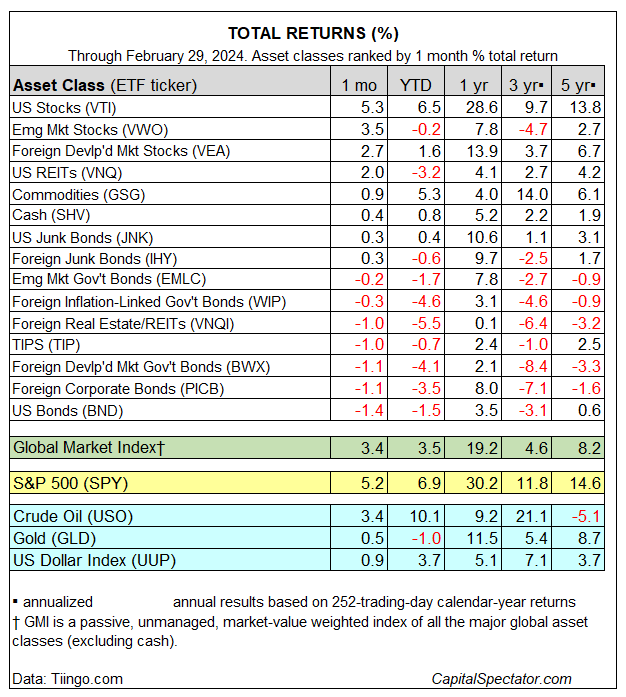

Stock markets around the world led returns for the major asset classes in February, topped by US shares, based on a set of ETFs.

Bonds, by contrast, declined, in the US and abroad while commodities extended a year-to-date rally and US real estate investment trusts rebounded after falling sharply in January.

Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) posted the strongest monthly return for the major asset classes in February with a 5.3% increase. The gain marks the fund’s fourth straight monthly advance.

Emerging markets stocks (NYSE:VWO) and shares in developed ex-US countries (VEA) were in second and third place, respectively, last month for the gainers.

Much of the red ink in February was concentrated in bonds. The deepest loss last month: US investment-grade bonds, which shed 1.4%. Year to date, Vanguard Total US Bond Market (NASDAQ:BND) is down 1.5%.

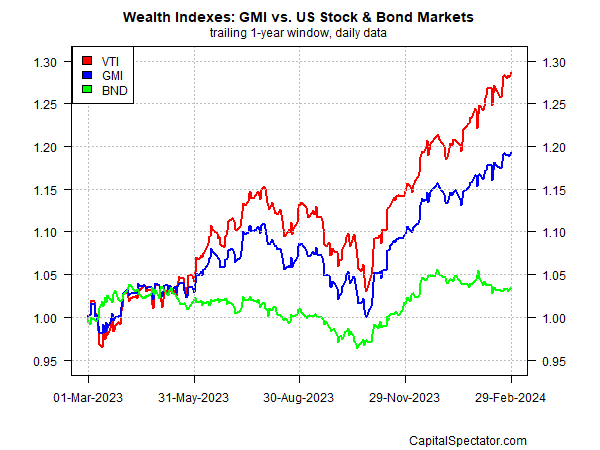

The Global Market Index (GMI) rose for a fourth straight month in February, posting a strong 3.4% increase.

GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

GMI’s one-year performance accelerated to 19.2%, thanks in no small part to the rally in US stocks (VTI) and, increasingly, foreign shares in developed markets (VEA). Meanwhile, the US bond market (BND), despite this year’s loss, continues to hold on to a modest 3.5% rise over the past 12 months.