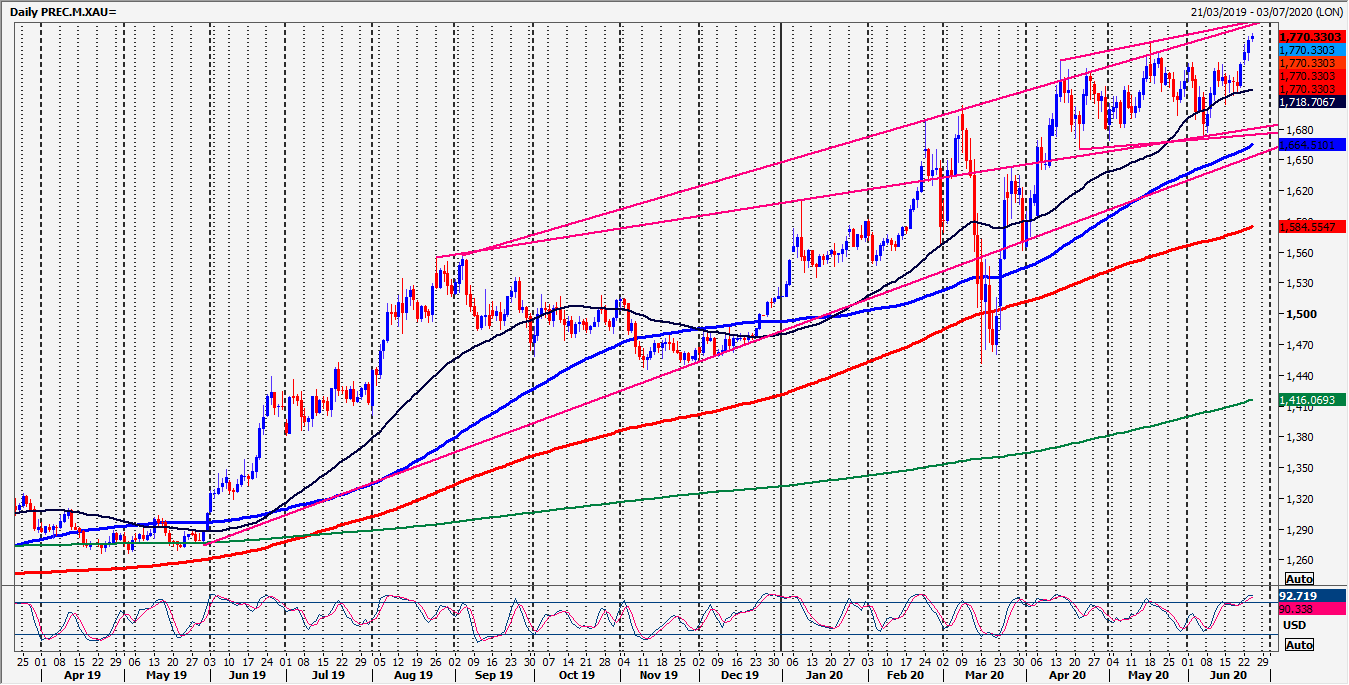

Gold Spot had a 1 day consolidation phase holding the bull market high seen in May at 1762/64 and first support at 1744/42 perfectly. We wrote: we are not severely overbought and this is a strong bull trend. So shorts may actually be risky. A sustained break above 1768 must be seen as the next buy signal after the 2 month consolidation phase (very common in bull markets)…

Buy signal confirmed as we hit the first breakout target of 1773. Outlook remains positive. Silver Spot bottomed 3 ticks above best support at 1760/50 and higher also of course, through 1760/50 to re-target 1780 and 1800/10. We topped exactly here overnight but outlook remains positive.

Today’s Analysis

Gold beat the bull market high seen in May at 1762/64 for the next buy signal after the 2 month consolidation phase (very common in bull markets) targeting 1773, minor resistance at 1778/80 and perhaps as far as 1789/91 this week.

Best support at 1764/62 of course. Longs need stops below 1758. An unexpected break lower risks a retest of strong support at 1744/42. Longs need stops below 1738.

Silver bulls also back in control as we hit all targets as far as 1800/10 before the 2 week high at 1825/28, which should be seen before the weekend. A break higher tests the June high at 1836.

Buying opportunity at 1765/55, with stops below 1745. An unexpected break lower targets 1725/20.

Trends

- Weekly outlook is positive

- Daily outlook is neutral

- Short Term outlook is positive