Asian markets closed mixed on the last trading day of the year, but were sharply lower than their 2010 settling prices. The Nikkei gained .7% to 8455, closing the year down 17%. Australia’s ASX 200 slipped .4%, declining 14.5% in 2011. In China, the Shanghai Composite jumped 1.2%, but dropped 22% for the year. The Hang Seng edged up .2%, a minor change to the index’s 20% drop in 2011.

In Europe, the major indexes enjoyed moderate gains. The CAC40 climbed 1%, the DAX advanced .9%, and the FTSE edged up .1%. For the year, the indexes fell 18%, 15%, and 6% respectively. Regional banks were the biggest losers, shedding almost 40% over the past year.

US stocks closed lower in light trading. The Dow fell 69 points to 12218, trimming its 2011 gain to 5.5%. The Nasdaq eased .3%, slipping 1.8% for the year, and the S&P 500 closed down .4%, ending flat for 2011.

After a Wild Ride, S&P 500 Ends 2011 Exactly Where it Began

American Airlines parent, AMR, tumbled 32% on news the company would be delisted from the New York Stock Exchange, after filing for bankruptcy last month.

Currencies

The Yen surged .9% to 76.91, and the Pound rallied .8% to 1.5543, as the Dollar traded lower. The Australian Dollar gained .7% to 1.0209, and the Swiss Franc edged up .2% to 1.0660. The Euro closed flat at 1.2961.

Economic Outlook

Tuesday’s major reports will include the ISM manufacturing index, constructions spending, and the minutes from the last FOMC meeting. No major earnings reports are scheduled.

Stocks Surge on Opening Day of 2012

Equities

The year opened strongly for Asian markets, as investors were encouraged by upbeat Chinese PMI data. The Kospi surged 2.7% to 1875, and the ASX 200 climbed 1.1%, with materials stocks leading the gains. Hong Kong’s Hang Seng jumped 2.4% to 18877, as petroleum stocks rallied more than 4%. Markets in Japan and China were closed for holidays.

European markets gained as well, boosted in the afternoon by strong US data. The FTSE advanced 2.3%, the DAX rallied 1.5%, and the CAC40 rose .7%.

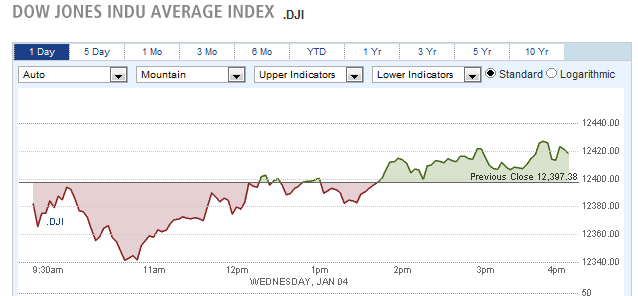

US stocks posted strong gains as well. The Dow jumped 180 points to 12397, the Nasdaq rallied 1.7%, and the S&P 500 climbed 1.6%.

Currencies

Investor optimism pressured the US Dollar, which fell across the board against major currencies. The largest gainer was the Australian Dollar, which traded up 1.3% to 1.0371. The Euro and Pound gained .9% to 1.3050 and 1.5648 respectively, while the Canadian Dollar and Swiss Franc rallied .8%. The Yen had a smaller .3% gain to 76.65.

Economic Outlook

In the US, the ISM manufacturing index rose to 53.9 from 52.7, slightly more than expected. Constructions spending rebounded after last month’s .2% decline, climbing 1.2%.

Upbeat Economic Data Helps US Markets Erase Losses

Equities

Asian markets traded mixed on Wednesday, following Tuesday’s advance. For the gainers, the Nikkei rallied 1.2% to 8560, and the ASX 200 surged 2.1%, as mining giant BHP Billiton soared 4.1%. On the losing side, the Kospi declined .5%, the Shanghai Composite sank 1.4%, and the Hang Seng slid .8%

European banks tumbled 3.6%, weighing on the region’s indexes. The CAC40 slumped 1.6%, the DAX fell .9%, and the FTSE declined .6%. News that Italy’s largest bank, UniCredit, will need to raise 8 billion euros to meet capital requirements, pressured financials.

US markets traded lower at the open, but erased their losses as the day progressed. The Dow rose 21 points to 12418, while the S&P 500 and Nasdaq ended flat.

Dow Erases Morning Losses to Close Higher

Currencies

The Euro fell .9% to 1.2942, the Swiss Franc dropped 1% to 1.0620, and the Pound eased .2% to 1.5618, as debt fears hit European currencies. The Yen and Australian Dollar settled flat, while the Canadian Dollar ticked down .1% to 1.0124.

Economic Outlook

Vehicle sales remained at an annualized rate of 13.6 million, slightly above expectations, and factory orders increased by 1.8% after last month’s .2% decline.

Fall Despite Strong US Data

Equities

Asian markets traded mostly lower on Thursday, as concerns over Europe’s debt troubles resurfaced. The Nikkei dropped 71 points to 8489, the ASX 200 skidded 1.1%, and the Shanghai Composite fell 1% to 2149. Oil stocks helped offset losses in financials, with the Kospi easing a mere .1%, and the Hang Seng gaining .5%.

In Europe, stocks dropped once again, weighed down by banks. The CAC40 fell 1.5%, the FTSE lost .8%, and the DAX shed .3%. Italy’s MIB index tumbled 3.7%, as Italy’s leading bank, UniCredit, continued to drop.

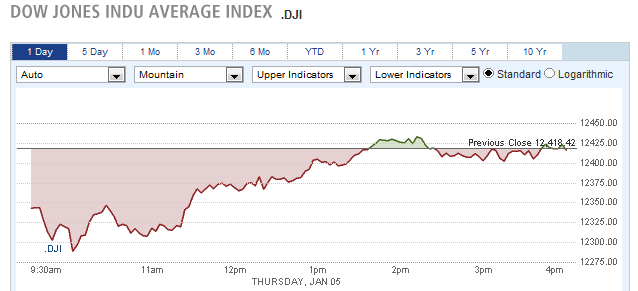

US markets once again recovered from early losses. The Dow closed down 3 points, erasing a 130 point drop, while the Nasdaq climbed .8% and the S&P 500 rose .3%.

Dow Closes Flat, Bouncing Back from Morning Loss

Denndreon shares surged 39.8% after reporting a huge jump in revenues.

Currencies

The US Dollar rallied across the board, while the Euro fell to a 15-month low of 1.2771, down 1.2%. The Swiss Franc lost 1.1% to 1.0493, and the Pound dropped .8% to 1.5487. In the Pacific, the Australian Dollar declined 1% to 1.0252, and the Yen shed .6% to 77.22.

Economic Outlook

ADP payroll data showed a massive jump of 325K jobs last month, blowing past estimates for a 176K gain, and boding well for Friday’s official non-farm payroll report. Weekly jobless claims fell to 372K from last week’s 387K, slightly better than forecast.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Global Stocks Trade Mixed on Final Day of the Year

Published 01/06/2012, 06:47 AM

Updated 05/14/2017, 06:45 AM

Global Stocks Trade Mixed on Final Day of the Year

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.