Today is a day off in most trading venues in Europe and America with limited commodity market dynamics. However, it is an excellent reason to take a closer look at the recent developments in oil and gold.

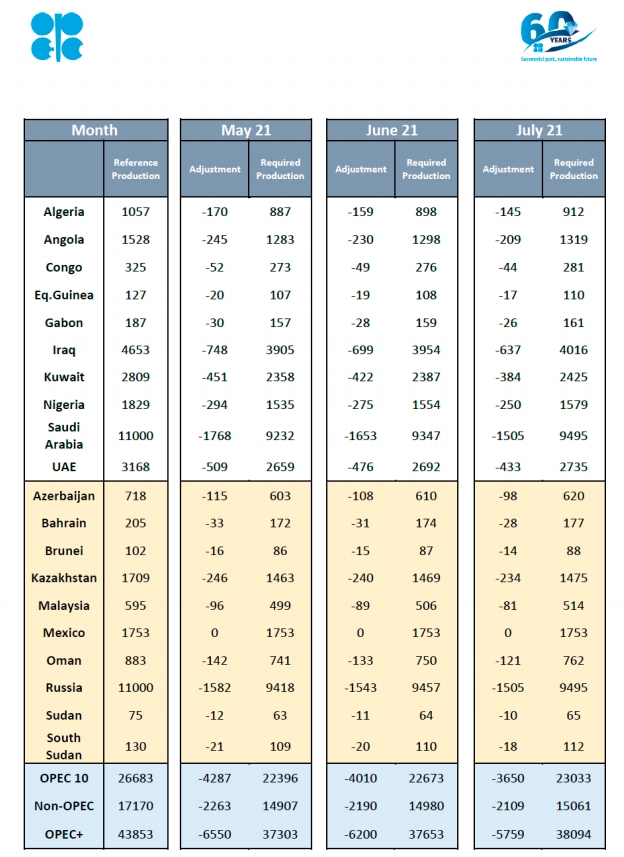

During another OPEC+ meeting, production quotas remained roughly unchanged in April, assuming production of 7m BPD below last March's levels. Separately, Saudi Arabia will voluntarily remove a further 1m BPD from the market.

May-June quota increases of 350k b/d and July quota increases of 450k b/d are planned. These are less drastic increases than the stipulated 500k b/d per month since February. Saudi Arabia will further ramp up production, splitting the return of the voluntarily reduced 1m BPD over the next three months.

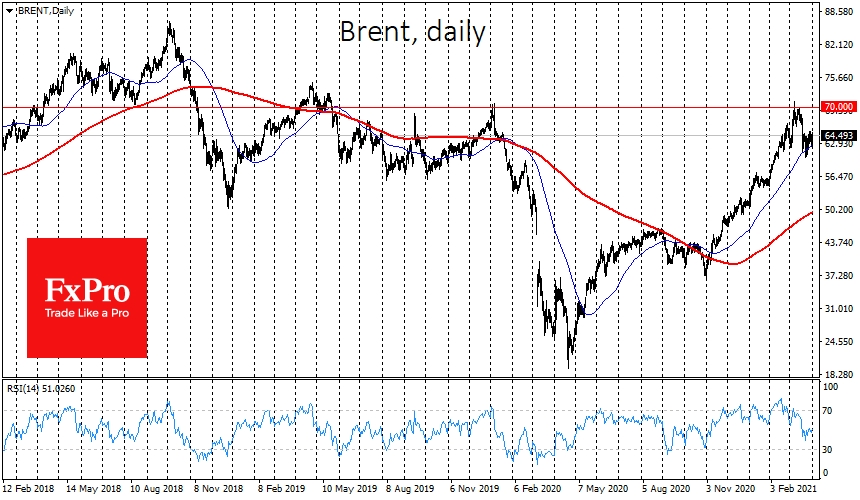

Oil volatility late last month appears to have forced the cartel to raise production more cautiously, despite notable improvements in the US and Chinese macroeconomic indicators.

Robust production data from primary oil consumers, the world's top two economies, allowed oil to stay within the upward trend.

Brent once again found support on the downside to its 50-day moving average and gained more than 3% by Thursday's close. Further improvement in the macroeconomic outlook could continue to push the price higher and bring Brent back above $70 in April.

However, traders will need to pay more attention to US production dynamics, which could be boosted by favourable price conjuncture.

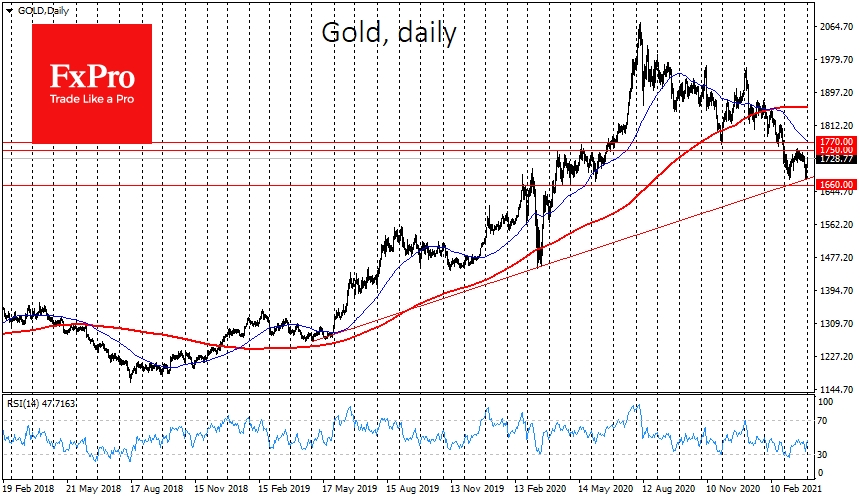

Gold gained support earlier in the week on the downside to the March lows at $1680 and the long-term upside trend support line from mid-2019. Interestingly, gold has been walking on the edge of a bull market this week. A drop below $1660 would be a 20% failure from last August's peaks, formally entering the bear market stage.

In case of a further bounce in the gold price, traders should look out for the dynamics near $1750. Earlier in March, the rebound lost strength near those levels. A decisive break above would mark greater buying power.

Additionally, a jump in the price above $1770, where the 50-day average passes and the December lows area are located, would cement a correction in gold and a return to the upside.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold And Oil Seem To Have Completed Their Correction

Published 04/02/2021, 04:17 AM

Updated 03/21/2024, 07:45 AM

Gold And Oil Seem To Have Completed Their Correction

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.