Recently, Mark Zuckerberg appeared before the US Congress to discuss his new Libra project and to attempt to calm concerns related to his new global alternate currency project. It appears this project is putting global political leaders in a particularly powerful position of either accepting the Libra project as a viable future solution and implementing new laws and regulations in support of it or to shelve the idea while they consider the local and global risks associated with a project that creates a new class of global currency. (Source: https://www.bloomberg.com)

We believe the risks associated with a massive corporate and international backed Crypto/Alternate currency are far too great, at this time, for the US government to attempt to consider with only 12+ months to go before the US Presidential elections. This is almost like opening Pandora’s Box in terms of total global risks and outcomes. It becomes almost impossible for the US government, Federal Reserve or any other global central bank to be able to protect its citizens from the risks associated with any type of technology collapse, fraud, hacking or any other unknown risks associated with such an idea.

The concept of a “Safe-Haven” may come into question over the next 10+ months as investors continue to question what may happen in the global markets, global political events and asset valuations related to Cryptos, Precious Metals, and foreign currencies. Our researchers believe mature economy currencies will quickly become new currency Safe-Havens for global investors over the next 10+ months as banking, credit and economic risks continue to shake out weaker markets.

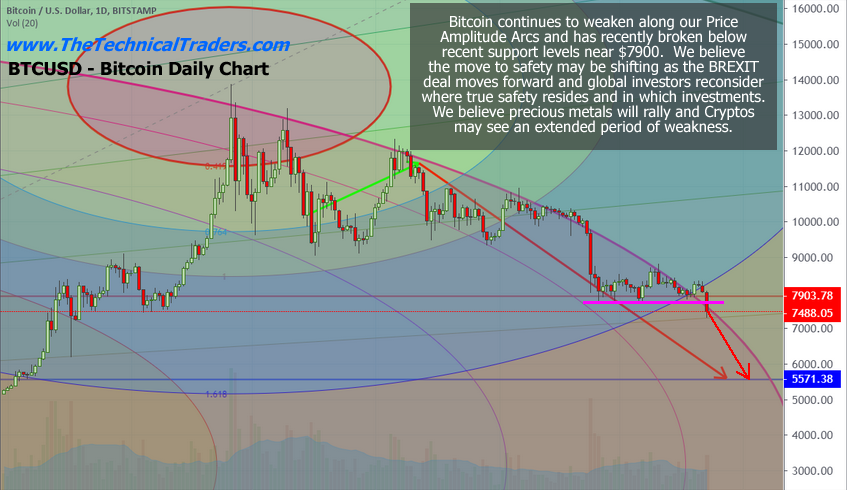

Cryptos may see some support as price rotates over the next 10+ months prior to the US Presidential elections, yet we believe the real global asset markets (stocks, currencies, debt/credit, and bonds) will take center stage as the world transitions through a very tumultuous period prior to the November 2020 US elections. Even for a period of time shortly after the US elections, global assets will continue to reposition as future economic and regional asset value expectations shift.

There is a very real potential that global investors continue to seek safety and liquidity in the global major markets, economies and global currencies. Additionally, Precious Metals continue to show very little signs of weakening over the past 12+ months.

In fact, Precious Metals have continued to stay much stronger than many other investments over the past few years. Gold is up +17.60% from October 2017. Palladium is up 78.81% since October 2017. Silver is up 4.9% over that same period of time. Once the next upside price leg begins in Precious Metals, we may see a massive price increase in Gold and silver. Supply issues continue to push Palladium prices higher as well.

Imagine being able to trade the precious metals sector easily with little downside risk and only being involved during the rallies and not the selloffs, all while generating 2x the return that VanEck Vectors Junior Gold Miners (NYSE:GDXJ) has return in 2019.

Gold is setting up in a manner that is very similar to what happened in April 2019 – a sideways momentum base pattern that eventually broke to the upside in early June 2019. Once that move higher began to take place, the continued move to the upside was very quick and extensive. We believe the next upside move in Gold and Silver will be very similar – a moderately slow rotation out of the momentum base, then a fast acceleration to the upside as global investors realize the shift to safety has begun again.

We believe Cryptos may be left on the sidelines as investors prefer more traditional assets as a measure of safety as global concerns continue to weigh on investor’s minds headed into a very contentious US presidential election. Currencies, Metals, Mature global market assets and true value stocks may become the investment of choice until we see some real clarity for the future from the global markets, global central banks, and global political leaders.