What happens when an irresistible force meets an immovable object? We’re about to find out in the gold markets.

The irresistible force is Chinese gold demand, which is surging along with its price. Gold flirted with $1,300 on Thursday and Friday. (Much higher demand from India could be coming shortly, too.)

The immovable object is Wall Street’s bearish view on gold, a view that hardened after gold plunged 28% last year. Wall Street hates gold with the white-hot heat of a thousand suns.

But I think Wall Street is about to get blown away. And not just because gold hit a three-month high on Tuesday.

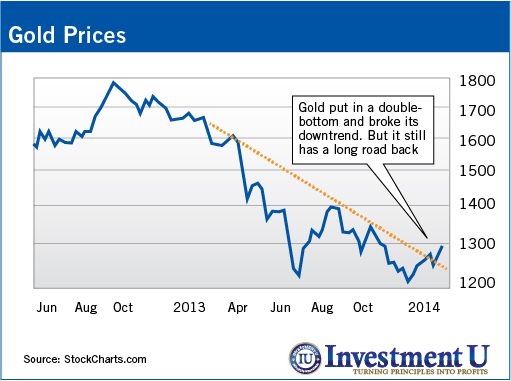

A chart of gold prices shows that the metal has fallen very far – but there are signs to give the bulls hope. We can see a double-bottom is in place. Gold broke its weekly downtrend.

I’d say the technical picture is improving even as bullish fundamentals line up for the next push higher.

They include…

Renewed Buying From China

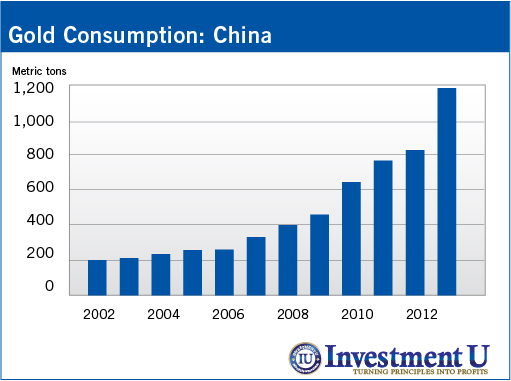

China’s gold consumption jumped 41% last year to 1,176.4 metric tonnes, according to data from the Chinese Gold Association. “Chinese consumer demand is unprecedented,” one dealer said in news reports.

Jewelry demand climbed 43% and bullion demand soared 57%.

Consumer sales surged by at least 20% in December 2013 from a month earlier and were up 15% compared with the same period in 2012.

China’s 2013 gold imports from Hong Kong more than doubled from the previous year, even though its own mines are producing at record rates.

An End to Selling of Gold by ETFs?

Assets in bullion-backed exchange-traded funds shrank 33% last year. All that metal rushing out of the funds weighed heavily on gold prices.

China bought most of the gold that the funds sold, and doesn’t seem eager to give it back.

But ETF selling has slowed to a trickle. Gold ETF outflows slowed 76% from December to January, according to data from ETF Securities.

What’s more, the end of January saw gold ETFs experience their largest inflows in a year.

It’s still early in the year, but if the funds are done hemorrhaging yellow metal, that lifts a huge weight off the market price.

Yellen Puts Wings on Gold

New Federal Reserve Chairwoman Janet Yellen appears for the moment to be following the easy-money path laid by predecessor Ben Bernanke. And that’s good news for gold.

Although she said tapering of the bond-buying program is likely to continue, she also signaled there is no preset course for the scale-back of quantitative easing. That statement helped gold rally this week.

India May Lift Restrictions on Gold Imports

Last year, India’s gold imports soared. In fact, the trend was blamed for pushing India’s current account deficit to a record.

So the Indian government hiked duties on gold imports three times last year, to a record 10%. It also dictated that a fifth of all imports of gold be shipped out.

Since India was 20% of global demand in 2012, these actions pushed gold prices lower last year. Indian gold imports probably fell 70% in the final quarter of 2013.

These policies have reduced India’s current account deficit, as intended. But it’s also ruining India’s jewelry business. Many experts expect India to ease restrictions on imports after the official current account deficit is released next month.

There are other forces at work, including a potential strike at gold mines in South Africa and booming gold coin sales in the U.S.

Could gold prices go lower? Yes. But it darned sure looks like the bottom is in. If that’s the case, gold miners, which have been beaten into the dirt, are now bargains.