Asian markets rallied on Tuesday, despite a bankruptcy filing by Elpida memory, in Japan. The Nikkei gained .9% to 9722, recovering from early losses, after chip-related stocks initially sold off, but later recovered. The Kospi rose .6%, as Hynix memory jumped 6.8%, and the Hang Seng surged 1.7% to 21569. The Shanghai Composite edged up .2%, and the ASX 200 posted a narrow loss.

Upbeat US consumer confidence data helped boost European markets in the afternoon. The DAX climbed .6%, the CAC40 gained .4%, and the FTSE rose .2%. The ECB will be injecting additional liquidity on Wednesday to help regional banks, which are expected to borrow 500 billion euros.

Currencies

European currencies closed higher on Tuesday, as the Pound, Euro, and Swiss Franc all rose .5%. The Australian Dollar inched up .1% to 1.0771, and the Canadian Dollar gained .4% to .9952. The Yen settled flat at 80.48, after swinging up and down by .5% during the day.

Economic Outlook

Consumer confidence blew past forecasts, jumping to 70.8 from last month’s 61.5 reading, a 1-year high. The Richmond manufacturing index surged to 20 from 12, whereas analysts had expected a slide to 11.

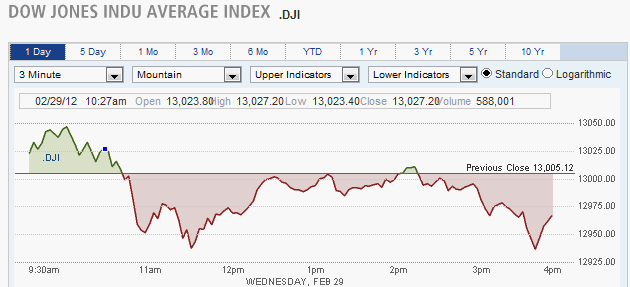

Stocks Ease as Bernanke Fails to Offer New Stimulus

Equities

Asian markets closed mostly higher on Wednesday in anticipation of the ECB’s latest injection of liquidity. The Kospi rallied 1.3% to 2030, a fresh 6-month high, and the ASX 200 gained .8%. In China, markets were mixed, as the Shanghai Composite slumped 1%, ending an 8-day winning streak, while the Hang Seng closed up .5%. Japan’s Nikkei closed flat at 9723, surrendering a substantial 140-point advance from earlier in the day.

In Europe, markets traded lower in the afternoon, taking the lead from Wall Street. The FTSE sank 1% to 5872, the DAX skidded .5%, and the CAC40 eased fractionally. Banking shares bucked the downtrend, rising .5%.

US stocks fell, as remarks by Fed chairman, Ben Bernanke, made investors nervous. Bernanke said the job market is “far from normal” and may require additional stimulus, but failed to offer any plans of additional easing at this point. The Dow lost 54 points to 12952, the Nasdaq shed .7%, and the S&P 50 declined .5% to 1366.

Dow Falls Below 13000, Down 54 Points

Apple shares gained 1.3% to 542.44, pushing the companies market cap past the half-trillion mark to $506 billion, in anticipation of the company’s iPad 3 launch.

First Solar tumbled 11.3% after missing profit forecasts and slashing its outlook. Home builders gained after the CEO of Toll Brothers said the company “feels the best” in 5 years. Toll Brothers shares climbed 4.6%, Pulte Homes rallied 6.3%, and Lennar gained 3.9%.

Currencies

The Dollar rallied nearly across the board. The Euro slumped 1.1% to 1.3321, the Swiss Franc dropped 1% to 1.1055, and the Yen shed 1% to 81.29. The Australian Dollar and Canadian Dollar both fell .5%..

The Bank of England’s governor, Marvin King, said he sees no need for further quantitative easing. The upbeat outlook helped the Pound overcome the broader sell off, inching up fractionally to 1.5907.

Economic Outlook

GDP data for the 4th quarter showed the economy grew at 3%, better than the 2.8% forecast by analysts. Chicago PMI rose to 64 from 60.2, significantly better than the 61.6 expected.

Global Stocks End Mixed

Equities

Asian markets traded higher on Friday, amid signs the US economy is improving. The Nikkei climbed .7% to 9777, the Kospi rose .2%, and the ASX 200 gained .4%. The Shanghai Composite surged 1.4% after a government official said banks will increase lending to land developers, and the Hang Seng advanced .8% to 21562.

European markets closed mostly lower despite gains in financials on the heels of the latest liquidity injection by the ECB. The FTSE and CAC40 declined .3%, while the DAX edged up fractionally.

US stocks ended down, with the S&P 500 declining .3%, the Nasdaq down .4%, and the Dow down 3 points. Small-cap stocks were particularly under pressure, as the Russell 2000 sank 1.6% to its lowest level since the end of January.

Currencies

The Dollar posted significant gains against global currencies on Friday. The Euro and Swiss Franc both dropped .9% in a day-long slide. The Yen and Pound both sank .8%, and the Australian Dollar declined .7% to 1.0732. The Canadian Dollar fared better than its peers, easing .4% to .9891.

Economic Outlook

Monday’s reports will include factory orders and the ISM’s non-manufacturing index.

Stocks and Metals Drop as China Cuts Growth Outlook

Equities

Asian markets traded lower on Monday, as disappointing growth forecasts from China weighed on the region. China expects its GDP to grow by 7.5% in the coming year, its lowest level in 8 years. The Nikkei declined .8% to 9697, the Kospi fell .9%, and the ASX 200 eased .2%. In greater China, the Hang Seng slumped 1.4% to 21265, and the Shanghai Composite lost .6% to 2445.

Greece warned the country would trigger collective action clauses (CACs) if private debt holders do not accept the latest 53.5% haircut on their debt. The move would be considered a default by Greece, and could have significant impact on the credit markets. European markets slipped, as the DAX fell .8%, the FTSE dropped .6%, and the CAC40 declined .4%.

US stocks managed to erase most of their losses, but still closed down. The Dow ticked down 15 points to 12963, the Nasdaq sank .9% to 2950, and the S&P 500 dropped .4% to 1364.

Currencies

The Dollar closed mixed in Monday’s currency trading. European currencies rose, as the Pound, Euro and Swiss Franc all gained .2%. The Australian Dollar dropped .6% to 1.0670, and the Canadian Dollar fell .5% to .9940. The Yen advanced .4% to 81.46.

Economic Outlook

The services sector grew more than expected, as the ISM non-manufacturing PMI rose to 57.3 from 56.8. Factory orders fell by 1%, but the drop was smaller than forecast.

Fear Hits Markets, Dow Drops More than 200 Points

Equities

Asian markets extended their losses as concern over a slowdown in China weighed on the region. The Hang Seng tumbled 2.2% to 20806, and the Shanghai Composite sank 1.4%, as auto-maker BYD plunged 9.9%. The Nikkei shed .6% to 9638, the Kospi dropped .8% to 2000, and the ASX 200 fell 1.4%, as materials stocks sold off.

European markets plunged, amid escalating fears of a Greek default. The CAC40 tanked 3.6%, the DAX sank 3.4%, and te FTSE lost 1.9% as broad selling gripped the market. Banking shares were particularly hard-hit, as the sector skidded 5.3%, while auto-makers dropped 4.9%.

The selloff continued in the US. The Dow lost 204 points, to 12759, recording its biggest drop in 2012. The S&P 500 fell 1.5%, and the Nasdaq declined 1.4%. Materials and banking shares ld the declines amid concerns over global growth and fallout risk from Greece.

Currencies

Traders dumped foreign currencies for US Dollars as the market shifted to “risk off” mode. The Australian Dollar lost 1.1% to 1.0552, pressured by losses in metals. Amongst European currencies, the Pound fell .9% to 1.5720, the Euro dropped .8% to 1.3114, and the Swiss Franc declined .7% to 1.0886. The Yen benefited from the shift in risk, gaining .8% to 80.86.

Economic Outlook

Wednesday’s reports will include the ADP employment report, the Challenger job-cut report, productivity & labor costs, consumer credit, weekly oil inventories, and weekly mortgage applications.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Global Stocks Rise, Energy Slides

Published 03/07/2012, 06:57 AM

Updated 05/14/2017, 06:45 AM

Global Stocks Rise, Energy Slides

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.