For weeks markets have been oscillating within the constraints of central-bank action versus lack thereof. We have finally reached the decision threshold and central banks acted in accordance with what the broader markets speculated. This in turn led to assets moving accordingly.

The Fed's decision to buy MBS and ECB's to buy sovereigns calmed fears, but it also kept interest rates suppressed. This opened up the door to the widespread "search for yield" that we are accustomed to in times of easing. Although most risks are still inherent, the prices at which one is compensated are at historic lows. In terms of yield spread, the incentive may still remain, but absolute returns are harder to find.

What was seen in the days leading up to the Fed decision was a front running in Junk Bonds (JNK). This asset class showed strength compared to long term treasuries (TLT). There was a spike in both the price movement and its respective MACD indicator. At low interest rates, higher risk companies can lend at lower rates, which is a positive. Similarly, the so called floor under the economy creates a stronger environment in which these companies can function.

Another class that saw strength was emerging market debt. Investors looking to take on alternative forms of risk in search of return have looked overseas. Emerging debt (EMB), on a relative basis, is reaching yearly highs. The breakout doesn't look to be losing momentum, but it has seen a drastic move recently. Consolidation in the near term is possible.

The last debt instrument that saw a spike was inflation protected securities (TIP) vs. long term bonds . This asset is linked to inflation expectation, and a gradual rise ensued when QE3 odds increased. The gradual increase transitioned into a spike when easing was announced, and as is seen, this indicator usually has elongated periods of uptrend post QE.

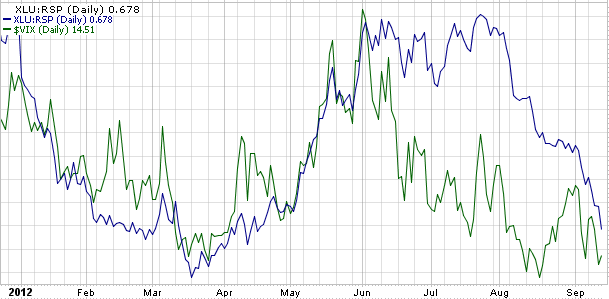

Equity markets show the next sign of diminished risk aversion. The chart below compares the price action of the VIX (VXX) and Utility stocks (XLU) over equity markets (RSP). These two indicators correlate highly with each other, and subsequently inverse to risk assets. VIX broke down in early summer, but it took QE becoming a reality for utilities to break down as well. Both indicators are at severely depressed levels, which the fed desires. The hope is to push money into riskier ventures. As long as the price action remains at these levels, volatility and asset depreciation should remain limited.

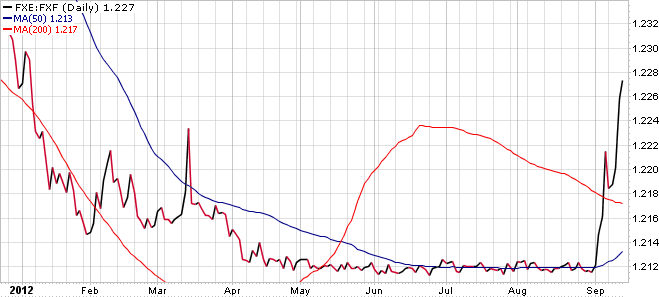

An interesting indicator that represents a more bullish global trend is the Swiss Franc (FXF) versus the Euro (FXE). In order for the Swiss to maintain a form of economic normalcy in a highly volatile global environment, they opted to put a ceiling on its currency strength. They would only let the pair fall to levels around 1.20. The chart below shows this holding for a better part of 5 months. The bank had to exhaust many of its reserves keeping the price action limited. However, on the announcement of ECB bond buying and depreciating yields, the franc weakened. The Euro has shown broad strength, from the Dollar to the Yen, and this looks to be translating into the Franc as well. Upon volatility returning, this pair could prove to be an attractive trading opportunity considering the 1.20 floor.

The last road that will be traveled within this tour of current easing, is in the realm of emerging market's equity. This first indicator is Emerging Markets (EEM) over world equity (VT). Emerging Market has shown considerable weakness as of late, but upon Fed action, money poured into their respective markets. Both Latin America and Asian Pacific regions saw price spikes. Strength looks to have returned, but considerable overhead still remains. A true break out of its range would speak volumes towards global strength as a whole.

Next is Chinese equities (FXI) over world equity. This indicator has been brutally suppressed lately, but with foreign central bank action, China looks to have found a bottom. Many were puzzled at the apparent inaction of The People's Bank of China on stimulating its weakening economy, but others have compensated for them. The strength comes in the form of a better global outlook, and with it, should be a considerable move in Chinese equities. Further progress needs to be made, but the vision looks to be a more stable and stronger world economy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Global Macro: The Search For Yield

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.