Lewis Carroll’s Alice in Wonderland is a timeless tale that chronicles the journey of a young girl into a psychedelic fantasy land. This tale is one that turns logic upside down, and takes us into a bizarre world that defies reality. To get to this world Alice falls down a precarious rabbit hole, perhaps the same one that has swallowed the junior gold stocks.

The juniors have seen so much carnage lately that investors have completely disregarded their sector. And this disregard has sent them down a proverbial rabbit hole, into a world that is bizarre and illogical to say the least. Though these stocks certainly don’t have much support with gold prices so weak lately, popular consensus that their sector is dead is pure fantasy.

Provocatively Carroll’s book falls into a genre called “literary nonsense”. And to play off this I would consider the fantasy land engulfing the juniors “literally nonsense”. In order for the junior sector to die, gold’s secular bull market would have to be over. And for a myriad of reasons, gold’s bull is nowhere near finished.

As long as gold’s bull market stays alive, there will always be a place for juniors. In fact, juniors’ role in the gold production cycle is indispensable. So rather than looking at this sector as sounding its own death knell, it should be viewed as a once-in-a-lifetime buying opportunity.

Given the performance of junior gold stocks, it’s no doubt a difficult sell to investors. Those of us who’ve owned juniors on the way down have certainly felt the intense pain. Many who’ve been burned will never come back. And for new investors considering a maiden venture into this realm, they’d understandably be repulsed by the current market sentiment as well as the chart action.

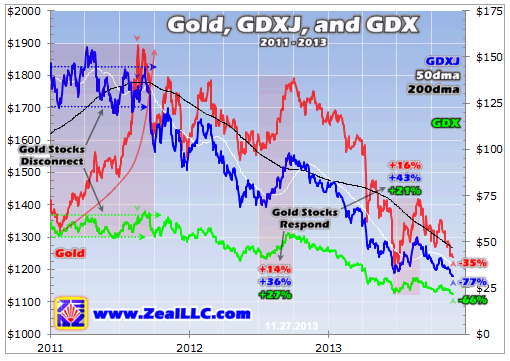

Gold stocks’ misery began right around the beginning of 2011. And you can get a clear visual picture of this in the chart below. In it are the three-year performances of gold and the two most popular gold-stock ETFs, GDX and GDXJ.

The largest of these ETFs is GDX, Van Eck’s Gold Miners ETF (in green). GDX is comprised of the world’s biggest and best gold-mining stocks, large producer companies that are collectively responsible for a big chunk of mine output. The much smaller GDXJ, Van Eck’s Junior Gold Miners ETF (in blue), is comprised of some of the world’s finest junior producer and exploration stocks.

Though I’ll focus on the juniors, I wanted to show GDX’s action to provide some context on the gold-stock sector as a whole. And as you can see, the entire sector has taken a beating amidst gold’s slide. No gold miner, no matter how big and bad, has been immune to the selling. Since gold’s August 2011 all-time high, GDX is down a gut-wrenching 66% to this week.

It’s been much worse for the juniors though. Since gold’s high, GDXJ has plummeted 77% to this week. And provocatively this is the best the juniors did over this stretch. GDXJ’s heavy weighting towards producers and larger deep-pocketed exploration companies only shows the damage of the junior elite. The smaller explorers, which are the vast majority of the junior-gold population, fared much worse than their GDXJ counterparts.

And interestingly junior suffering extends beyond gold’s 2011 apex. As you can see in this chart, gold stocks didn’t even participate in gold’s powerful 2011 upleg. Much to the dismay of investors, this sector consolidated sideways as gold soared higher. Gold stocks, as seen in both GDX and GDXJ, actually fell down the rabbit hole in late 2010.

Overall it’s been three long years that gold stocks have been out of favor. And this has no doubt led to the confidence crisis that is having a devastating effect on the juniors. Many of the larger companies will be able to weather this storm. But many of the smaller ones have not or will not. And this is readily apparent as shown in a fascinating new report on junior miners published by PricewaterhouseCoopers Canada.

This report, appropriately titled “Survival Mode”, analyzes the top 100 mining companies (based on market capitalization) listed on the TSX Venture Exchange. PwC pores through these companies’ financials and other market activities in order to offer insights, via useful multi-year trending, into this tricky realm. Though not all of these companies are gold-centric, over one-third do focus on the yellow metal (gold is the largest group by far). This report offers a great representation of what’s going on in the junior-gold realm.

The data in PwC’s report was as of the year ended June 30th. And the first thing of note was the year-over-year change in the collective market capitalization of the top 100. In 2013 it fell a staggering 41%. And this was on the heels of a nasty 43% decline the previous year. This certainly supports the carnage we’ve seen with GDXJ!

Also like GDXJ, we need to keep in mind that this PwC measure only represents the larger elite companies. I suspect the market-cap declines are progressively worse for every subsequent 100 companies. The smaller and less-liquid ones are typically subject to a lot more downside pressure.

Another interesting measure is changes to cash and short-term investments. In 2013 the cash balances of the top 100 companies went down a collective $700m, which is equivalent to a 36% YoY decrease. This cash drain is a huge problem for these companies since most don’t have a consistent-enough source of cash flow to support replenishment.

The only way most of these companies are able to replenish their treasuries is to raise capital via financing activities. Producers and advanced-stage developers can sometimes access bank debt to fill their coffers. But with metals prices down, these companies have had a difficult time procuring loans and/or getting them with reasonable terms. As a result, they’ve had to rely more on selling their shares. And as the explorers can attest to, this has been a fool’s errand lately.

Most juniors rely on equity financings to fund their work programs. And to sell their shares, they naturally need an investor contingent willing to buy them. The larger juniors can sometimes attract institutional investors, but for the most part the buying rests on the shoulders of retail investors. And given the current sentiment maelstrom, these investors sure have been hard to find. This is readily apparent in the cash flow statements of the top 100, with cash provided by financing activities down by 34%.

Sadly juniors’ financing woes are amplified at these lower valuations. Significantly lower share prices means they need to sell significantly more shares to get the funds required for their endeavors. Needless to say, this is incredibly dilutive for existing shareholders. And that’s even if they had the investor interest and/or enough shares available on the shelf. By dollar amount, equity financings for the top 100 were down 50% YoY ($795m vs. $1.6b)!

Overall even with juniors cutting costs and reeling in capex (capex is down by 15% YoY, including a 28% decline for the explorers), this lack of financings has forced them to pull more from cash reserves. And it isn’t just the explorers drawing down cash, it’s also the producers. With metals prices lower, revenues were down 25% and consolidated net income was down 60%. This forced many producers to pull from cash reserves in order to fund operations.

Another thing PwC keeps tabs on is write-downs. We all saw the massive write-downs announced by the majors in Q2 this year. And apparently this trend trickled down to the juniors as well. By dollar amount, write-downs were up 175% YoY. And this wasn’t distorted by a small handful of large ones. Over one-third of the top 100 wrote down at least one asset.

The final tidbits from the bowels of the junior rabbit hole are more from the TSX.V than PwC. Things have been so bad that IPOs on the TSX.V have fallen by more than half in the past three years. And this is accompanied by the fact that graduations to the TSX big boards are down 74% YoY. Folks just aren’t interested in fresh meat, and the mining companies aren’t performing well enough to deserve promotions.

The recent performance of the GDXJ ETF and the alarming data revealed in the PwC report paints a pretty ugly picture of the state of the junior golds. So ugly that most folks have completely discounted this sector’s ability to ever recover. But though it has ventured deep into the proverbial rabbit hole, this sector is long overdue for a reality check.

The reality is junior gold stocks are wildly oversold. Only in a bizarre fantasy world should they be this beat up, even with the weaker gold prices we’re seeing today. They’re trading as though gold is going to zero. But it’s not. In fact, gold is overdue for a powerful mean-reversion upleg that should send prices well above 2011’s high.

When gold finally recovers, the junior-gold-stock sector will follow. And it will follow in violent fashion, with an upswing that is just as ferocious as the downswing has been. These stocks are so undervalued that it won’t take much investor interest to bid share prices far higher. Just as the juniors negatively leverage to the downside, they’ll positively leverage to the upside.

And there will be no disconnect like 2011’s anomaly. When gold emerges from its slump, the juniors will leave the fantasy land they’ve fallen into to emerge from the rabbit hole with renewed vigor, much like Alice.

We’ve already seen signs of life even amidst the recent bear run. As you can see in the chart above, in the rare occurrences when gold mounted a charge the juniors roared higher. This happened in Q3 2012 when GDXJ gained 36% to gold’s 14%, and then again in Q3 2013 when GDXJ surged 43% to gold’s 16%.

Investors must however be cognizant of what will be a new junior landscape upon the imminent junior revival. This sector simply can’t weather this maelstrom without any casualties. Many juniors will not be able to recover, and will either go out of business or be absorbed into more solvent companies. We must be prudent when choosing which stocks to ride.

Thankfully there’s a healthy contingent of elite high-quality juniors that are well-positioned to lead the charge higher. These companies have solid assets, superior management, and relative financial strength. When things get cooking again in the junior realm, their stocks will attract the most investor attention.

The bottom line is there’s been wailing and gnashing of teeth in the junior-gold-stock realm. And this realm has been beaten down far worse than it should have been even amidst the currently weak gold-price environment. Junior golds have fallen way down the rabbit hole, into an unrealistic and irrational fantasy world that cannot subsist.

Gold will eventually wake up from its slumber. And when it does, the juniors are going to rocket higher in epic fashion. Investors who take advantage of this historic opportunity by scooping up high-quality high-potential juniors for cheap ought to be greatly rewarded.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold's Junior Sector: Once In A Lifetime Buying Opportunity

Published 11/30/2013, 02:08 PM

Updated 07/09/2023, 06:32 AM

Gold's Junior Sector: Once In A Lifetime Buying Opportunity

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.