European markets are pointing to weaker start on Friday as they weighed up the impact that the coronavirus outbreak was having on the global economy and the failure of EU leaders to agree an ambitious rescue package. Not even the continued rebound in oil prices or the U.S. House of representatives passing a $484 billion coronavirus aid package is proving sufficient to lift stocks on Friday.

Oil Rally Eases

Sentiment this week has been closely tied to the ebbs and flows of the oil market. WTI managed another staggering rally on Thursday, jumping 19.7%, whilst Brent added 4.7% following a timely exchange of threats between President Trump and Iran. However, there are signs of the rally in oil tiring, which perhaps isn’t that surprising given the slew of dire data in the previous session. Data releases across the globe illustrated the devastating effect that the coronavirus outbreak is having on the world economy.

PMIs in Europe showed the complete collapse in service sector activity, whilst manufacturing sectors also fell deeper into contraction. With unemployment in the U.S., the world’s largest economy, now over 26 million, hopes of any quick rebound in the global economy are fading fast.

UK Retail Sales Dive -5.1%

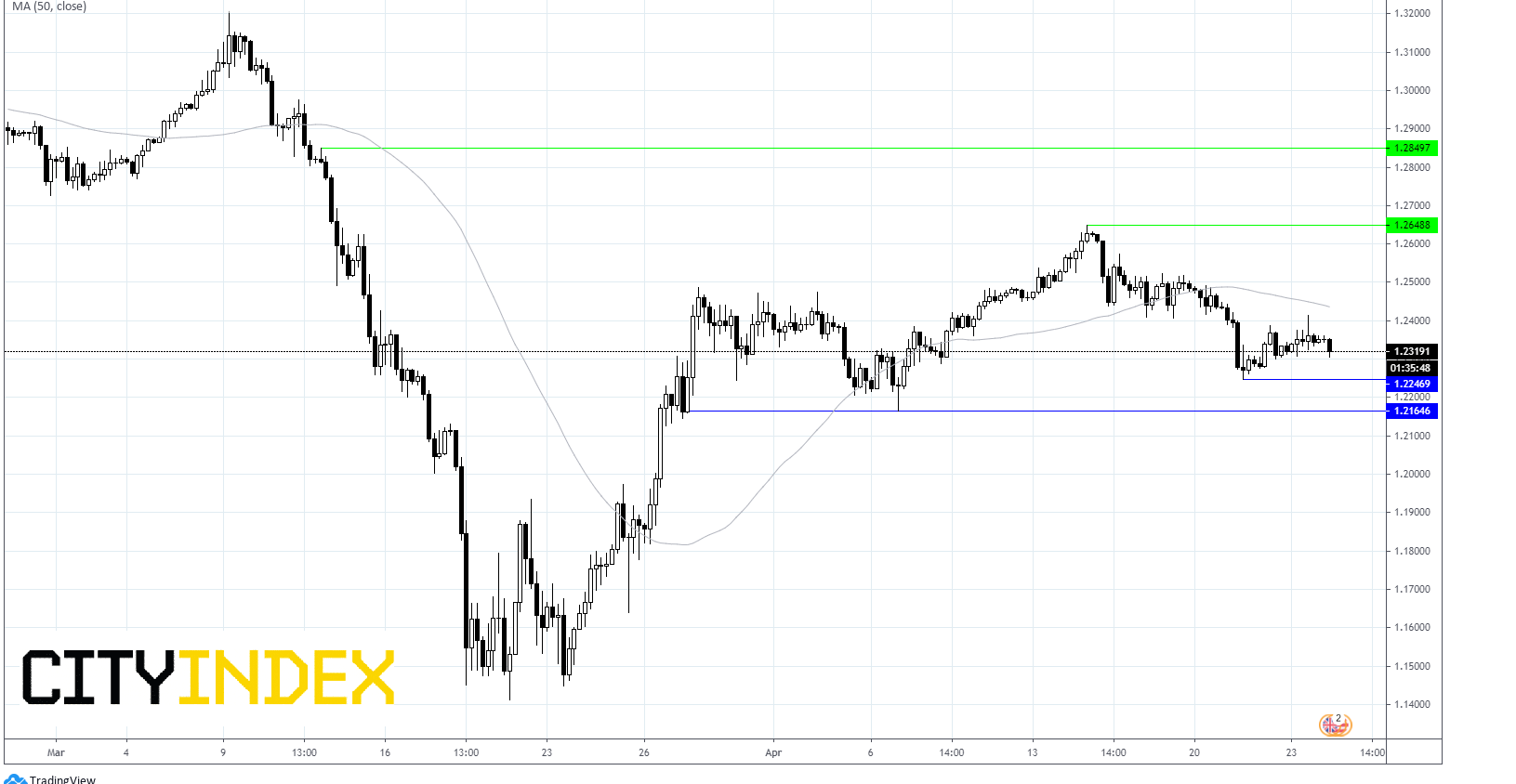

Whilst the poundhad almost been immune to the eye watering data in the previous session that is not the case this morning. Yesterday, the UK composite PMI dropped to a record low of 12.9, the pound still finished the session on positive ground.

Today, sterling is heading back towards $1.23 after the release of disappointing UK retail sales. UK retail sales plunged -5.1% mom in March, worse than the 4% forecast. The data only captures the start of the lock down so we know these figures are going to get a lot worse.

Added to that, without a vaccine it is highly unlikely that there will be a quick rebound in the retail sector. Even when the UK starts to ease lock down restrictions and reopen its economy there will almost certainly be restrictions on shops, with limits to customer numbers at any one time.

EU Summit Failings

Adding to the gloomy mood in the market was the Eurogroup leader’s unambitious conclusion to the EU Summit. The leaders failed to agree on a broad and imminent rescue package leaving the Euro struggling to find buyers.

Despite extensive discussions the group only approved previous plans for a limited package whilst kicking the can down the road for any larger financial response in June. The euro continues to hover around a monthly low versus the U.S. dollar. Traders will now look ahead to IFO Business sentiment data.