Forex News and Events

Soft US data expected today

After the ECB meeting, financial markets are now turning their attention to the Fed. On Wednesday, traders and investors will be closely scrutinizing the Fed’s much-awaited decision. However, markets have already ruled out a rate hike. As it stands, there is a 4.0% likelihood of rates increasing at the next meeting. While we do not believe that a rate hike depends on domestic data, we will pay be paying close attention to the released data. Early this afternoon, February retail sales will come out and are expected to print lower than January (-0.1% m/m versus 0.2% m/m). In addition, the producer price index is also expected down to -0.2% m/m from 0.1% a month earlier.

Recent Fed comments show that the central bank is more concerned with what is happening globally than with affairs closer to home. Of primary concern are low oil prices, which seem to be one of the main reasons why the Fed is keeping the rate down. Now that oil is coming back, the Fed should have no reason to remain patient. From our standpoint, we believe that the underlying fundamentals of the U.S. economy are far too weak to support any further monetary policy divergence. Economic slowdown only reveals American difficulties. For example, weaker Chinese exports are clearly due to the western crisis. As a result, we are bearish dollar, as we do not expect a rate hike this year due to larger economic difficulties. We firmly believe that markets will start pricing a monetary policy convergence. Right now the dollar is overvalued which is not great news for the ECB.

SNB unlikely to act this week

We suspect that it was an emotional roller coaster for the SNB last Thursday. First, the ECB released a barrage of substantial stimulus measures with heavy reliance on lowering interest rates. We heard a collective groan from Bern. The Governing Council of the ECB cut rates on the main refinance operations, marginal lending facility, deposited facility and increase monthly purchases under the asset purchased program. Unfortunately for the SNB capital inflows into Switzerland have a high sensitivity to lower interest rates in Europe. EUR/CHF reacted logically falling sharply to 1.08930. However, in the accompanying press conference Draghi provided the SNB with a temporarily life line. The ECB president stated in clear terms “we don’t anticipate it will be necessary to reduce rates further.” Sounds from Bern quickly turned into a cheer and the EUR/CHF reverse course heading to 1.10229. The removal of expectations for further interest rate actions by the ECB has allowed pressure on the CHF to dissipate. The current trend of the CHF suggests that the SNB will not have to act on 17th March. Despite SNB Jordon comment suggesting that Swiss monetary policy strategy has limited the appeal of the CHF we suspect that the SNB actually has less control. In addition, deeper negative rates lower band to -1.25% or expansion of balance sheet of 100%+ of GDP has potential destabilizing risks that are hard to model. We agree with SNB governor board member Andrea Maechler statement that there are limits to central bank effectiveness. And believe the SNB is very close to those limits. For now it’s unlikely the SNB will have to dig into their depleted tool kit, yet given the ECB deteriorating inflation and growth outlook we suspect that additional policy measure will be need. We remain negative on the EUR/CHF in light of mounting European event risks and steady demand of long term safe haven assets.

EUR/GBP - Direction-Less.

The Risk Today

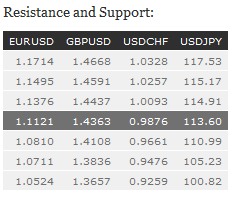

EUR/USD has moved sharply higher after Draghi's comments last week Yet, the pair is now consolidating. Hourly resistance lies at 1.1218 (10/03/2016 high). Hourly support can be located a 1.1080 (11/03/2016 low). Expected to show further consolidation. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD's short-term bullish is finally not coming to an end despite ongoing bearish consolidation. Indeed major resistance at 1.4409 (19/02/2016 high) has been broken. New hourly resistance can now be found at 1.4437 (11/03/2016 high). while hourly support can be found at 1.4118 (10/03/2016 low). The technical structure suggests further consolidation before entering into another upside move. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY remains in a range between strong resistance at 114.91 (16/02/2016 high) and support at 110.99 (11/02/2016 low). Hourly support lies at 112.61 (10/03/2016 low). The technical structure suggests a growing short-term momentum. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF has not been very volatile these past two days. An hourly support lies at 0.9796 (11/03/2016 low). Hourly resistance is located at 0.9891 (11/03/2016 high). Expected to show further consolidation. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.