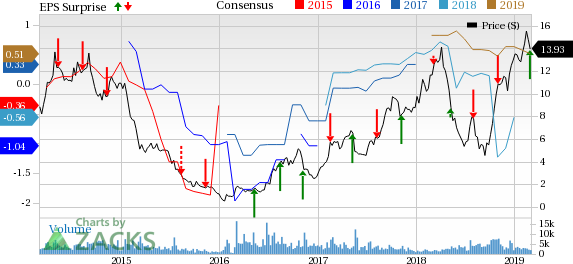

Gol Linhas Aereas Inteligentes S.A. (NYSE:GOL) delivered adjusted earnings per share of 38 cents in the fourth quarter of 2018, beating the Zacks Consensus Estimate of 21 cents. However, results were partly affected by exchange and negative monetary variation.

Meanwhile net revenues of R$3.2 billion improved 10.1% year over year owing to solid demand for air travel and a strong pricing. Passenger revenues accounted for bulk (93.3%) of the top line and rose 10.3% on a year-over-year basis.

Operational Statistics

Consolidated revenue passenger kilometers (RPK) — measure for revenues generated per kilometer per passenger — increased 3.5% year over year. The metric improved 1.8% and 18.7%, each on the domestic and international front.

Consolidated available seat kilometers (ASK), measuring an airline's passenger carrying capacity, rose 2.4% year over year. While domestic capacity inched up 0.4%, international capacity expanded 18.8%.

In the fourth quarter, the company’s total load factor (percentage of seats filled with passengers) was 81.9% compared with 81% in the year-ago period. The metric improved as traffic growth outpaced capacity expansion.

Average fares increased 6.7% in the quarter under review. While net passenger revenue per ASK climbed 7.7%, total revenue per ASK grew 7.5% year over year. Cost per ASK slid 2% year over year. The metric decreased 19.4% excluding fuel. This upside was driven by improved operating results from aircraft sales.

Financials

Gol Linhas exited the fourth quarter with a total liquidity (including cash and cash equivalents, financial investments, restricted cash and accounts receivable) of R$3 billion, a decline of R$207 million compared with the year-ago figure. Additionally, long-term debt totaled R$5.86 billion at the end of the fourth quarter compared with $5.94 billion at the end of the year-ago period.

Total operating expenses increased slightly to R$2.53 billion. The metric excluding fuel, contracted 17.5% year over year. Total volume of departures decreased 2.3% while the number of seats increased 1.9%.

2019 Outlook

The company anticipates net revenues of approximately R$2.9 billion, unchanged from the past expectation. Additionally, earnings per share are envisioned in the range of $1.30-$1.50. Previously, the estimate was in the band of $1.20-$1.40. The Zacks Consensus Estimate for the same stands at 57 cents. The forecast for fuel price has been reduced to R$2.8 per liter. Meanwhile, the prediction for pre-tax margin has been increased to 10% from the prior 9%.

The capex anticipation remans the same at R$650 million. Also, the effective tax rate is still projected to be 20% in the year. The company’s expected fleet size at the end of the year is fixed between 122 and 125. The view for capacity and load factor is also unaffected at 6-10% and 79-81%, respectively. However, the operating margin forecast has been raised to 18% from 17% expected earlier.

The guidance includes the impacts from down trending oil prices, appreciation of Brazilian Real against U.S. Dollar, lowered taxes on jet fuel and effects of the 737 MAX fleet acceleration program.

2020 Outlook

For 2020, the carrier anticipates fleet size to grow between 125 and 128, untouched from the past expectation. Additionally, capacity and load factor are still estimated to increase in the 7-10% and 79-81% range, respectively. The projection for total net revenues are fixed at R$14.2 billion. Also, the prediction for effective tax rate is the same at 20%. Moreover, the company continues to expect capex of R$600 million in the year.

However, it now anticipates fuel price of R$2.9 next year compared with the former estimate of R$3. Meanwhile, operating margin forecast has been raised to 19% from 18%, expected previously. Pre-tax margin is now forecast to be 12% compared with the previous projection of 11%. Further, earnings per share are now anticipated between $1.70 and $2 compared with $1.60-$1.90, expected earlier.

The view includes the impacts from down trending oil prices, appreciation of Brazilian Real against U.S. Dollar, reduced taxes on jet fuel and effects of the 737 MAX fleet acceleration program.

Zacks Rank & Other Key Picks

Gol Linhas carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the same space are Azul (NYSE:AZUL) , Air China Ltd. (OTC:AIRYY) and SkyWest, Inc. (NASDAQ:SKYW) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Shares of Azul and Air China have rallied more than 79% and 19%, respectively, in the past six months. Meanwhile, the SkyWest stock boasts an impressive earnings history, having outperformed the Zacks Consensus Estimate in each of the preceding four reported quarters, the average being 16.9%.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

See Stocks Today >>

Air China Ltd. (AIRYY): Free Stock Analysis Report

Gol Linhas Aereas Inteligentes S.A. (GOL): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post

Zacks Investment Research