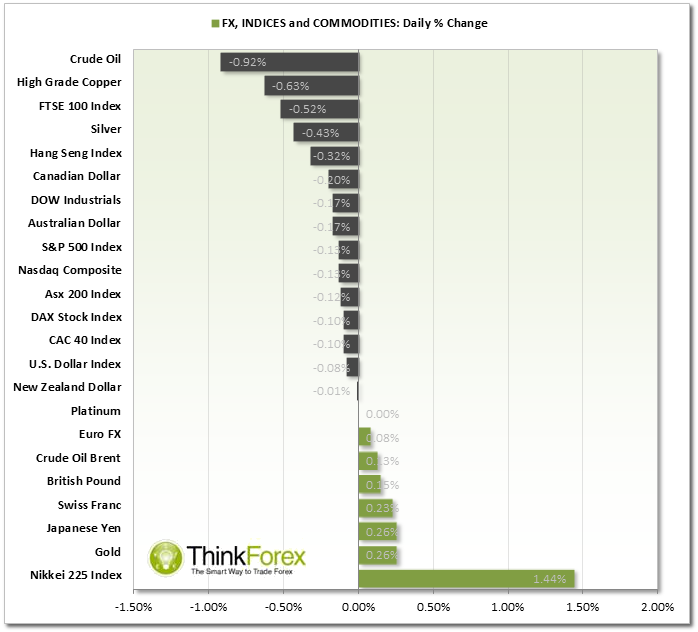

Market Snapshot:

AUD: Construction work q/q came in far les than expected at -1% vs 3% making it the lowest since May 2013.

GBP: Mortgage approvals are at their highest level since October 2007, whilst retail and wholesale sales since June 2012.

USD: While CD Consumer confidence came in less than expected at 78.1 vs 80.2 it has been increasing steadily since 2009 and at similar levels to Q1 2008. Richmond manufacturing also cane in less than expected and at the lowest level in 7 months. House prices, whilst still increasing is losing momentum to suggest we have seen the strongest part of the growth phase. USD Index sold down to 80.34 and we remain within last week's trading range.

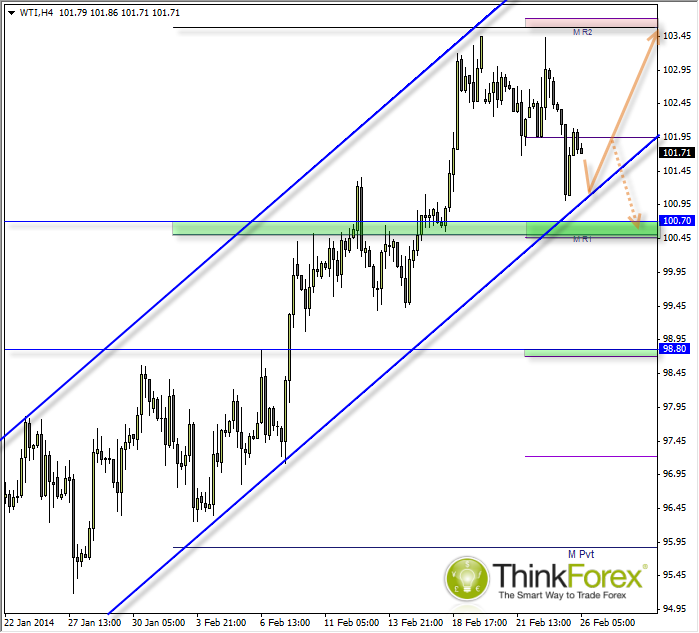

CHARTS OF THE DAY:

WTI: Above 100.7, targets 103.5

WTI reached out target outlined on Monday and due to the strong bullish channel my bias is for a continuation of this trend, once the lower channel has been tested.

While our target was hit the subsequent sell-off did not reach the expected retracement zone, hence the suspicion of another low before a resumption of the uptrend.

Keep in mind the bullish channel needs to be used 'with a pinch of salt' so allow for some noise around this trendline. In the event we do break beneath it I would want to see price trading below 100.45-70 support zone before turning bearish. Indeed bullish setups may be considered around this support zone if need be.

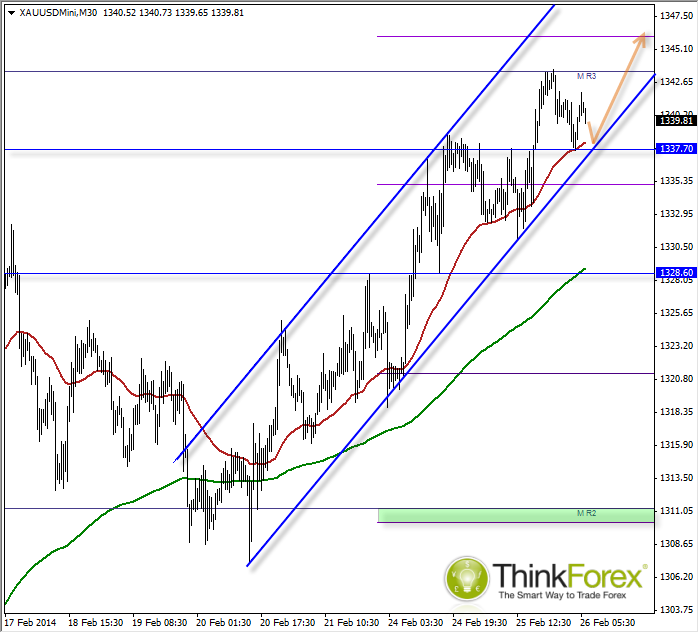

GOLD: Above 1337, targets 1346

This is almost an identical set-up to WTI. At time of writing we appear to make making another move towards 1337.70 (yesterday's low) which may provide good shorting opportunities for scalpers. However, as we approach this level we need to be aware of the support confluence comprising of 50eMA. Pivotal S/R and lower channel line.

Yesterday's high was the Monthly R3 but due to the bullish momentum of the current trend and the cyclicity of the higher highs and lows I fancy at least another attempt to get above 1337, and my target of 1346 is the weekly R2.

Disclaimer: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market.

If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade. A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au. The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.