Forex News and Events

Safe haven battle

In the wake of Britain decision to leave the European Union, financial markets adjusted mostly as expected, meaning that investors fled risky assets to buy safe havens ones, nothing revolutionary. In the FX market, it translated into a substantial increase in demand for the Swiss franc and the Japanese yen, the two famous safe haven currencies, while the pound sterling, the single currency and all commodity currencies saw a rapid slide in price. However, since mid-June the Swiss franc and the Japanese yen started to behave differently.

Indeed, historically the correlation between CHF/USD and JPY/USD would be between 0.4 and 0.6 (this applies for weekly, bi-weekly and monthly correlation) but since the Brexit vote, the dynamic between the two safe haven currencies has changed dramatically. Indeed, the correlation is now negative - at around -0.40 in average - meaning that the Swiss franc has kind of lost its safe haven status. The question is: why the dynamic has changed quite so dramatically?

Well, it seems that it is a central bank story, namely that one of the two managed to be feared by traders, while the other one lost its credibility. Indeed, after the Brexit vote the SNB made clear it had intervened in the FX market and will keep doing so to protect the franc against further appreciation. A few days later the Swiss franc returned roughly to its pre-Brexit levels, while the Japanese yen kept appreciating massively against all currencies. This morning the CHF lost 0.20% against the dollar, while the JPY surged 0.70%, showing clearly that the correlation is now negative. All in all, it suggests that no matter what the BoJ will do to devaluate the yen, the market will likely not buy it, just like it did in January this year when the BoJ cut rates to negative territory and the yen surged 4% in less than three days. Unfortunately for the BoJ, it seems that the SNB has succeeded in preserving its credibility, while the Japanese central bank will now has to face alone the increasing amount of worried investors looking at solution to protect their capital.

Will SNB measures be sufficient?

The Swiss National Bank is expanding its balance sheet in an effort to mitigate upside pressures on the Swiss currency. The size of the total sight deposits increased significantly during the week ending July 1st. These grew by CHF 6.3 billion to 507.5 billion just a week after Brexit. What we now find concerning is the size of the balance sheet which is over 100% of the annual Swiss GDP. The pace of the increase has not been so fast since the abandoning of the peg in January 2015.

We feel that the negative rates policy and FX intervention are not likely to be sufficient to relieve pressure from the uncertain economic and market conditions. The CHF should continue to suffer from its traditional safe haven status. It remains largely overvalued and deflation pressures should persist. In fact, we do not believe that current monetary policy will increase inflation.

The SNB is also on high alert for further EU developments in particular the risk of an EU dislocation. This possibility is growing, Finland has now also launched a petition to signal their intention to leave. More significant SNB measures are on the cards as the central bank stands ready to protect its currency and economy.

The Risk Today

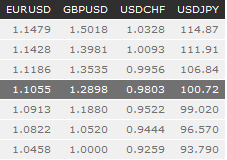

EUR/USD has largely weakened. Hourly support is given at 1.1074 (06/07/2016 low) while hourly resistance is located at 1.1189 (24/06/2016 high). Strong resistance is given at 1.1479 (06/05/2016 high). Sharp moves do not have to be ruled out as there are still a lot of uncertainties on asset pricing in the market. In the longer term, the technical structure favours a very long-term bearish bias as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD keeps on declining and is trading at levels unseen in more than 30 years. The pair has broken hourly support lies at 1.3121 (27/06/2016 low) and hourly resistance is given at 1.3534 (29/06/2016 high). Uncertainties are important on the market, we cannot rule out further decline.. The long-term technical pattern is negative and favours a further decline as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200-day moving average). Key support at 1.3503 (23/01/2009 low) has been broken and the road is wide open for further decline.

USD/JPY is going lower. Hourly supports at 101.70 (intraday low) has been broken and the pair is heading towards other support at 99.02 (24/06/2016 low). Hourly resistance is given at 103.39 (01/07/2016 high). Expected to show further consolidation in the short-term. We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is heading toward hourly resistance at 0.9837 (28/06/2016 high) while hourly support can be found at 0.9648 (24/06/2016 high). Expected to further weaken. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias since last December.