So how do you regulate a new market that is decentral in nature?

Best Answer: Let them regulate themselves

It may sound surprising but the world's two most crypto friendly nations are going this way. Very recently both Japan and South Korea have announced the formation of a self-regulatory program for crypto exchanges.

The idea is that those with hands-on experience in the blockchain industry will be able to do as good a job at setting and enforcing guidelines than any government body, if not better. The notion has also been championed by the CFTC in the United States, and by CryptoUk in the United Kingdom.

Depending on the circumstances, self-regulation doesn't always work out. India had formed the DABFI crypto self-regulatory body back in February 2017. Yet now, after a sweeping crackdown from India's central bank, crypto exchanges in India are fighting for their right to exist and many will likely relocate.

The pressure is now high for Japan and South Korea to deliver quick and comprehensive results that demonstrate their ability to service themselves in a satisfactory way.

Today's Highlights

China Figures

US-Japan Meeting

Crypto Divergence

Please note: All data figures and graphs are valid as of April 17th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

With the airstrikes in Syria now seemingly behind us, the geopolitical outlook is looking somewhat more stable as many believe the Western response to Assad's chemical weapons is now complete.

Stock markets in the United States rose yesterday as tensions eased. However, markets do seem to be under pressure in Asia this morning despite some rather picture perfect numbers from China.

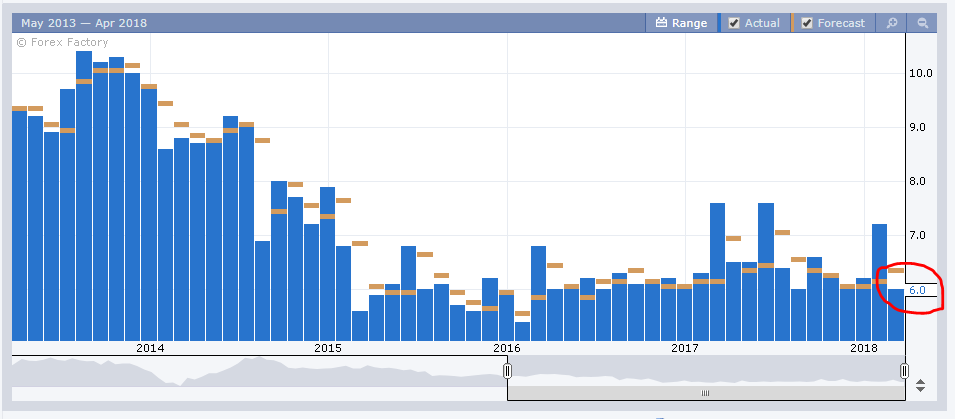

The Chinese government seemed to get exactly what they were looking for as GDP growth came in at 6.8%, exactly as anticipated. When the headline figures are this great, many are looking to alternative figures like industrial production, which did not quite meet its quota.

The China A50 index is taking a bit of a hit and is now at its lowest level in seven months.

USA-Japan Strained Relations

All eyes will be on Trump's Mar-a-Lago golf resort today where the main guest is Prime Minister Shinzo Abe who will be visiting the President from Japan.

Abe has been rather notably left out of the current talks with North Korea and is no doubt feeling a bit snubbed after Japan did not receive any exemption on Trump's new Steel and Aluminum Tariffs.

The two leaders do seem to have a great relationship on the surface and will seek to smooth things out while whacking a few little white balls around the green. Of course, if all goes well it will be more than just the men's egos that get a boost.

As far as currencies go, we can see here the US Dollar against the Japanese Yen, which is sitting remarkably lower than it's 200-day average price (yellow line).

Crypto Divergence

As we've noted several times before, the crypto market tends to move together when things are falling but when prices are rising performance between different coins may vary.

Therefore, it's a great sign that over the last week the different cryptos have all been rising but with widely different percentage gains. Here we can see all of the different cryptos in eToro on a single graph.

The bitcoin short squeeze on Thursday the 12th is rather apparent with everything rising together but since then we're seeing a lot more divergence than we've grown accustomed to in recent weeks

Still, it does seem that the sentiment of the entire market is rather correlated as investors still are putting all cryptos in the same basket rather than taking a particular stance on one or the other.

This level of correlation is also seen in the stock market as overall sentiment does have a tendency to affect individual stocks. The more we see different assets with different levels of performance the better it will be.

Of course, the inherent volatility in this market is still extremely risky and investors should take note of associated risks. As the old saying goes, you can't make an omelet without breaking a few eggs.

Let's have an amazing day ahead.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.