In recent weeks we wrote first that the gold mining stocks were approaching a bottom and later that they had hit bottom. Bottoms typically occur in an instant. They are rarely a process like tops.

However, bottoms can form patterns such as double bottoms and inverse head and shoulder bottoms. The rebound in gold stocks began November 24, but after five days of selling, there is potential for a bullish bottoming pattern.

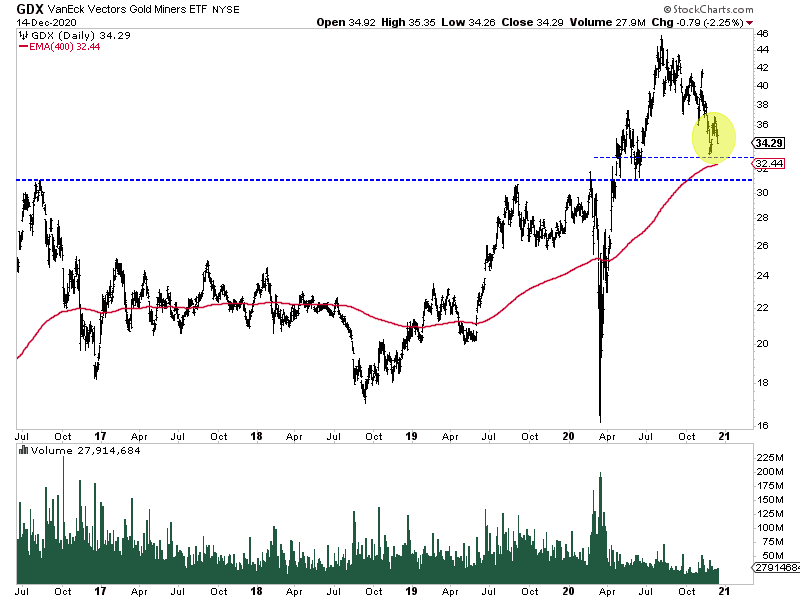

VanEck Vectors Gold Miners ETF (NYSE:GDX) closed Monday at $34.29. It hit a low of $33.25 on November 24. There is very strong support around $33.00.

The 38% retracement from the 2016 low is at $33.00. The 400-day exponential moving average (red), which supported corrective lows in 2001, 2002, 2003, 2006, 2009, and 2010, is at $32.44.

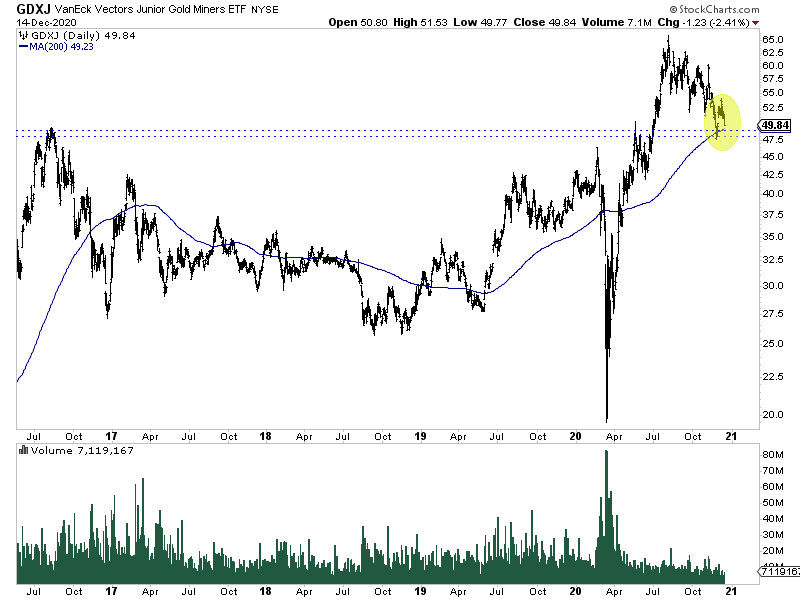

The prognosis for VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) is similar.

It closed Monday at $49.84. It hit a low of $47.68 on November 24. It has a confluence of strong support around $48.

The 38% retracement from the 2016 low is $47.00, and from the Covid low, it is $48.36.

The 200-day moving average is at $49.23, while former 7-year resistance (now support) in daily terms is $48.63.

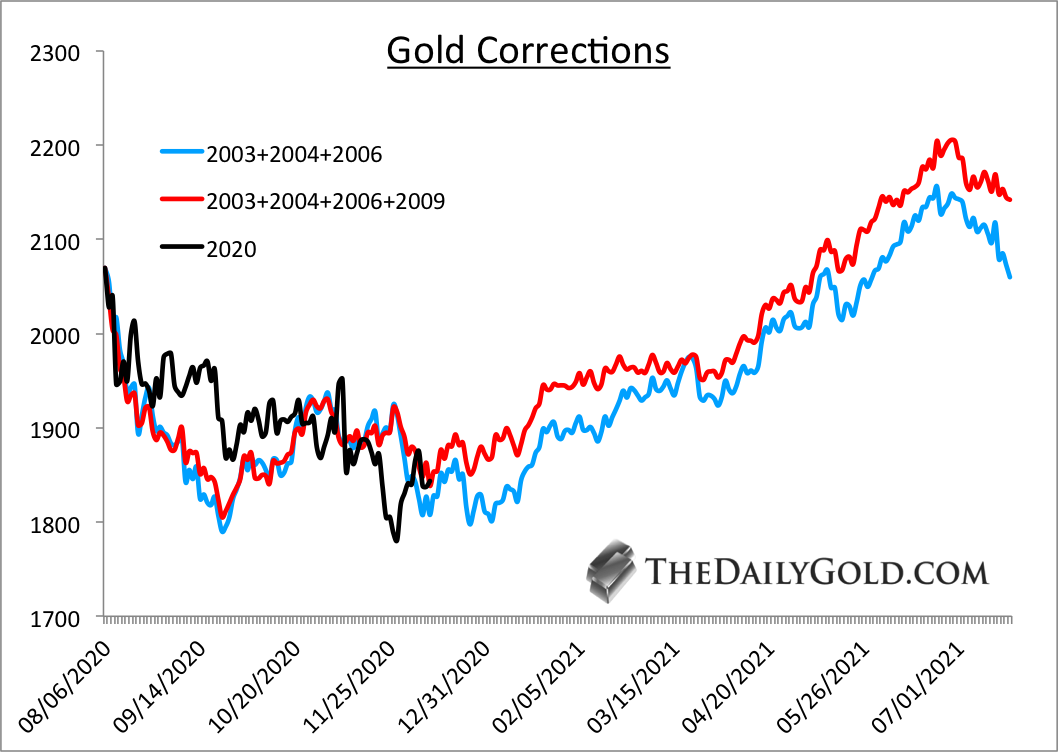

History shows us that there are some instances in which Gold grinds out a bottom.

We compared the performance of Gold following interim peaks that we deemed similar to the August 2020 peak. That includes the peaks in 2003, 2004, 2006 and early 2009.

The analogs argue Gold could grind out a bottom over the coming weeks and work its way higher in the first half of 2021.

The takeaway is that a sustained rebound will require more time, which does not mean we should abandon our constructive views on the sector.

The weight of the evidence (technical, fundamental, sentiment) argues that the correction in Gold and gold stocks is nearly complete. My guess is that GDX and GDXJ will form a double bottom over the days ahead.

It’s much easier to chase momentum and buy when everyone is doing it. It’s more difficult to buy at the end of a correction and even during a bull market. But that’s where we are.

The present is an opportunity to buy quality at a much better price and value than several months ago.