Talking Points

- Crude Oil Slammed As Traders Look Past Turmoil In Eastern Europe and Iraq

- Gold and Silver Crushed As US Dollar Bulls Return Following Holiday Trading Lull

- Silver Awaits Clearance Of Critical $19.00 Floor To Open Next Leg Lower

Most major commodities have managed to regain their footing in Asian trading today. This follows a plunge for gold and crude oil on Tuesday as a return of the US dollar bulls put pressure on the pair. Gold was sent reeling by roughly 1.6 percent to post a decline of more than $20.00 an ounce. While WTI slid to its lowest level since January.

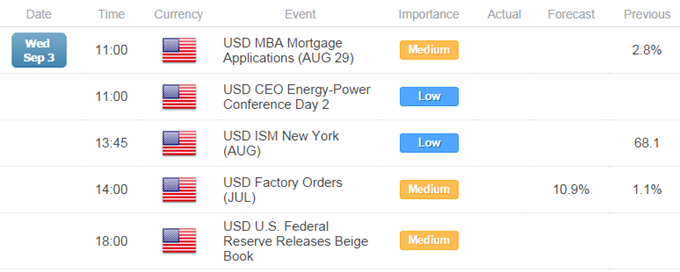

Looking ahead the general market current appears to be flowing in favor of the greenback, which could spell further weakness for the precious metals. The upcoming release of the Fed’s Beige Book may offer the reserve currency some guidance. If the anecdotal evidence offered by the report is broadly positive it could offer the USD some further fuel.

Meanwhile, the weekly release of the DOE’s Petroleum Status Report has been delayed until Thursday. The report is set to cross the wires shortly after natural gas storage figures. This could set the pair of energy commodities up for a bout of intraday volatility. Natural gas prices plunged back below the $4.00 handle on Tuesday and suffered the largest decline in six months.

Turmoil in Eastern Europe and Iraq appear to be a distant blip on traders’ radars for the time-being. The threat of sanctions on Russian commodity exports still looms. Yet the probability that Western Europe will cut off its largest energy supplier seems low at this point. It would likely take a material escalation and international response to the conflicts to yield fear-driven buying of the precious metals and crude oil.

CRUDE OIL TECHNICAL ANALYSIS

WTI has been sent reeling following a failure to crack the 23.6% Fib and descending trendline on the daily. The emergence of an Evening Star formation against the backdrop of a sustained downtrend suggests the potential for further weakness. A push below the 92.55 barrier would open the 2014 lows at 91.40.

Crude Oil: Crashes Following Retest of Critical Fib Level

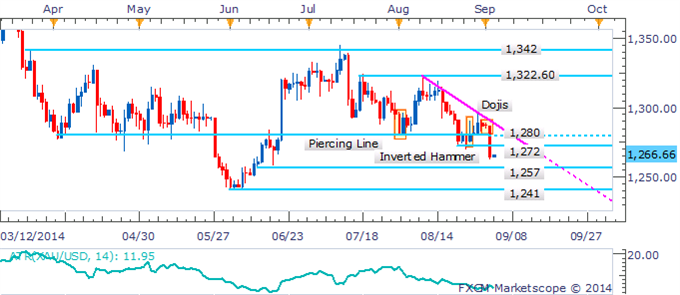

GOLD TECHNICAL ANALYSIS

Gold’s crawl under the 1,272 floor turns the immediate risk lower for the precious metal and casts the spotlight on the 1,257 barrier. A break lower could see an extended decline towards the June lows near 1,241. However, it should be noted that a low ATR reading generally does not favor a sustained move following a breakout. This could make a clean run lower difficult.

Gold: Clearance Of The 1,280 Hurdle Casts The Immediate Risk Lower

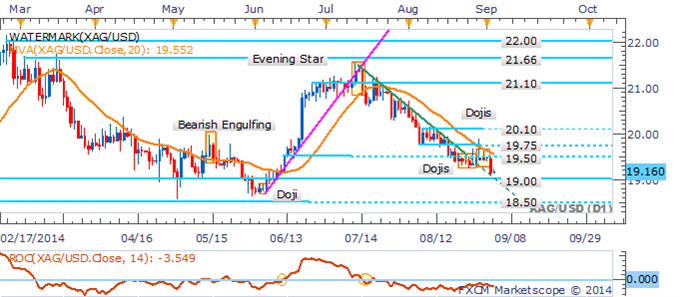

SILVER TECHNICAL ANALYSIS

The silver bears have regained control of prices following an enduring tug-of-war with the bulls near 19.50. The precious metal may extend its recent declines against the backdrop of a sustained downtrend on the daily. However, fresh short positions may be best afforded on a break below the nearby 19.00 handle.

Silver: Bears Regain Control Of Prices Near 19.50

COPPER TECHNICAL ANALYSIS

Copper’s descent has stalled as an ensemble of Dojis indicates indecision from traders. The commodity has demonstrated a tendency to whipsaw in intraday trade recently. This suggests that despite some tentative signs of a downtrend it may be difficult for a clean run lower to occur.

Copper: Dojis Signal Hesitation From Traders

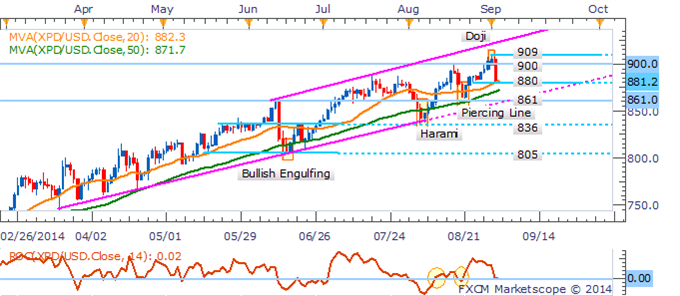

PALLADIUM TECHNICAL ANALYSIS

Palladium’s retreat under the 900 handle is seen as corrective at this stage. Within the context of a core uptrend buying dips is preferred. The emergence of bullish reversal signal would be seen as a fresh opportunity for longs.

Palladium: Buying Dips Preferred While Core Uptrend Intact

PLATINUM TECHNICAL ANALYSIS

Downside risks remain for platinum given the context of a sustained downtrend on the daily. The leap over the 1,412 barrier suggests the potential for a descent on the April lows near 1,395. A climb above the descending trendline would be required to warn of a base and the possibility of a sustained recovery.

Platinum: Sellers Reemerge After Failure To Crack The 1,424 Ceiling