If the dollar goes through a corrective downswing, it’s more bullish for gold? Not if a decline in the euro caused gold to rise in the first place.

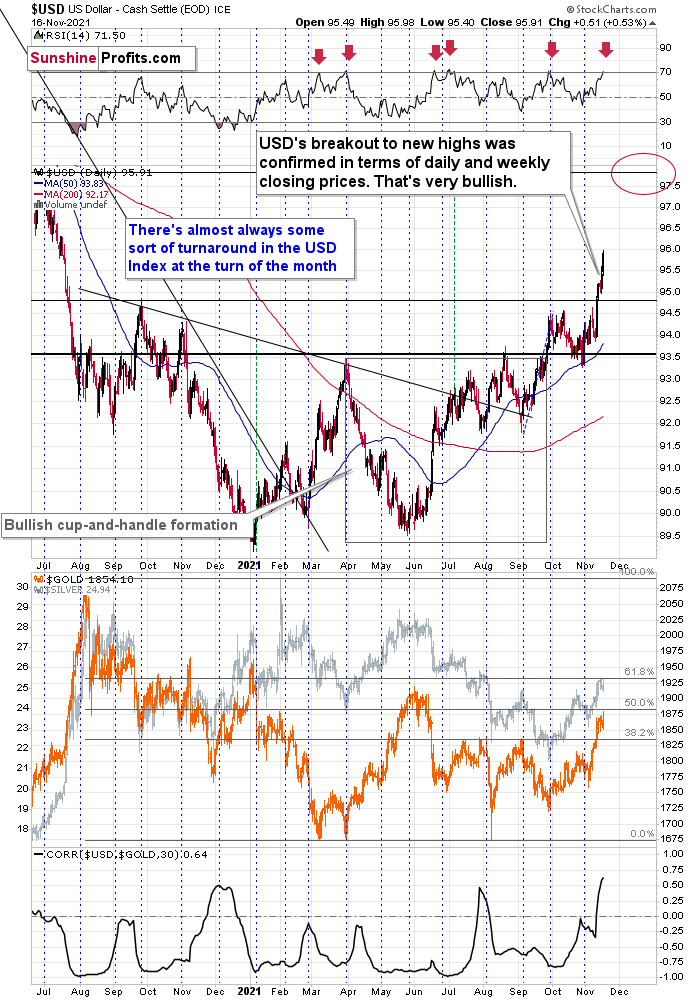

Another day, another new yearly high for the USD Index. The U.S. currency soars just like it has since the beginning of the year, in tune with what I said at that time, (and against what almost everyone else said about its outlook). The rally accelerated recently, with the USD Index soaring by 0.78 on Wednesday.

So, surely that’s bullish for the USD Index? - one might ask.

No.

“Bullish” or “bearish” relates to the future, not to the past. In fact, the rally in the USD Index might need a breather as all markets—no matter how bullish or bearish the situation is in them—can’t rally or decline in a straight line, without periodic corrections. The USD Index, gold, silver, mining stocks, and practically all the other markets are no exception from this rule. Even real estate prices don’t increase over the long run without periodic downturns.

As you can see on the above chart, the U.S currency index soared to almost 96 on Tuesday and it’s after an almost straight-up rally. This rally caused the RSI indicator to move above 70, and this has been a quite precise short-term sell signal this year. In fact, in all cases when we saw it, some kind of short-term correction followed.

Based on the size of the current rally, it seems that the current situation is most similar to what we saw in early March and in late June. That’s when we saw short-term declines that took the USDX approximately a full index point lower. In the current case, it could mean a decline back to 95.

This would be a perfectly natural thing for the USD Index to do right now, given that the previous resistance (which now serves as support) is located slightly below 95. The support is provided by the late-2020 high and the March 2020 low (not visible on the above chart).

So, surely this corrective downswing in the USD Index would cause an even bigger rally in the precious metals sector, right?

That’s where things get complicated.

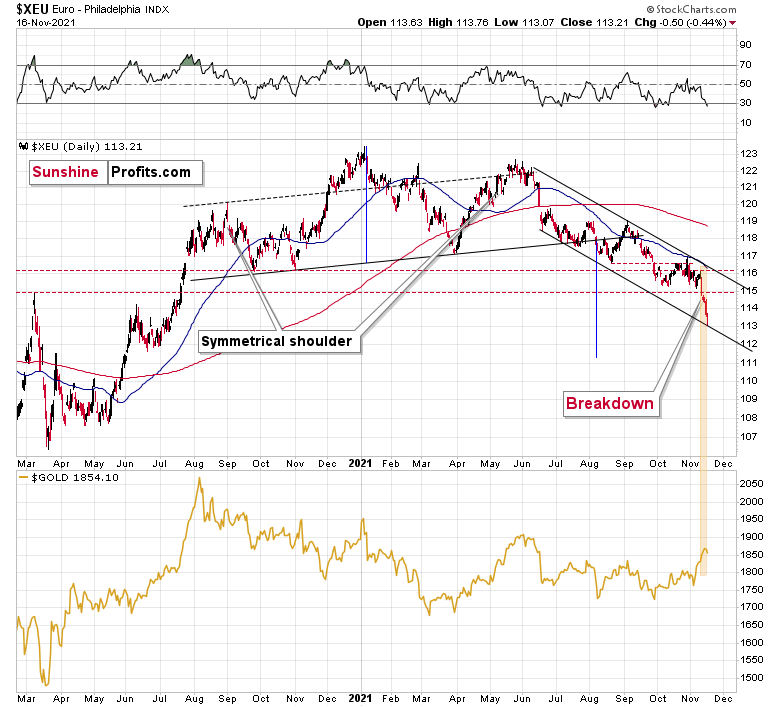

You see, the biggest (over 50%) part of the USD Index (which is a weighted average) is the EUR/USD currency pair. Let’s take a look at it.

The Euro Index moved sharply lower last week and just like the RSI based on the USD Index flashed a sell signal, the RSI based on the Euro Index flashed a buy signal. Also, the Euro Index just moved to the lower border of its declining trade channel, which is likely to indicate some kind of rebound.

Why am I discussing the euro here? Because that’s what’s complicated about the current USD-gold link.

The euro recently declined and the prices of silver and gold recently rallied shortly after dovish comments from the eurozone. Namely, while the expansionary nature of fiscal and monetary decisions in the U.S. might be after its peak (with the infrastructure bill signed even despite high inflation numbers), the eurozone is far from limiting its expansionary (i.e., inflationary) policies, and it was just made clear recently.

That was bearish for the euro and bullish for the gold price—as more money (euros in this case) would be chasing the same amount of physical gold bars.

The point here is that it might have been the decline in the value of the European currency that caused gold to rally, and it had little to do with what happened in the USD Index.

Don’t get me wrong, most of the time, the gold-USD link is stable and negative. In some cases, gold shows strength or weakness by refusing to move in tune (and precisely: again) with the U.S. dollar’s movement. But in this case, it seems that it’s not about the U.S. dollar at all (or mostly), but rather about what happened in the Eurozone and euro recently.

I marked the recent decline in the euro and the rally in gold with a golden rectangle.

The usual link between gold-USD would have one assume that lower USD Index values (due to higher EUR/USD values) would trigger a rally in gold. However, given how things worked and the fact that we saw/heard the news coming from the Eurozone, it seems like this “temporary” and “bearish for the PMs” interpretation would actually prevail.

It could also be the case that we see some kind of mixed reply from the precious metals sector when the USD Index and the Euro Index correct. The PMs could, for example, fall only after the situation regarding the gold-USD link gets back to normal—that is perhaps after both currencies correct.