Cotton prices advance as global cotton stock forecast was lowered. Will cotton continue climbing?

US Department of Agriculture revised its world cotton opening stocks downwards by 900,000 bales for April according to WASDE report. At the same time the USDA downgraded its forecast for world ending stocks for 2017-18 by 600,000 bales. Lower world inventories are bullish for cotton prices.

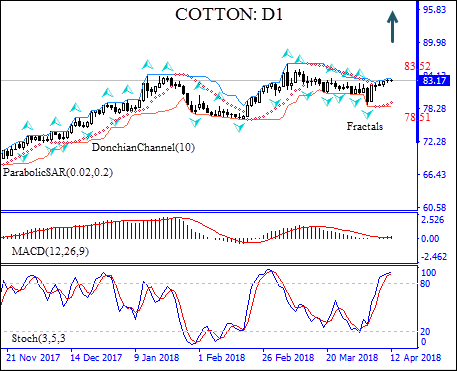

On the daily time frame the Cotton: D1 has been retracing following the decline after hitting four-year high in the beginning of March.

- The Parabolic indicator has formed a buy signal.

- The Donchian channel indicates an uptrend: it is tilted upward.

- The MACD indicator gives a bullish signal.

- The Stochastic oscillator is in the overbought zone which is bearish.

We expect the bullish momentum will continue after the price closes above the upper bound of the Donchian channel at 83.52. A price point above that level can be used as an entry point for a pending order to buy. The stop loss can be placed below the fractal low at 78.51. After placing the pending order the stop loss is to be moved to the next fractal low following Parabolic signals. Thus, we are changing the profit/loss ratio to the breakeven point. If the price meets the stop loss level (78.51) without reaching the order (83.52), we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position Buy

Buy stop Above 83.52

Stop loss Below 78.51