Gold Today: New York closed yesterday at $1,279.70. London opened at $1,270.00 today.

Overall the dollar was stronger against global currencies, early today. Before London’s opening:

- The $: € was stronger at $1.1725 after the yesterday’s $1.1740: €1.

- The Dollar index was stronger at 93.89 after yesterday’s 93.73.

- The Yen was weaker at 110.86 after yesterday’s 110.33:$1.

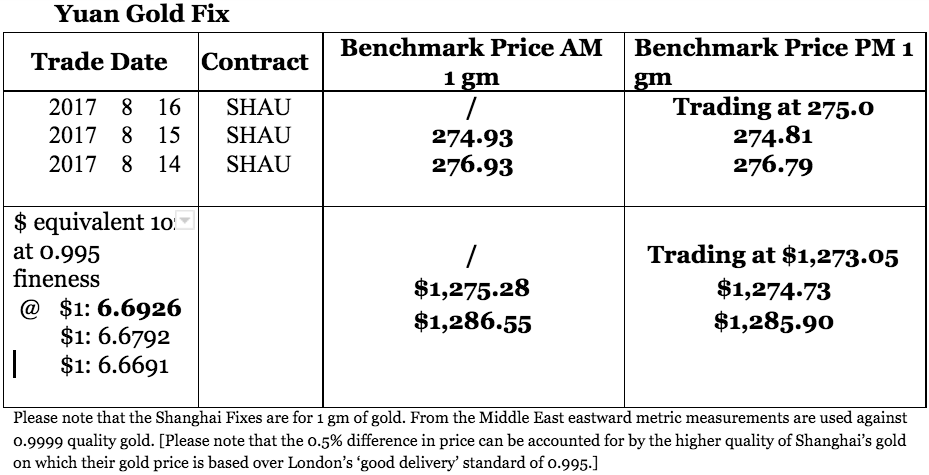

- The Yuan was much weaker at 6.6926 after yesterday’s 6.6792: $1.

- The Pound Sterling was weaker at $1.2883 after yesterday’s $1.2957: £1

New York closed $5.00 higher than Shanghai’s close yesterday. Then today sees Shanghai dropping the gold price once again just before London opened, which lead to London’s prices being lower for the same reason as yesterday, as the dollar continued higher, in its falling

pattern.

Shanghai continues to lead the way down, but following a stronger dollar as it adjusts to

dollar gold prices.

Silver Today: Silver closed at $16.71 yesterday after $17.07 at New York’s

close Monday.

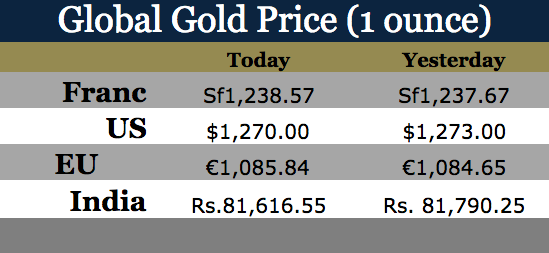

LBMA price setting: The LBMA gold price was set today at $1,270.15 from yesterday’s $1,274.60. The gold price in the euro was set again at €1,084.67 after yesterday’s €1,084.67.

Just before the opening of New York the gold price was trading at $1,270.00 and in the euro at €1,085.84. At the same time, the silver price was trading at $16.71.

Gold (very short-term) The gold price should consolidate, in New York today.

Silver (very short-term) The silver price should consolidate, in New York today.

Price Drivers

The dollar continues to rise taking gold prices in the dollar down. You will note that the euro gold price is barely changing, showing that this is not gold’s trading pattern, simply adjustments to the gold prices as currency exchange rates change.

The Fed Minutes are due out today, which the press is saying will impact on gold. It will be a factor no doubt, but the U.S. data of late and since the last meeting has been disappointing. Indeed, it is becoming clear based on the data that inflation falling is a deep worry. We read the indications, post the FOMC meeting as indicative of no rate hike but there is a possibility that the Fed’s Balance very slow decrease may still be on the cards. However, we do not think that this is sufficient to be a negative factor on the global gold price. Yes, it may slow U.S. demand until more negative data on inflation comes out, but it will have little to any impact on global gold demand.

India: With no duties being applied to gold jewelry exported from India the opportunity to export it, eventually to reach countries like Thailand, a lot of gold coins and medallions have left the country [15% of all jewelry exported is in this form]. This has been then, exported from Thailand back to India duty free because of the Trade Agreement with Thailand. The government of India has banned exports of gold of a carat level above 22 carats.

This would make it more difficult to establish the value of the gold, but we suspect the canny Indian gold dealers would have little difficulty in maintaining this trade, with a little bit of refining brought in. And that need not be that expensive! Such is the gold trade in India.

Gold ETFs: Yesterday there were no purchases or sales into or from the SPDR Gold Shares (NYSE:GLD) ETF or the Gold Trust (NYSE:GLDW) yesterday. The SPDR gold ETF and Gold Trust holdings are at 791.008 tonnes and at 213.28 tonnes respectively.

Since January 4th 2016, 166.645 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust.

Since January 6th 2017, 4.679 tonnes to the gold ETFs we follow.