Matt O’Brien at the Washington Post thinks gold is doomed:

When you think about it, a bet on gold is really a bet that the people in charge don’t know what they’re doing. Policymakers missed yesterday’s financial crisis, so maybe they’re missing tomorrow’s inflation, too. That, at least, is what a cavalcade of charlatans, cranks, and armchair economists have been shouting for years now, from the penny ads that run on the bottom of websites…

But economists do, for the most part, know what they’re doing. Sure, they missed the crash coming in 2008, but that wasn’t because they didn’t understand how bank runs work.

This is partially right but also wildly wrong. Gold is, indeed, a type of insurance against things going wrong. In the past we’ve called it “a credit default swap on central banks.” The nature of gold as an insurance contract explains why it can be out of favor — way out favor — when the sun is shining and the sky is blue.

It’s also true that a whole bunch of cranks are willing to make the case for gold anywhere, at any time, under any circumstances (including wholly inappropriate ones). But that has been true for decades, ever since the early 1980s really… and mentioning it now is a red herring.

The notion that economists “know what they’re doing” — and by extension central bankers — is the real howler.

These guys know what they are doing? Really? Seriously? Market history, going back decades or even centuries, is a seeming testament, over and over again, to the fact that free market manipulators and economic schemers DON’T know what they are doing. The standard lesson of history is not that markets can be controlled… but that aggressive attempts at control always end in tears, or the destruction of the free market itself, or some combination of both.

Bloomberg: Hedgies are now holding their first net short position in gold since 2006:

Hedge funds are holding the first ever bet on a decline in gold prices since the U.S. government started collecting the data in 2006.

…the short wagers show investors expect the rout to deepen. Bullion has fallen almost every day in July, leaving the metal poised for the biggest monthly decline since June 2013.

This is partially why we put gold in the “too hard bucket.” We have been vocally bearish gold for months, on the radio and in print, stating we would rather be short than long if someone put a gun to our head.

But at this point gold just looks “too hard,” meaning way too muddled for a trade. The charts look horrible and suggest downside could even accelerate. The big picture backdrop is incredibly ugly (and those expecting inflation “any day now” might have to wait another two years). And yet, at the same time, you never know when the Fed will go “surprise dove”… and the underlying positioning is too bearish to be comfortable. Gold might be capitulating here or could have hundreds of dollars of downside left. Too hard bucket.

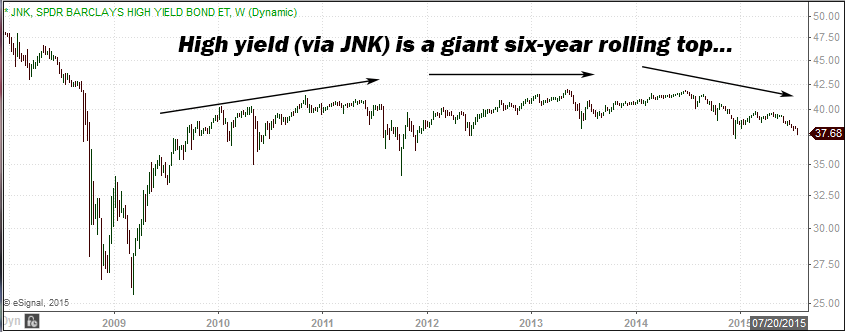

The Financial Times observes that junk bond yields for miners are spiking higher (which is bad):

The rout in commodity prices has propelled yields for lower quality debt sold by mining groups to their highest level since the financial crisis.

With prices for key commodities such as oil, gold and copper falling sharply against the backdrop of slowing demand from China, investors who financed the debt of miners and oil drillers face a worrying outlook…

We’ve written about this in prior SIR issues (see SIR 65, “Lending On Iron”) and fully expect things to get much, much worse. All kinds of crazy, wacky, completely non-viable loans were authorized in the frenzy to get a piece of the shale and base metal booms.

There is a tongue in cheek saying: “A rolling loan gathers no loss.” That whole rolling thing is now coming to an end.

Meanwhile hedge funds, bearish on gold, are getting net bullish on USTs:

The latest dive in commodity prices has prompted hedge funds and other large speculators to take a bullish view on Treasuries for the first time since last fall.

Speculative accounts added a net of nearly 33,000 10-Year U.S. Treasury futures contracts as of July 21, according to data from the Commodity Futures Trading Commission. That left the group with an overall bullish position in U.S. government debt for the first time since the week ended Sept. 26, when crude-oil prices were in the early stages of a precipitous decline.

Another one for the “too hard bucket.” After a bullish trend run lasting nearly forty years (!), US Treasurys have shown clear signs of a “generational cycle top.” It is possible that long-bond yields have already seen their lowest levels for decades to come (implying bonds have topped).

And yet if “risk-off” comes back in earnest, bonds could surge again (and yields fall) as capital withdraws from global markets and USTs come back into vogue as a safe haven. This, too, would add to US dollar strength, which in turn would make everything worse… we see bonds like gold, a trade for the “too hard bucket” to be handled lightly or not at all due to cross-currents.

And global growth worries are now pummeling commodities, but who would want to buy?

Investors are bailing on commodities amid mounting worries about the pace of global growth.

New data showing China’s factory activity hit a 15-month low and a leaked Federal Reserve memo betraying concerns about how fast the U.S. is growing added to concerns Friday and accelerated the selloff of commodities—from oil to gold to copper.

Money managers reduced bets on higher oil prices to their lowest level in 2½ years, while ramping up bets on lower copper prices to their most bearish in two years, according to weekly data from the Commodity Futures Trading Commission.

This is the part where clever, long-term value investors start pulling out all the old sayings about buying low and selling high and painting themselves as contrarian because they are willing to nibble a little or maybe even brave the risk of falling anvils. This whole attitude strikes us as too clever by half, however, because the bigger they are, the harder they fall, and the biggest and hardest thing that is falling right now is China and that is a huge, huge phenomenon.

For value investors feeling smug about their hard asset purchases, we would remind them of a Jeremy Grantham observation: Lazy value investors do better than diligent ones in a crisis, because diligent value investors buy too early, at what they perceive to be incredibly good values, while lazy value investors are not roused until panic has truly set in and prices have hit full-blown crisis levels. Are we at full-blown crisis levels in respect to China slowdown fears yet? No.

Over in emerging markets, the economic picture is going from bad to worse as retail sales slump for commodity exporters:

Retail sales growth in commodity-rich developing countries has slipped to its lowest level for six years, according to new research, underlining how broader economic malaise has hit consumers’ pockets.

The slowdown in consumer spending – which is particularly pronounced in Russia, Brazil, Colombia, Chile and South Africa – shows how the impact of lacklustre commodity exports is weighing increasingly heavily upon shopping habits in the developing world.

Emerging market equities are a slow motion trainwreck in our view. The pain has been building for quite a while and has roots in two distinct areas: China slowdown and the US dollar carry trade unwind. The China slowdown, happening before our eyes, is a means of transmitting deflation globally as China lowers prices to help shore up jobs and export volumes. Meanwhile China’s seemingly endless capex boom is finally ending (you can only build so many ghost cities and eight lane superhighways going nowhere).

The US dollar carry trade is the pain train that is still just down the track. Emerging market governments (among other institutional borrowers) are effectively net short trillions of dollars worth of USD via dollar-denominated debts. As the world gets “squeezed” by the USD carry trade unwind, a stronger greenback is going to make all that pain worse.

Hear that whistle in the distance? It’s the sound of the pain train coming for EM as currencies crash on Fed fears and the China slump:

The currencies of Brazil, Mexico, South Africa and Turkey have all crashed to multi-year lows as investors flee emerging markets and commodity prices crumble.

The drastic moves came as fears of imminent monetary tightening by the US Federal Reserve combined with shockingly weak figures from China, which stoked fears that the country may be sliding into a deeper downturn and sent tremors through East Asia, Latin America and Africa.

Yeah that. And the USD carry trade unwind, which makes everything worse when EM equities cease to be attractive as a destination and institutional investors start questioning the solvency of some of these governments a la 1997 Asian currency crisis (with some weird new twist just to keep it interesting)…

Making things worse, BI reports that a multidecade mega-drought may be coming to the United States:

The four-year California drought is causing unparalleled devastation to the region.

Analysts at Bank of America Merrill Lyncy) think it’s going to get a lot worse.

“We view the unprecedented drought in California as a harbinger of the coming global water crisis,” BAML strategists wrote in a note to clients on Tuesday.

This could get really bad… for countries OTHER THAN the United States. I mean, a multi-decade drought would be hard on the US too. But look at the second and third order impacts:

- The United States is an agrarian superpower…

- The largest grain exporting country in the world.

- If US grain supplies are hit by a drought, the USA will hold back grain reserves…

- Hurting guess who, the countries with heavy reliance on grain imports…

- Which cycles back around to who: China, Japan, and other heavy grain importers…

- And in turn vulnerable emerging markets, who spend more on food costs per capita.

If you want to increase the risk of conflict and serious economic strife, mess with people’s food supply. But I tell you what, in a world where drought is ravaging food supplies, you want to be in a breadbasket like the United States, i.e. a breadbasket with missiles and aircraft carriers protecting it (as opposed to one that can get taken over like the Ukraine). As with so many other global ills, problems that impact the United States are likely to impact other vulnerable nations to much greater degree…

Switching tracks to recent volatility — don’t worry about elevated stock valuations, on the US equity side everything will be fine — right? I mean nothing bad ever happens to US equities, it says so right here in the New York Times:

There has been no shortage of market-moving business and economic news this year. But for the overall American stock market, none of it has really seemed to matter.

Crises have come and gone, yet the American market has remained astonishingly calm… for buy-and-hold investors, there is still a reasonable chance that this could turn out to be a profitable year.

Is “astonishingly calm” a good thing? Not if the calm market participants have all the comprehension of, as Bill Bonner once put it, “a squirrel watching a bank robbery.” We have a hunch this “astonishing calm” is going to translate into something else.

But hey, if extrapolating existing trends to infinity is your thing, there are plenty of takers for that outlook too. For example, a study has been produced suggesting robo-advisors will run more than two trillion by the year 2020:

[Robo adviser] popularity is going to explode even more, if new projections from consulting firm A.T. Kearney are in the right ballpark. Assets under management by robo advisers are estimated to increase 68 percent annually to about $2.2 trillion in five years, according to a forecast from the firm. About half of that is expected to come from money that’s already invested and the rest from non-invested assets.

Hey, it could happen… if the low-to-no volatility equity market just keeps drip, dripping higher for five more years, powered by sixty more months of stock buybacks, financial engineering tweaks, and projections of low interest rates and shrinking equity risk premiums as far as the eye can see.

But what are the odds of that really? We are not all that bullish on the robo adviser phenomenon because it seems more likely passive investing has reached a powerful cyclical peak. No environment in history, perhaps, has been as favorable to the passive investing approach as the past six years, leading to all kinds of talk as to how passive investing vehicles are going to consume all hedge funds and all active managers too.

But good luck with that when volatility comes back, and mildly bored passive investors are subjected to the terrors of whiplash volatility and the risk of downtrends that last for months or even secular bear markets that last for years. Think those can never happen, that they’ve been banished forever? Ask equity investors in China about that…

Heads up, the Federal Reserve is meeting this week and the case for a rate hike is building:

A strengthening economy and gathering momentum in the property market are bolstering arguments for higher interest rates in the second half of the year as Federal Reserve policymakers prepare to meet this week.

The Federal Open Market Committee will convene on Tuesday and Wednesday after Janet Yellen, the Fed chairwoman, told Congress that the US economy needs higher short-term rates and that there were risks in waiting too long.

Yawn. We have been playing the Federal Reserve “will they or won’t they” game for so long it feels like all the drama has been sucked out of it. And does anyone really care? The Fed’s actions are still a rorschach ink blot of sorts. If they raise a quarter point and then gush about how they won’t raise again for a super long time, the bulls can treat this is as “the longest slowest hike trajectory in history” and paint such in their favor. Or if they don’t raise the market can interpret this as a bearish sign for the US economy — oh no, they are getting nervous again — and drop on perceived dovishness.

The crux of the matter in our view is that all the drivers of this long engineered bull market are slowly winding to a close… but the bulls still have a psychological hold… so there is likely more “shock and blah” on deck.

And finally, perhaps the weirdest thing you will hear about this week — the Mike Tyson Bitcoin ATM Machine. Copy from the website:

MIKE TYSON’S FASTEST KNOCK OUT IN THE RING WAS 30 SECONDS.

THE MIKE TYSON BITCOIN ATM CAN TURN YOUR CASH INTO BITCOIN IN UNDER 20 SECONDS.

But if you lean in too close, will the machine bite your ear?

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer