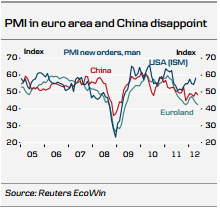

- With weak data in the euro area and China recently, doubts have risen over the global economy. Are we heading for a new downturn? Or is the recovery just postponed?

- We believe what we are seeing is a soft patch in the global industry relating to the uncertainty surrounding the euro debt crisis and possibly the rise in oil prices earlier in the year.

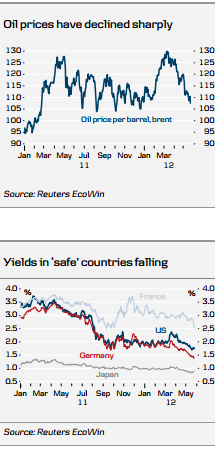

- In the short-term, things are likely to get a bit worse, as, for example, US industry is likely to also show softness. But stabilising forces are in play as oil prices have fallen fast, bond yields in ‘core’ countries are at record lows and food prices have declined.

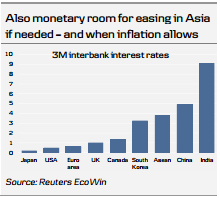

- We also expect to see a policy response from a range of countries and this will increasingly become the focus of the markets. We look for easing from the ECB, the Bank of Japan, the People’s Bank of China and other Asian central banks,

- and for a fiscal expansion in China. If things worsen more than expected in the short-term, the Federal Reserve is also likely to enter QE3.

- Finally our main scenario entails that Greece does not leave the euro after the election. We expect this to give relief to markets over the summer.

- As these factors kick in, we expect to see a recovery in global growth in H2. Hence, while things are expected to worsen in the short term, we look for improvement during the summer.

- Oil prices have fallen quite strongly over the past month. After rising sharply to USD126/bbl (Brent) in February on tensions with Iran and expectations of stronger demand from China, prices have fallen even more sharply over the past two months to trade at USD106 currently. This will provide a short-term boost to global consumers and in particular benefit the US economy which is most exposed to oil prices.

- Bond yields have fallen to record lows in core countries such as the US, Germany and the UK. For the euro area as a whole, bond yields have hardly risen despite the rise seen in peripheral countries as this has been compensated by lower yields in Germany and not least France where yields have fallen on positive comments from Moody’s saying that the French plan for sustainable finances is positive. In the US, the low bond yields are clearly underpinning the housing market, which has shown increasing strength recently.

- Food prices are also lower over the past two months following a fall in general commodity prices. This is particularly beneficial for emerging markets where inflation is falling more quickly on the back of this. This is not least giving China greater scope to manoeuvre. We expect inflation in China to fall below 3% during the summer, clearly below the 4% target of the People’s Bank of China.

Is Global Recovery Cancelled - Or Just Postponed?

Is Global Recovery Cancelled - Or Just Postponed?The recent data flow out of the euro area and China has raised serious concerns that the global economy is faltering again. In the euro area, PMIs point to a deepening recession. And in China the PMI data out overnight suggests growth is unchanged at a low level around 7-8%. Hence, the expected rebound has failed to materialise so far. The combined disappointing newsflow points to downside risks for our global growth scenario for this year.

For markets, though, what is important will be what the profile for growth is likely to be for the rest of the year as a lot of the current weakness is already priced in the markets. Is growth continuing lower in the second half or will we recover after all – just later than expected?

Our take is that the global industry is going through a temporary soft phase. Oil prices rose strongly in the beginning of the year and this has had a negative impact on global consumption which is feeding through to production now. And the uncertainty over the euro crisis is making companies more cautious and hence holding back investment and production in the short-term.

Stabilising Forces Kicking In

So why the muted optimism that growth will recover again after a period of weakness? There are overall three forces we expect to drive this. The first one is that we have stabilising forces that will work with a lag and in particular have an impact on growth in H2:

Policy Response Coming Up

The other force that is likely to support the economy and market sentiment is a policy response from global policymakers.

ECB cut Coming Up - And Non-Standard Measures Could Be Used

In Europe, we expect the deteriorating PMIs to trigger a move from the ECB in June. We expect a one-off rate cut off 25bp – leaving the refi rate at 0.75%. We expect deposit rates to be left unchanged while we look for the marginal lending rate to be lowered 50bp to 1.25%.

However, our expectation is that the ECB will refrain from introducing further stimuli in the form of non-standard measures until the political leaders in the EU have delivered their part and we are on the other side of the Greek election. Ultimately, market stress could force a ECB response. Despite recent increases, we are not there yet. If Spanish and Italian 10-year yields climb above 7% and stress also increases substantially in credit markets, we expect the ECB to announce a new round of LTROs to ensure sufficient liquidity in the system. This could also help support peripheral sovereign bonds. If this is not enough to calm the market, the maturity could be increased further and the SMP programme could be revived to support markets in times of severe stress.

China To Step Harder On The Gas, BoJ To Increase Asset Purchases

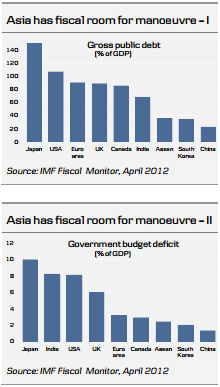

We expect China to ease fiscal and monetary policy more aggressively in the coming months. So far monetary and fiscal policy have only been eased modestly. The reserve requirement is been cut by 150bp and construction of social housing has been increased slightly. Regarding infrastructure spending, the message until this week has been that focus would be on completing existing infrastructure.

However, this week, the Chinese government signalled more substantial easing of both fiscal and monetary policy. A statement from the government said that “we must proactively take policies and measures to expand demand to create a favourable environment for stable and relatively fast economic growth.”

Specifically, the statement says that China will start a series of key infrastructure projects and speed up the completions of existing infrastructure projects. The projects will include railways and environmental protection. The Chinese government has not put a specific number on the size of the programme.

In addition, we expect the People’s Bank of China (PBoC) to cut the reserve requirement more aggressively in the coming months to allow for faster growth in credit and money supply. Both are slightly below target at the moment. We expect four 50bp cuts before the end of 2012. The pace could be quite aggressive – possible a cut each month until September. The reserve requirement for large banks is currently 20%, so there is ample room to cut if needed.

At this stage, we do not expect PBoC to cut its leading interest rate – albeit admittedly the likelihood of a rate cut is increasing. Should data continue to deteriorate, a rate cut would probably be the next line of defence in addition to even more aggressive cuts in the reserve requirement.

More fiscal easing could be announced if needed. One option would be to reintroduce subsidies for purchase of eco-friendly and other consumer durables. It was hugely successful in boosting private consumption in 2009, but was abolished in December 2010.

The final option would be to abolish some of the regulatory tightening measures that have been introduced over the past years including the increase in down-payment in connection with home purchase and restriction on home ownership.This would be a big boost to the house market, but we also regard it as the least favoured option by Chinese policymakers.

Experience from 2008 suggests that China’s fiscal easing works relatively fast. There was a substantial impact on the real economy less than three months after the fiscal stimulus was announced in October 2008.

In the rest of Emerging Asia, we could also be moving into a more aggressive easing cycle. Relatively healthy public finances and relatively high interest rates leave room to respond. India is the weakest link in Emerging Asia.

In Japan, the Bank of Japan could respond with more aggressive QE. Fiscal policy is already a major boost to growth. Domestic demand has been expanding by more than 3% in the past three quarters, supported by reconstruction after the earthquake.

Fed To Move If Growth Or Jobs Disappoint

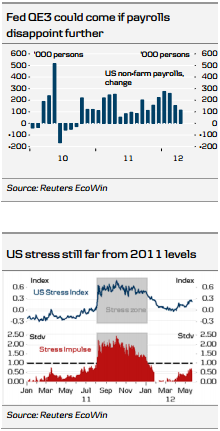

The current ‘Operation Twist’ is scheduled to terminate at the end of June which makes the 20 June FOMC meeting an obvious candidate for QE3. The likelihood of such a move has risen lately, following the weak PMIs out of Europe and the slowdown in Chinese growth. On top of this, minutes from the April FOMC meeting were slightly more dovish as the number of members indicating that “additional monetary policy accommodation could be necessary if the economic recovery lost momentum or the downside risks to the forecast became great enough” rose to “several” from “a couple”.

That said, as stated in the minutes, the FOMC needs to see a loss of momentum in growth in order to support more QE, and this has so far not materialised in domestic data. This was also confirmed by comments from Dudley, the President of the New York Fed, yesterday. Over the past couple of months, US data has been mixed but generally points to a continued moderate recovery.

The Fed’s primary focus is the state of the labour market and here the May employment report released on 1 June will be key. The March and April reports showed a deceleration in job growth and if this continues, the pace of employment growth will be below what the Fed sees as consistent with its mandate. Another weak employment report would, in our view, tilt the balance in favour of another round of QE. This is however not our expectation, as other indicators such as initial jobless claims and the NFIB index are pointing to a continued healing of the labour market.

Another trigger of QE3 is financial stress. Although the European crisis has pushed market stress upwards, we are still far from the levels seen in H2 11. Also worth keeping in mind is the reasoning behind the decision to do QE2 in September last year. Reading through the FOMC minutes shows that the primary reason for the decision to implement Operation Twist was the deterioration in economic growth momentum and not the stress in financial markets. We thus think that stress levels need to go markedly higher before the Fed will act – as long as economic data continues to confirm an ongoing economic upswing.

Given our expectations of a rebound in private job growth in May, we currently see only a 25% chance of further Fed easing at the 20 June meeting. However, if we are proven wrong, there was an interesting article in WSJ in March, describing three possible tools to further monetary policy easing.

The article suggests that should another round of easing be deemed necessary, it is likely to be in the form of sterilised bond buying, i.e. the Fed buys longer-dated MBS or Treasuries and withdraws the extra liquidity generated by this transaction via reverse repos or term deposits. This would favour those in the FOMC who worry about the inflationary effect of the expansion of the Fed’s balance sheet and increase in the money base. A problem with xtending the current Operation Twist is that the Fed has a limited amount of short-dated treasury securities on its balance sheet to swap against longer-dated securities. The sterilised bond buying programme does not have such imitations.

BoE Sidelined But Could Act If Turmoil Increases

In our baseline case we don’t expect more stimuli from the Bank of England. The minutes from the recent meeting showed an 8-1 vote against more stimuli and the BoE appears to be sidelined. However, as with the Fed, the BoE would likely respond if markets stress intensified further and growth indicators softened. There is clearly a global growth agenda at the moment and there will be pressure on all policymakers to act if things deteriorate much further.

Solution In Greece To Give Relief

The third force we believe will underpin growth in H2 globally is a resolution of the Greek situation where Greece stays in the euro. Although we expect tensions to get higher in the short term up to the election on 17 June and the period shortly after could be rather messy, we believe that EU/IMF and Greece will ultimately come to an understanding and avert a Greek exit. The alternative is simply too risky for both the EU and Greece.

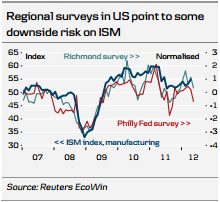

Summary: Worse Before It Gets Better

In the short-term, we see the macro picture as staying very mixed as there is a risk that US manufacturing data such as ISM is also being hit from the apparent global soft patch in the industry cycle. Softness in regional surveys highlights this risk. PMIs in the euro area will likely also stay at very low levels for a while. However, as the above mentioned forces start to kick in, we believe growth will lift slowly again during H2.

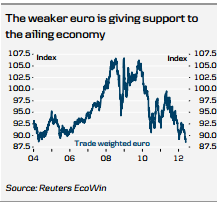

China is expected to see a (delayed) rebound in growth triggered by policy stimulus and falling inflation. US fundamentals are quite strong still and the economy should rebound in H2 from slightly below trend growth in H1. And the euro area should see an easing of the recession as the rest of the world improves export demand. The euro area is getting support from a sharp weakening of about 10% over the past year. Using standard multipliers, this gives a boost to GDP of around 0.75 percentage points after a year.

Timing is uncertain but we expect signs of a global H2 rebound to emerge some time in late summer. May data for industrial production and retail sales in China should already give a little relief as we believe the April weakness was partly due to calendar effects (fewer working days this year compared with last year).

Risks are clearly skewed to the downside as we could end up in a scenario of a Greek exit and a stronger intensification of market stress. This would lead to a sharp deterioration in the macro picture.

Eventful Calendar Over The Coming Month

As shown on the front page, there are many events to keep an eye on over the coming month. US ISM and non-farm payrolls on Friday next week will be crucial for a potential Fed response. On 6 June, the ECB meeting is expected to result in a 25bp cut.

Then on 17 June, Greece will go to the polls for a second time, with the result crucial for Greece’s faith in the euro. On the following two days (18-19 June), global leaders will meet for the G20 Summit in Mexico where the current economic and financial situation will be high on the agenda. If markets are in turmoil, we might get a coordinated policy response.

One day later on 20 June, the Fed meeting will include a press conference and new economic projections.

On 28 June, EU leaders will meet again for a two-day summit to follow up on the informal dinner this week where a range of growth initiatives and steps to take the EMU to the next level were discussed.

All these events over the coming month will likely prove very significant for where the global economy is heading the rest of the year.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research an alyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation b y the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of th e Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. E mployees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over -all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis

of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a soli citation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.