GoDaddy Inc. (NYSE:GDDY) has announced changes at its management level. The web hosting company announced that its chief executive officer (CEO), Blake Irving, would retire at the end of this year, effective December 31, 2017.

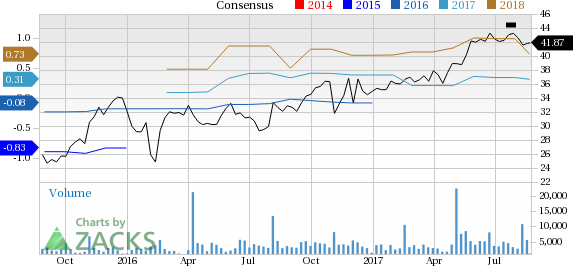

Following the news, the company’s share price increased 1.01%. Also, the stock has been steadily treading higher on a year-to-date basis. The company's shares have gained 19.8% year to date, outperforming the industry’s gain of 18.7%.

More Into the Headlines

Post Irving’s retirement, Scott Wagner, GoDaddy’s current chief operating officer (COO) and president, will become the new CEO of the company. However, Irving will continue to serve on the company’s board through June 2018

Wagner has been working with GoDaddy for the last four years. During this time, he was promoted to various positions with expanded responsibilities. In 2016, he was promoted as the president of GoDadday. He looked after various important matters including marketing, customer care, international markets, and corporate development.

Given that Wagner has already been working with the company for quite a long time and has the required experience in marketing, governance and leadership, we believe, his appointment will be instrumental in helping the company achieve long-term goals.

Recent Second Quarter Results & Guidance

The company recently reported strong second-quarter results. Its earnings of 13 cents per share surpassed the Zacks Consensus Estimate. The increase was driven by growing revenues, strong adoption of its new products, including its new mobile-optimized website builder, GoCentral, and contribution from HEG acquisition. Also, strong growth in customers and expanding average revenue per user (ARPU) led to the top-line growth.

For the third quarter, the company expects revenues in the range of $577-$582 million, including HEG. The Zacks Consensus Estimate is pegged at $578.9 million.

For full-year 2017, GoDaddy raised its revenue guidance to $2.215-$2.225 billion from its earlier guidance range of $2.195-$2.225 billion. The new guidance represents a year-over-year growth of approximately 20%. The Zacks Consensus Estimate is pegged at $2.22 billion.

About GoDaddy

GoDaddy is engaged in the designing and development of cloud-based technology products for small businesses, web design professionals and individuals. The company’s industry peers include big names such as MakeMyTrip Limited, CafePress and GrubHub.

Zacks Rank & Stocks to Consider

Currently, GoDaddy has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Lam Research Corporation (NASDAQ:LRCX) and Alibaba Group Holding Limited (NYSE:BABA) , sporting a Zacks Rank #1 (Strong Buy), and PetMed Express, Inc. (NASDAQ:PETS) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lam Research delivered a positive earnings surprise of 4.44%, on average, in the trailing four quarters.

Alibaba Group Holding Limited delivered a positive earnings surprise of 12.16%, on average, in the trailing four quarters.

PetMed Express delivered a positive earnings surprise of 10.78%, on average, in the trailing four quarters.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

GoDaddy Inc. (GDDY): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research