Rounding out the dismal services PMI reports that came out today, the J.P.Morgan Global Services PMI, shows the growth of global services activity hit a 40-month low in February.

J.P.Morgan Global Services PMI™

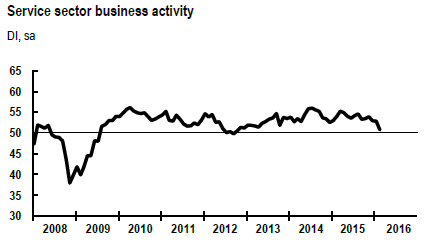

The rate of expansion of global service sector business activity slowed to a 40-month low in February. The J.P.Morgan Global Services Business Activity Index – a composite index produced by J.P.Morgan and Markit in association with ISM and IFPSM – fell to 50.7, a reading only moderately above the stagnation mark of 50.0.

National PMI data suggested that the US had shifted from being a driver to a drag on global services output growth. US services activity fell slightly for the first time in almost two-and-a-half years. However, the underlying dynamics of the US survey were less negative than the headline reading. Indices tracking new business, employment and future activity all pointed to slower rates of growth as opposed to outright contraction.

Three of the other national surveys reported lower activity; France, Hong Kong and Brazil. The downturn in Brazil was especially severe, with business activity, new orders and employment all falling at series-record rates. Service sector activity rose in the eurozone, Japan, China, the UK and India, albeit at slower rates. Russia also reported higher output, following four successive months of contraction.

Commenting on the survey, David Hensley, Director of Global Economic Coordination at J.P.Morgan, said: “February PMI data point to a further slowdown in the rate of expansion of global service sector output. Business activity rose at the weakest pace since October 2012, as growth of new business and employment also eased. The moderation was broad-based by category, with providers of business, consumer and financial services all seeing output growth slow during the latest survey month.”

Global Service Sector

Global Recession

A global recession is generally defined as 2% growth or less. That’s certainly where the global economy is headed. In fact, reduce China’s fluff GDP numbers to something more realistic and the global economy in recession already.