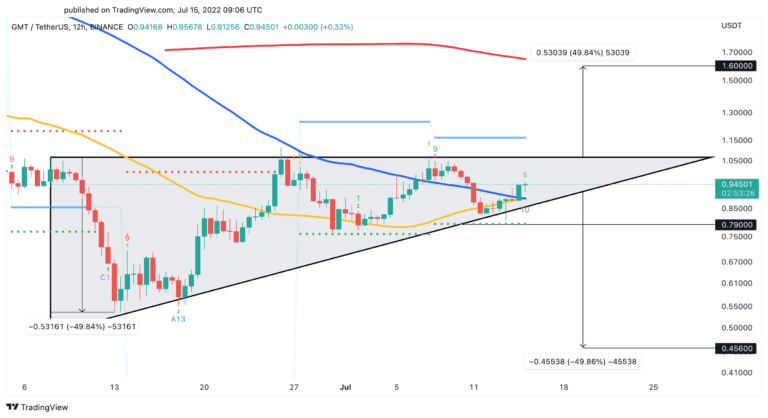

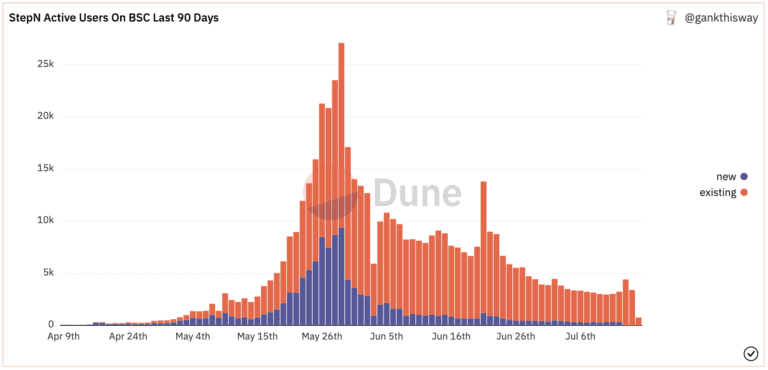

STEPN’s GMTn/USD token looks primed for a spike in volatility as activity on the app continues to decline. Web3 “move-to-earn” app STEPN hasn’t registered any new users on its BNB chain version in the past three days, while activity from existing users continues to decline. STEPN’s GMT token appears primed for a significant price moment. GMT currently trades 77% below its all-time high of $4.2o in late April. The token briefly recovered over the past month after hitting a low of $0.53 on June 13. Still, STEPN appears to be locked in a stagnant period without providing a clear sign of where it’s heading next. The 12-hour chart shows that GMT’s price action has formed an ascending triangle. The consolidation pattern anticipates that once STEPN breaches the $1.10 resistance or the $0.79 support level, a 50% price movement may follow. This target is derived from the height of the triangle’s Y-axis. Although technical indicators show indecision around GMT’s price, the on-chain activity looks pessimistic. The number of active players on the BNB chain version of the game has plummeted by nearly 96% in the last two months, and no new BNB players have joined in the past three days. A similar trend is also playing out on the app’s flagship version Solana. After registering an all-time high of 104,149 users on May 26, there are now only 20,777 players as of July 14, representing an 80% drop in activity. While user activity shows STEPN is in decline, it is essential to wait for a decisive close of GMT’s price outside the $1.10 to $0.79 range before considering a long or short position. Only a sustained break out of this interest zone can help determine where GMT will go next. Until that happens, caution is advised.Key Takeaways

STEPN at Risk of Steep Correction

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GMT At Risk As STEPN Network Activity Plummets

Published 07/15/2022, 07:46 AM

GMT At Risk As STEPN Network Activity Plummets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.