For investors concerned with macroeconomic trends, last week was very eventful.

A huge Japanese pension fund tanked as a result of yen appreciation... The British government released a quarterly report showing a surprisingly strong economy despite the Brexit... And, perhaps most importantly, Janet Yellen finally gave us some answers about the timetable for a policy rate increase...

Well, sort of. OK, not really.

Let’s actually start with those cryptic remarks.

Yellen in Jackson Hole

The yearly Jackson Hole Economic Symposium kicked off on Friday. All eyes were on Fed Chair Janet Yellen as she gave a much-anticipated speech on the Fed’s policy toolkit.

Her remarks spanned several dense pages. But most investors have focused on one rather hawkish sentence about interest rates:

Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.

Granted, this is a pretty nonspecific statement. But it’s much more suggestive than Yellen’s past remarks. It seems to indicate that she and the Fed could move forward with a rate hike in the coming months.

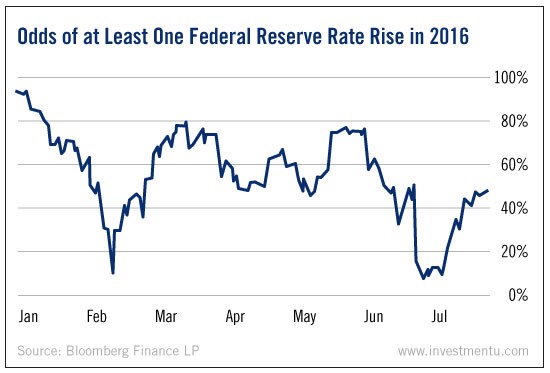

In Wall Street’s view, the odds of a 2016 rate hike are currently between 40% and 50%.

As you can see, Brexit news sent the odds down near zero earlier this summer. But we’ll have more on that in a moment.

First, let’s head east.

Japanese Government Pension Investment Fund Rout

Tokyo got some bad news on Friday.

Last quarter, the Japanese Government Pension Investment Fund - the largest pension fund on Earth - dropped by 3.9%. Or $52 billion dollars.

The fund managers were angling for faster growth, so they moved half of its assets from bonds into equities. It turned out to be very bad timing.

That’s because the yen rose sharply in the aftermath of the Brexit pound crash and the Korean won devaluation. This is bad news for Japanese stocks... and the government might be tempted to do something about it.

Japan has an agreement with the U.S. that it won’t competitively devalue its currency. But this recent blow to the pension fund could potentially put a yen drop back on the table. That would be a weighty decision, and it’s far from certain (or even likely).

A yen devaluation would upset Washington by deflating the dollar. But on the bright side, it would boost Japanese exports, which could mean gains for owners of Japan-based ETFs like WisdomTree Japan Hedged Equity (NYSE:DXJ). For the interim, we’ll just have to wait and see.

Now, back to Britain...

The Brits Are All Right

Last week’s report from the U.K.’s Office of National Statistics painted a lighter view of Britain’s economy than many investors thought possible. Last quarter, consumer spending shot up by 1%, driving a respectable 0.6% increase in GDP during the months leading up to the Brexit shock.

There was a minor contraction in June, the month of the referendum. But even this may have a silver lining.

The pound crashed after the surprise “Leave” victory, which could help some British exporters. It could mean short-term gains for holders of British ETFs like the iShares MSCI United Kingdom (NYSE:EWU).

Over the long term, Brits could still be facing trouble. Most economists predict a sharp slowdown in the coming months as the U.K. begins to extricate itself from the European Union.