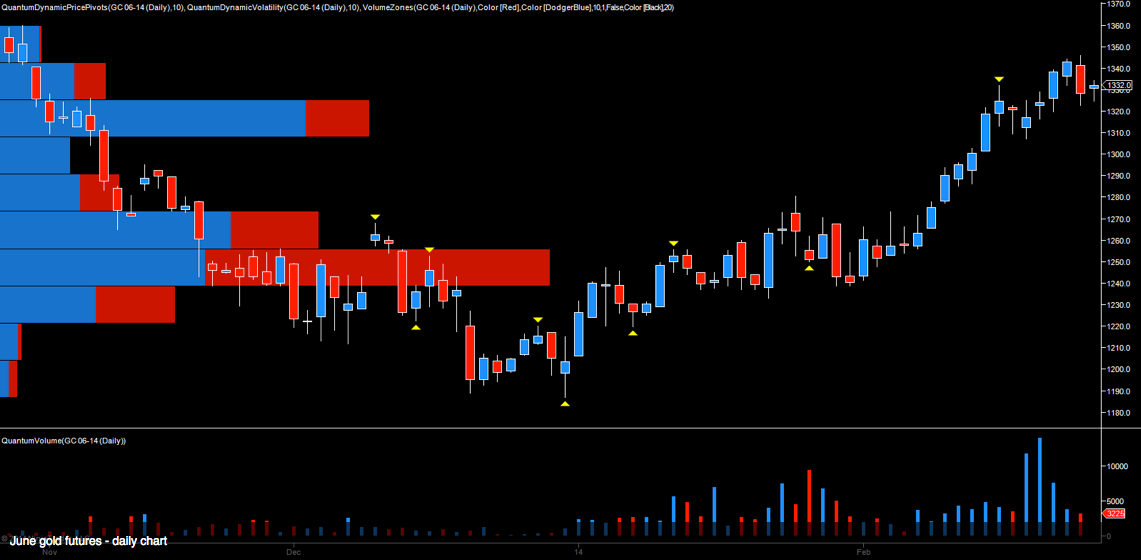

Gold’s recent bullish momentum appears to be holding firm for the time being and indeed February has been a positive month with only minor pullbacks and reversals denting the move higher. The first key level to be breached was the psychological $1300-per-ounce price point, which the precious metal easily cleared, moving smoothly through to test the $1345 per ounce region earlier this week.

Wednesday’s wide-spread down candle which saw the metal shed $10 per ounce was largely as a result of sustained dollar strength with the two now appearing to be back in correlation. However, it is interesting to note that Wednesday’s move lower was accompanied by only average volume, suggesting that the selling pressure at this level may simply be short-term profit taking and certainly not an indication of any structural weakness on the chart.

Testing Support

With the metal trading at $1332 for the June contract, we're now testing the platform of support clearly in place between $1315 and $1325, as shown by the volume at price histogram on the left-hand side of the chart.

Should this level hold, as expected, then the current bullish momentum for gold looks set to continue further and any clearance of the $1350 region will set the precious metal well on the way to take out the November high of $1360 per ounce in due course.