During one of my two speaking sessions at the Money Show in Orlando, Florida, on February 8, 2017, we had a question from the audience, asking us to weigh in on the issue of gold versus the dollar. Readers and followers of financial press may have observed reports that we took up our position in GDX (NYSE:GDX), the gold-mining ETF, on December 27, 2016 (initial 3%), and again on January 3, 2017 (to 4%), and January 9, 2017 (to 5%). It was fully rebalanced again to model weight on January 19, 2017, at 5%. We now hold an overweight position.

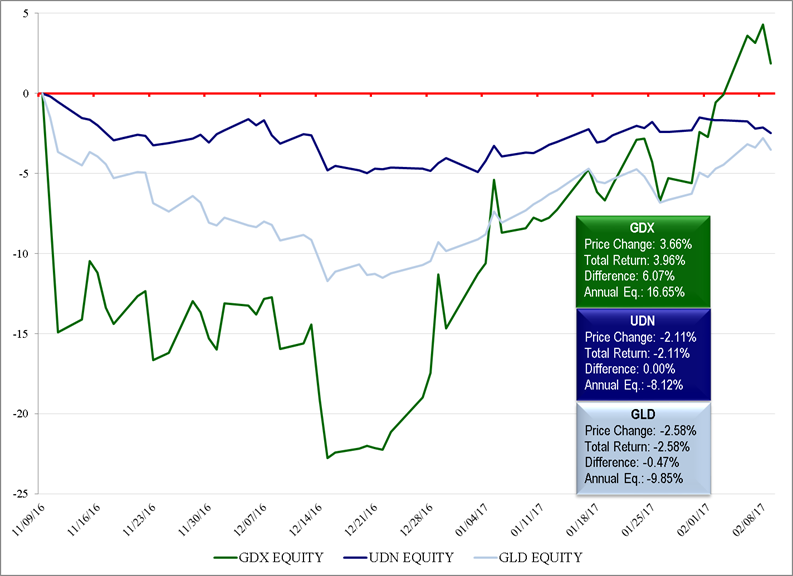

From our Bloomberg terminal, we compared UDN (PowerShares DB US Dollar Index Bearish Fund) to the performance of GLD (NYSE:GLD). GDX (VanEck Vectors Gold Miners US) was then added to the comparison. This series started on Election Day when the results were known and the Trump presidency became a reality. We carried that series through February 9, 2017, after we returned to our office from the Money Show visit.

- UDN (NYSE:UDN): An ETF that depicts the weakening aspects of the dollar.

- GLD: The ETF that is prominently used for gold.

- GDX: The gold-mining ETF that is held in client’s U.S. ETF managed portfolios.

The chart below tells the story. If UDN or GLD was traded during the same time period, the results were roughly the same. The correlation and volatility were different, but the results from November 9, 2016, to February 9, 2017 were essentially the same. Roughly the same amount of money would have been made or lost whether UDN or GLD was bought after Trump election and held until February 9.

The difference shown in this chart is the reaction of the gold-mining stock ETF. GDX shows the downward selloff after Trump’s election, a bottoming process in December 2016, and the progressive rising in GDX since that time. The total time period between election results and February 9, 2017, put GDX ahead of the metal and weak-dollar ETF.

One line of thought says that when gold-mining stocks are moving more robustly and higher than the metal itself, they portend rising prices for both. A second line of thought argues that when the reverse occurs, there are warning signs about the extension of a gold price rally. And the third line of thought argues that all of this is speculative and that none of this has long-term correlation. A fourth, fifth and sixth line of thought is that a higher gold price depends on a weaker dollar which depends on a higher inflation rate which depends on a continuing easy Fed policy.

We do not know which of those theories is correct, where the price of gold will be, what direction the dollar will take, or how detailed policies of the Trump administration, when known and implemented, will impact any one or several of these things.

We do know that gold prices have been rising, gold-mining stocks have been rising, and there are various explanations given for why those trends are happening. Is the cause a change in the monetary dynamics of the world? Is it India and the introduction of a new currency that will enable citizens in India to resume purchasing gold? Is gold going to have a role in Islamic societies, countries, and markets because of an alteration in Sharia (Islamic Law) that allows investment in gold? Are there other worldwide forces encouraging the use of gold as a monetary substitute? Or is gold just another metal – a barbaric relic of the past?

The answers to these questions can drive the investor’s decision-making process. Investors can determine individually what to do, how much, and when to do it.

At the moment, Cumberland Advisors’ US ETF managed accounts are overweight GDX, as has been reported in the financial press. It is important to note that our position could change at any time.