Prices are consolidating below the $50.00 level and are remaining above the rising 10-day moving average. There looks to be unfinished business above $50.00.