There has been a flurry of central bank activity in recent weeks. The US Federal Reserve (Fed)has signalled its intention to carry out the third hike of the year at its upcoming December meeting; the European Central Bank (ECB) announced it would “downsize” but extend its asset purchase programme into 2018; and the Bank of England (BoE) hiked rates for the first time in a decade. These developments have prompted us to assess whether there is any risk to global growth of a tightening in global monetary policy. We find the risk to be low and that global monetary policy will remain accommodative in 2018, although it will be less accommodative than in 2017.

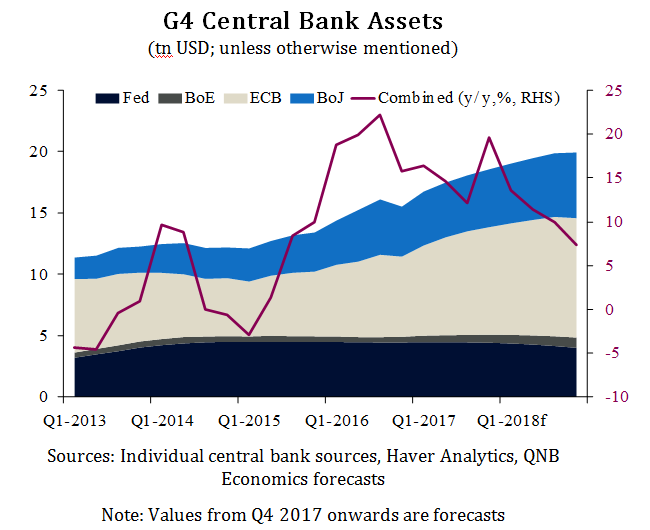

Our assessment of the future direction of monetary policy is based upon an analysis of two factors:expected changes in the size of central bank balance sheets and future inflation dynamics. The size of the central bank balance sheets essentially reflects quantitative easing (QE) programmes – G4 central bank balance sheets sharply increased after embarking upon bond buying programmes in the aftermath of the crisis, the effect of which was to lower long-term interest rates and stimulate demand. Increasing the balance sheet through more QE is another form of monetary easing.

The evolution of central bank balance sheets is relatively straight forward to predict because most central banks have already outlined what they plan to do. The Fed balance sheet already unwinding last month, with securities purchased during its QE programmes starting to mature without reinvestment. This process will gradually accelerate over the course of 2018 and result in a modest reduction of around USD140bnfrom the Fed’s USD4.5tn balance sheet.

The ECB, BoE and Bank of Japan (BoJ)are moving in the opposite direction, growing their balance sheets with more bond buying in 2018. The ECB has reduced but extended its QE programme to at least September 2018,maintaining a dovish stance despite falling unemployment and standout growth. The BoE and BoJ are arguably even more dovish in terms of the future of their QE programmes. Despite the recent rate hike, Brexit clouds the UK’s outlook and there has been little talk of removing QE, which was in fact intensified last year after the Brexit vote. The BoJ has repeatedly stated its commitment to maintain QE until inflation overshoots its 2% target – a very long way off considering that core inflation in Japan currently sits around 0%.

G4 Central Bank Assets (tn USD; unless otherwise mentioned)

Sources: Individual central bank sources, Haver Analytics, QNB Economics forecasts

Note: Values from Q4 2017 onwards are forecasts

The net result is that global central bank balance sheets will continue to expand in 2018. Based upon the policy commitments made by central bankers, we estimate that the combined G4 balance sheets will expand by an average of 11% in 2018. This represents a modest slowdown from an estimated 16% in 2017, due to the Fed’s balance sheet unwinding.

Understanding how inflation will progress and how it will influence interest rate decisions is a bigger challenge. Low unemployment failed to generate higher inflation in 2017, causing many to question the effectiveness of accommodative central bank policies. This concern seems to have informed the consensus inflation outlook for 2018. Projections from the International Monetary Fund (IMF), central banks and the private sector suggest small improvements in inflation of 10 to 20 basis points for the US, Japan and the Euro Area and weaker inflation in the UK. In particular, the Euro Area and Japan are expected to remain well below their inflation target. Using this outlook in the standard Taylor Rule,which links inflation to interest rate decisions, we find that the BoE could hike once and the Fed is predicted to hike two to three times in 2018. However, even if inflation is higher-than-expected in the Euro Area and Japan, guidance from the ECB and BoJ suggests they would maintain their easing bias. Both have repeatedly stated that policy rates will remain unchanged so long as QE remains in place.

Hence, the risk of a synchronised tightening in global monetary policy in 2018 seems low. The pace of policy normalisation remains different across each region. The Fed appears well ahead of its peers on the path to policy normalisation and that gap will likely widen next year. In aggregate, global monetary policy is likely to remain accommodative in 2018 and the risk of tighter policy to global growth is low.