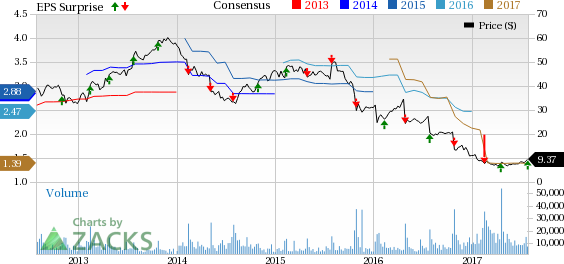

GNC Holdings Inc. (NYSE:GNC) reported second-quarter 2017 adjusted earnings per share (EPS) of 41 cents, reflecting a massive 48.1% year-over-year deterioration. However, the quarter’s adjusted EPS surpassed the Zacks Consensus Estimate of 40 cents by a penny.

The year-over-year decline can be attributed to a dull revenue performance in the reported quarter, primarily because of underperformance by the U.S. & Canada and manufacturing/wholesale segments.

Including one-time items, the company reported earnings of 23 cents per share, down 75.5% year over year.

Revenues

Revenues during the reported quarter dropped 4.8% year over year to $640.9 million. The figure also missed the Zacks Consensus Estimate of $648 million.

Apart from lower sales at the U.S. & Canada international and manufacturing/wholesale segments, the decline in revenues can be attributed to a overall drop in sales of protein, vitamins, weight management and food and drink categories.

Segment in Details

GNC Holdings reports operations under three segments: U.S. & Canada – including company-owned stores in the U.S., Puerto Rico and Canada, franchise stores in the U.S. and e-commerce; International – including franchise locations in approximately 50 countries, The Health Store and China operations; and Manufacturing/Wholesale – comprising manufactured product sold to other segments, third-party contract manufacturing and sales to wholesale partners.

During the reported quarter, GNC Holdings’ revenues from the U.S. & Canada segment dropped 4.8% to $543.4 million, primarily owing to a $15.1-million decrease due to the discontinuation of the Gold Card program. In domestic franchise locations, revenues however rose nearly 1 million on higher average store base partially offset by a 1.1% decrease in retail same-store sales.

The second quarter also witnessed the steepest decline in protein, vitamins, weight management and food and drink categories. This decline was partially offset by strong performance by the supplements, health and beauty and the herbs and greens categories. Also, Gnc.com comp decreased 6.3% in the second quarter.

Revenues at the international segment increased 1.3% to $43.6 million. Revenues from international franchisees decreased $1.3 million primarily due to the impact of a 1.9% drop in retail same store sales. Also, tough year over year comparison due to year-ago quarter’s additional sales of $4.0 million (associated with the timing of shipments resulting from the annual franchise conference) acted adversely.

Revenues from the China business increased $3.6 million in the current quarter from the year-ago quarter, partially offset by the decline in revenues from international franchisees.

Revenues at the manufacturing/wholesale segment (excluding intersegment revenues) decreased 8.9% to $53.9 million. Within this segment, third-party contract manufacturing sales fell 3% to $32.7 million, which was partially offset by a 19.3% decline in wholesale sales to $21.8 million and a 2.7% drop in intersegment sales to $61.3 million. Sales to wholesale partners decreased 16.6% year over year from $25.5 million to $21.2 million in the quarter. Intersegment sales deteriorated by $0.6 million from $56.6 million in the year-ago quarter to $56.0 million in the quarter.

Margin

Gross profit deteriorated 10.9% in the reported quarter to $212.7 million primarily due to the impact of pricing and loyalty associated with the One New GNC plan, which dented the retail margin rate. Consequently, gross margin contracted 227 basis points (bps) to 33% owing to lower sales and product margins at the company’s GNC.com business.

Selling, general and administrative expenses rose 10.8% to $154.0 million. However, adjusted operating margin deteriorated a huge 566 bps to 9.2% owing to a steeper decline in gross profit.

Financial Position

GNC Holdings exited the reported quarter with cash and cash equivalents of $51.9 million, up from $39.8 million at the end of first-quarter 2017. Long-term debt was $1.509 billion at the end of the quarter, compared with $1.502 billion at the end of first-quarter 2017. Year to date, the net cash flow from operating activities was $72.85 million, compared with $130.89 million a year ago.

Further, the company generated year-to-date free cash flow of $54.2 million as compared with $110.5 million in the year-ago quarter.

‘One New GNC’ Plan Update

Earlier, management had announced plans to revamp its existing business model, dubbed as the ‘One New GNC”. The company has been seeing transformational changes during the second quarter 2017 as well. Transaction growth was up 12.3% in the second quarter, resulting in a sequential improvement in first-quarter same store sales. As of the end of the second quarter of 2017, 7.3 million consumers joined the myGNC Rewards Program and there were approximately 237,000 PRO Access members. The company also launched a GNC storefront on Amazon (NASDAQ:AMZN), as a part of the company's omnichannel strategy.

Our Take

GNC Holdings exited the second quarter of 2017 on a disappointing note with revenues missing the Zacks Consensus Estimate. Although earnings exceeded the consensus estimate, the year-over-year decline on both the fronts was a huge disappointment. The decline can be attributed to lower sales in the company’s U.S. & Canada and manufacturing/wholesale segments. Also, the decline in gross and adjusted operating margin is a matter of concern.

On a positive note, during the second quarter, management witnessed positive response for its New GNC Plan. New consumer enrollment under the myGNC Rewards Program and launch of GNC storefront on Amazon buoy optimism.

Zacks Rank & Key Picks

GNC currently has a Zacks Rank #4 (Sell).A few better-ranked medical stocks are Mesa Laboratories, Inc. (NASDAQ:MLAB) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, INSYS Therapeutics sports a Zacks Rank #1 (Strong Buy), while Mesa Laboratories and Align Technology carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock has gained around 1.9% over the last three months.

Mesa Laboratories has a positive earnings surprise of 2.8% for the last four quarters. The stock has added roughly 2.6% over the last three months.

Align Technology has an expected long-term adjusted earnings growth of almost 24.1%. The stock has added roughly 16.8% over the last three months.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Mesa Laboratories, Inc. (MLAB): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

GNC Holdings, Inc. (GNC): Free Stock Analysis Report

Original post

Zacks Investment Research