Global Payments Inc.’s (NYSE:GPN) adjusted earnings per share of 94 cents beat the Zacks Consensus Estimate of 87 cents and grew 24% year over year.

Better-than-expected earnings were primarily attributable to higher revenues across its markets.

The company posted revenues of $847.9 million, which grew 18.4% year over year.

Total operating expense of $830.4 million increased 6.3% year over year due to higher cost of service.

Adjusted operating margin improved 130 basis points to 29.2%.

Segment Details

North America: Revenues of $624 million increased 20.3% year over year. Operating income of $185.1 million was up 30% year over year.

Europe: Revenues of $158.7 million increased 30% year over year. Operating income of $72.2 million was up 7.9% year over year.

Asia-Pacific: Revenues of $64.8 million increased 15.1% year over year. Operating income of $19.6 million was up 29.4% year over year.

Financial and Balance Sheet Position

Total cash and cash equivalents as of Jun 30, 2017 were $1.08 billion, down from $1.16 billion as of Dec 31, 2016.

Total long-term debt of $4.18 billion was down slightly from $4.26 billion as of Dec 31, 2016.

The company also approved quarterly dividend of 1 cent per share payable Sep 29, 2017.

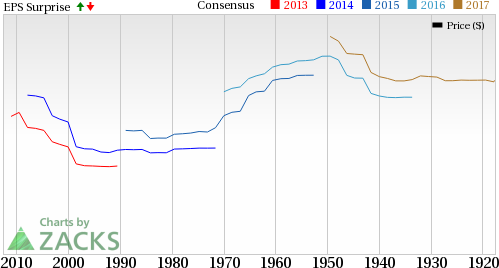

Global Payments Inc. Price, Consensus and EPS Surprise

Business Update

The company announced that it will acquire the communities and sports divisions of ACTIVE Network, providing cloud-based, mission critical enterprise software solutions to event organizers in the communities and health & fitness vertical markets globally, for $1.2 billion. The company will finance the cash portion with its existing credit facility and cash on hand. Transaction will be immediately accretive to adjusted net revenue growth, adjusted operating margins and adjusted earnings per share.

2017 Guidance Raised

Followed by strong earnings performance in the first half of 2017, the company raised its 2017 adjusted earnings guidance to a range of $3.85 to $4.00 per share, which reflects growth of 21% to 25% over 2016. Adjusted net revenues are expected between $3.40 billion and $3.48 billion, reflecting an increase of 20% to 22% from 2016.

Our Take

The company’s strong results reflect its effective business execution and growth from acquisitions. We favorably view its investments in enhancing digital capabilities and strong balance sheet.

Zacks Rank and Other Players

Global Payments carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

From the same space, Mastercard Inc. (NYSE:MA) , Total System Services Inc. (NYSE:TSS) and Alliance Data Systems Corp. (NYSE:ADS) beat their respective second-quarter estimates by 5.77%, 7.89% and 3.17%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Mastercard Incorporated (MA): Free Stock Analysis Report

Total System Services, Inc. (TSS): Free Stock Analysis Report

Alliance Data Systems Corporation (ADS): Free Stock Analysis Report

Global Payments Inc. (GPN): Free Stock Analysis Report

Original post

Zacks Investment Research