Please Note: Future editions of our Daily Market Update will focus on breaking news and important market commentary of the day. Our Weekly Market Update, published on Fridays, will now deliver to you value-added content and more detailed and comprehensive market analysis.

- With gold languishing near deep secular lows, its technicals look hopelessly broken.

- Sentiment is off-the-charts bearish, with traders universally convinced gold is doomed to spiral lower indefinitely.

- But gold’s weakness this year is very deceiving, as it wasn’t the product of global fundamental supply-and-demand forces.

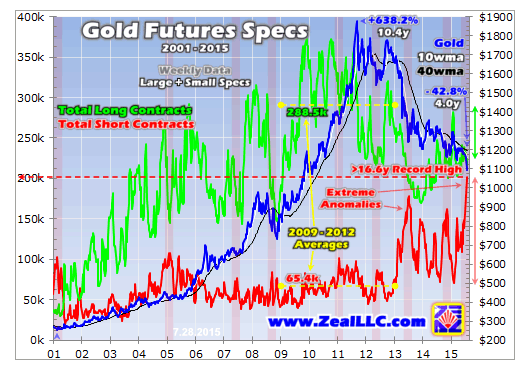

- Extreme record shorting by American futures speculators spawned these artificial lows.

- Gold’s imminent short-covering rally should be the largest ever, coming from record extremes.

Market Update

Today’s AM LBMA gold prices were USD 1,094.80, EUR 998.50 and GBP 707.74 per ounce.

Friday’s AM LBMA gold prices were USD 1,091.35, EUR 998.99 and GBP 703.01 per ounce.

Last week, gold and silver were mixed with gold marginally lower for the week - down 0.28% to $1,092.10 and silver up 0.4% to $14.77 per ounce.

This morning, gold is 0.1% higher to $1,096 per ounce. Silver is up 0.74% to $15.02 per ounce.

Platinum and palladium are 0.74% and 0.5% higher to $973 and $607 per ounce respectively.

Important News

GoldCore in Marketwatch – Market Watch

Gold stalls as US jobs data keeps door open to Sept Fed hike – Reuters

Gold Bulls Catch a Break as Dollar and Equity Drops Eclipse Jobs – Bloomberg

Gold turns higher in wake of jobs report – MarketWatch

Grim China data keeps stimulus hopes alive – Reuters

Important Analysis

Marc Faber: Gold To Be Revalued From $1,000/oz to $10,000/oz – Zero Hedge

China is hiding gold… lots of it – Mining.com

China is hiding 9,500 tonnes of gold – Business Insider UK

JPMorgan (NYSE:JPM) Gold Vault Hubbub – TF Metals Report

Greece inches closer to 3rd bail-out deal but Finns insist rescue package ‘won’t work’ – Telegraph