It’s been two and a half years since the bank-coordinated reversal of the bull market in gold and silver began on September 7, 2011, the day after gold touched an intraday high of $ 1923.70 . Since then, there have been repeated coordinated operations that have seen gold taken down to the $1,100 level.

But now, the gold price is insistently yearning upward through its technically significant $1,260 level, despite a mis-regulated futures market that annually supplies imaginary gold on a virtually unlimited basis to the sell side in the form of future sales of gold that are rarely if ever settled with physical gold.

Conspiracy Becomes Reality

Of course, such theories are dismissed by mainstream financial commentators and other market participants who sneer at them as just so much conspiracy theory. However, given the recent revelations of manipulation of interest rates, and the multitude of un-prosecuted crimes among financial titans such as Jon Corzine and Steven Cohen, the possibility that such a conspiracy exists carries incrementally more weight with each passing year.

But I’m not here to debate the existence of such a conspiracy today. To me, the overwhelming evidence confirming that it does indeed exist and is in fact relied upon by the United States government to perpetuate the illusion of viability of the rapidly depreciating U.S. dollar, is impossible to discount.

In fact, the continuing ability of the futures market to dictate a depressed and compromised gold price to the spot market has been rendered possible by the transfer of a portion of the $85 billion per month in Tier 1 assets fabricated from thin air by the United States Federal Reserve to duplicitous futures market participants who clear contracts using cash supplied from this scheme in lieu of gold.

I know, I know. It’s impossible. It’s insane. It’s outrageous. The government of the United States could not possibly coordinate such a complex scheme involving the nation’s top banks, when both are constitutionally mandated to act in the best interests of the citizens of the United States.

Citizen’s interest notwithstanding, however, if such a conspiracy was in fact behind the ability of the futures market to suppress the prices of gold and silver to convey to the financial world the superiority of United States denominated assets over precious metals, then that ability and the scheme itself would be weakened by the reduction of Quantitative Tier 1 Asset Fabrication, as the supply of fractionally extrapolated credit and capital available would be reduced proportionally.

Thus, tapering the production of phony assets must needs constitute the tapering of the effectiveness of the suppression of gold and silver prices by futures market participants.

The Fed Miscalculates

The Fed has demonstrated a propensity to consistently miscalculate the effect of their statements and actions on markets. While the swoon of emerging markets instigated by the repatriation of capital to the United States in anticipation of a diminishment of free money was to be expected, the Fed erroneously assumed that the capital would flow into U.S. equity and bond markets, thus mitigating the effect of the withdrawal, to some degree, of the government largesse.

You will remember the market tumble that was inspired by Ben Bernanke’s allusion to the idea of tapering in June 2013. The Dow Jones dropped 206 points, or 1.4 percent, the S&P 500 lost 22.88 or 1.4 percent, and the NASDAQ dropped 1.1%.

At the time, Bernanke rushed to emphasize that there would be no tapering at that time, but he did caution that the plan was to begin tapering in late 2013 and to completely end the quantitative counterfeiting program by mid-2014. He caveated that with the warning that stimulus might resume or even increase if economic data suggested weakening a reversal of recent gains.

You may also recall that other candidates for the roll of Chairman were passed over for holding a hawkish stance toward QE, (where they were mostly against it), while Janet was selected for her “dovish” attitude toward QE.

“Monetary policy is likely to remain highly accommodative long after one of the economic thresholds for the federal funds rate has been crossed,” she said in November last year during testimony.

That suggests the Fed has adopted a reactionary stance, and could easily reinstate an $85 billion per month rate of asset fabrication, or even more.

One thing is certain: if the fabrication of Tier 1 assets is integral to the futures market’s ability to skew pricing in precious metals to the downside, tapering will be short-lived, if gold and silver prices continue to pressure upward.

The Fed’s Rock and Hard Place

The idea that gold and silver could actually benefit from a withdrawal of Quantitative Asset Fabrication is contrary to the mainstream financial media message, who uniformly reports that the taper will result in reduced demand for precious metals.

That simply isn’t happening.

What’s worse, if the demand for gold and silver remains intact or strengthens in the face of tapering, then the perception will be that the U.S. market and GDP numbers that are being pointed to as a sure sign that the economy is on the mend in the U.S. is in fact a case of the Fed drinking its own Kool-Aid, and that the systemic problems in the U.S. economy are in fact deep and persistent. Which will undermine demand for U.S. bonds, unless there is a rise in interest rates to offset it.

That, in turn, will demonstrate just how hyper-inflated the money supply is in the U.S., and while hardening skepticism toward USD, it will re-establish gold and silver as the pre-eminent safe-haven refuge during economic crises, which will resume as the U.S. scrambles to resurrect the QE flow. But this time, that will optically be perceived as desperation, and in keeping with tradition, the Fed will have miscalculated just how undesirable their bonds have become. Again, gold and silver will be the natural beneficiaries of such sentiment.

Physical gold and silver demand continues to rise

Among the side-effects of delusion monetary and fiscal policy such as that practiced by the U.S., China, Japan, Europe and the U.K., is that the performance of gold and silver prices as driven by futures markets underscores the fallacy of such pricings’ reliability, and confirms their irrelevance in real terms. Considering that all of the world’s physical gold and silver is being purchased in spot markets, and increasingly hoarded in Asia, then relative to the vast amounts of new money being conjured up by these nations, there should be a correlative rise in the prices of precious metals on a strictly nominal basis. Gold and silver production remain flat, but fiat currency production is rampant. Thus, it’s simple economic logic that, in a free and uncompromised market, the prices of gold and silver should be rising.

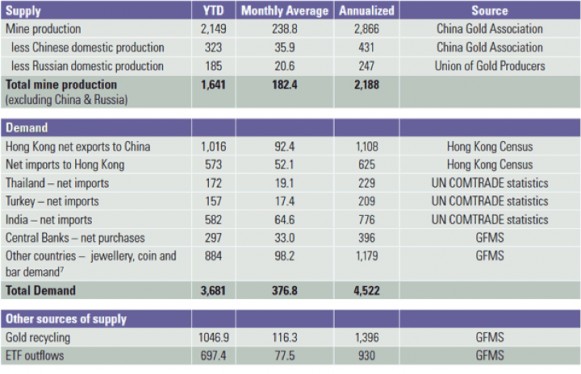

This chart courtesy of Sprott Corp., shows clearly the excessive demand for physical gold relative to mine supply.

A second coincident outcome of coordinated precious metals price suppression is that the demand for physical gold and silver is actually amplified by the suppressed prices, as investors in gold and silver understand through simple math that the current prices, while not relevant to real demand, nonetheless provide an opportunity to accumulate physical gold and silver at bargain prices This despite the reality that North American bullion dealers are demanding anywhere from 10 to 25% premium for buyers of actual physical gold bullion above the futures market driven spot price – another piece of evidence in the case for widespread price suppression of the metals through unlimited fabrication of paper gold in futures markets.

Germany Believes in the Conspiracy Theory

On January 17, 2014, an article in Bloomberg reported that Germany’s top financial regulator, Elke Koenig had warned of “possible manipulation of currency rates and prices for precious metals” being far worse than the Libor-rigging scandal, a conspiracy theory that became historical fact in the last couple of years.

“Firms including Barclays Plc (BARC) and UBS AG (UBSN) have been fined for manipulating Libor and related rates. The European Union fined six firms, including Deutsche Bank and Societe Generale SA (GLE), a record 1.7 billion euros ($2.3 billion) in December for rate-rigging. Ten people have also been charged in parallel U.S. and U.K. criminal investigations into the matter,” according to the article.

Deutsche Bank announced the same day that it would withdraw from the daily setting of the gold and silver benchmark price, citing the investigations by European regulators. And it comes as no surprise that these are the very same banks, along with ScotiaMocatta and HSBC, who are involved in fixing the daily gold.

Germany’s central bank Bundesbank announced in January that it would like to repatriate 300 tons of gold from vaults held in New York by 2020 – an indication of a lack of trust among central banks, according to a tweet by Bill Gross of PIMCO, one of the world’s largest fixed-income asset managers, in mid-January that was subsequently deleted.

The Return of the Gold Bull

While all of this evidence does not rule out the possibility of some new coordinated effort to suppress a rising gold price, the conclusion one can draw from analyzing the growing physical demand data, compared to the ineffectiveness of QE in ameliorating systemic weakness in the U.S. economy, is that the ability to suppress the gold price is breaking down.

And if the trend continues, it may just be that gold will finally throw off the shackles of U.S. dollar interest suppression, and resume the upward surge of the decade preceding 2011.