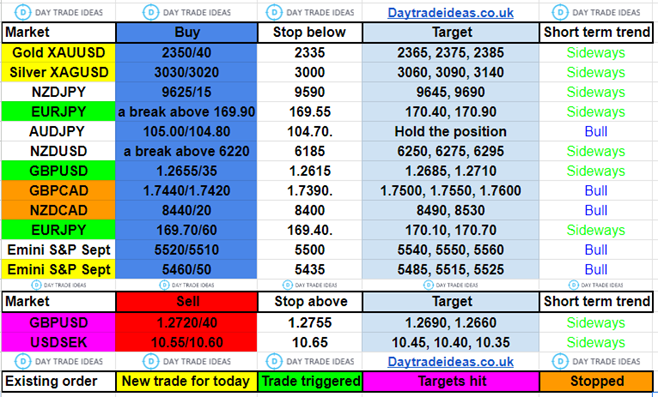

Gold

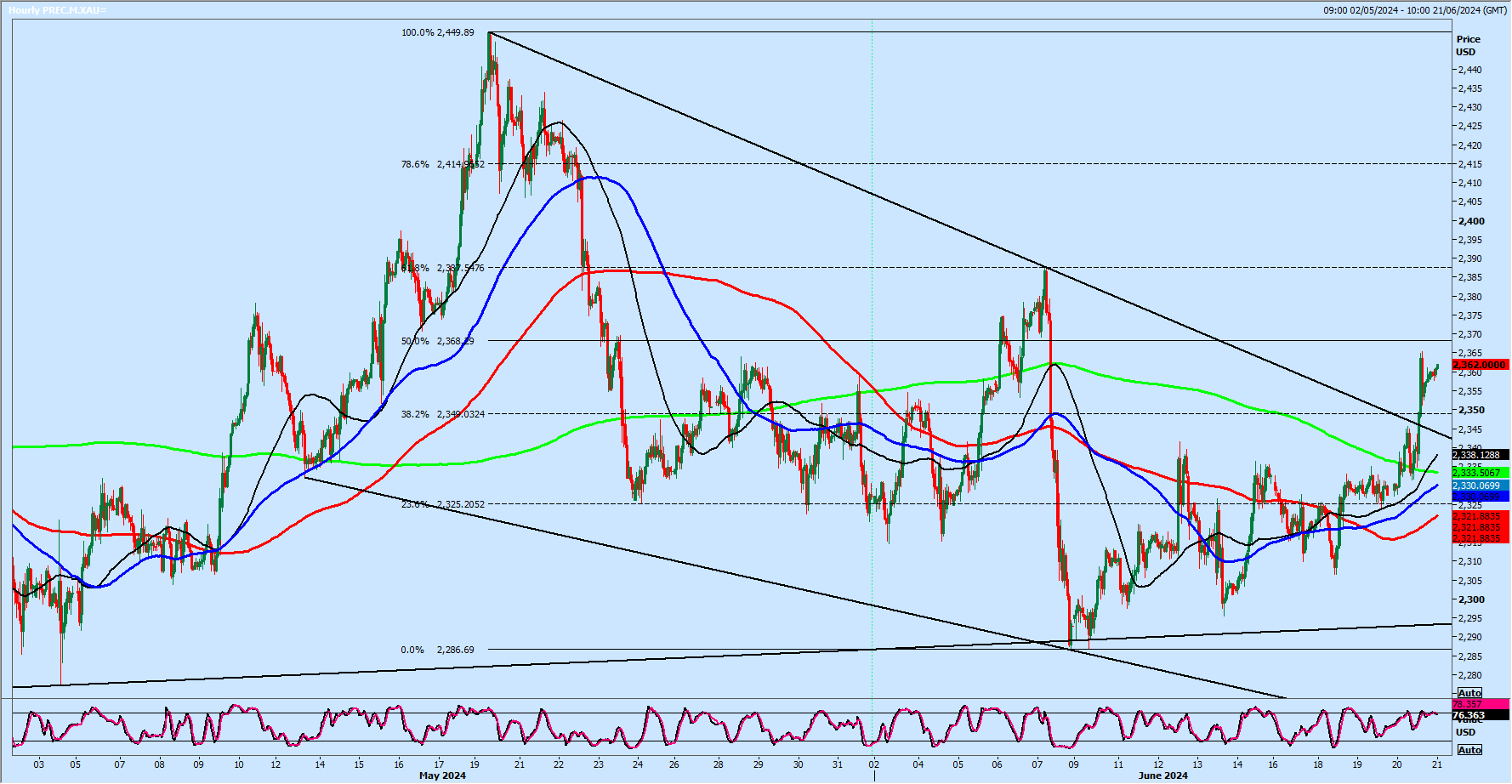

- Gold (XAU/USD) initially hit the sell level of 2345 and reversed to 2331. Well done if you took the profit in time because Gold then immediately and unexpectedly reversed, breaking the short-term descending channel and/or a 1-month descending triangle for a buy signal.

- We unexpectedly beat strong resistance at 2345/50 and shorts were stopped above 2355.

- As we wrote yesterday, a break and close above 2350 is an important buy signal so we are at critical levels now.

Next targets are: 2365, 2375, 2385. A break above 2390 can target 2410/15. - Today we should therefore have support at 2350/40 if we see any weakness and longs need stops below 2335.

Just be aware that a weekly close below 2335 will therefore be totally confusing!!!

Silver

- Silver (XAG/USD) beat minor resistance at 2955/65 yesterday and we wrote: with bulls taking control we could run as far as 3050/55 and 3090/99. We are almost there as I write and further gains are possible to 3145/55 into the beginning of next week.

- Support at 3030/20 today and longs need stops below 3000.

WTI Crude August Future.

Yesterday's low and high for the AUGUST contract: 8030 - 8152.

- WTI Crude August continues higher as predicted to my next target of 8130/40 and a high for the day almost exactly here. Further gains are expected towards 8190/8200 today.

Support at 8000/7960 was unfortunately missed by about 30 ticks yesterday.

Support at 8030/8000 today and longs need stops below 7960.

Friday’s trade ideas with stop loss and targets.