Gold – Gets Hammered on $1.37 Billion in Selling Volume

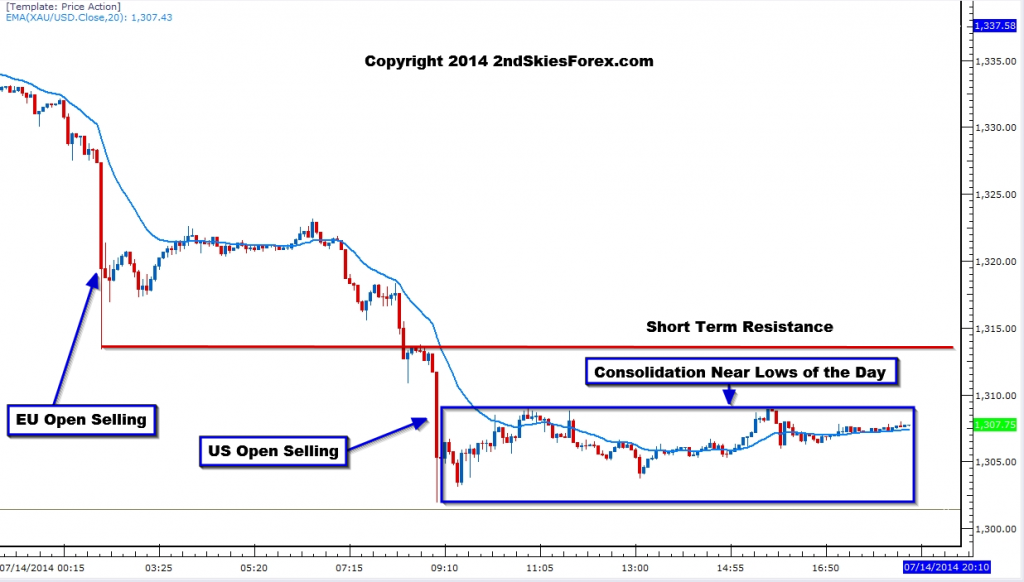

Today Gold got hammered from open to close, wiping out 17 days of gains in one fell swoop. Fat finger you say? Nope – just the usual suspects as the PM was sold right on time starting with the European open, and then followed up with heavier selling in the NY open.

Someone decided to dump $1.37 Billion in notional volume at the NY open, which following the $.5 Billion on the EU open. Needless to say, with such heavy notional selling, which clearly will not get you the best pricing, we can assume this was an intentional hammering sent to those holding a bullish sentiment (chart below – source: ZeroHedge).

For now, the PM has formed an inside bar just above 1300 (4hr chart), with small wicks on both sides, suggesting some rejection. However the 1hr and 5m chart show the same inside bar price action to be a consolidation near the lows. Until we get a double bounce off the 1302 lows, and at least a bounce above 1312, bearish pressure should remain.Watch for a break of 1300 during the European or NY open, which would put 1286/84 in sight and potentially 1257 under pressure (5m chart below).

Looking for tailored content based on your skill level? Check out our Customized Forex Trading App which will give you content based on your skill level and experience.