The macro outlook is currently littered with uncertainty, yet it contains a hint of predictability too. The decisions to be made over the next month are primarily concerned with political action. Bernanke meets in Jackson Hole on Friday, and there is the belief that he may reveal his hand.

The ECB meets throughout September, but the date on which a solution will be presented has less clarity. Along the same line, there is an idea that China may intervene to compensate for the East's recent string of bad data. All events are known to be pending, but their outcomes are unknown.

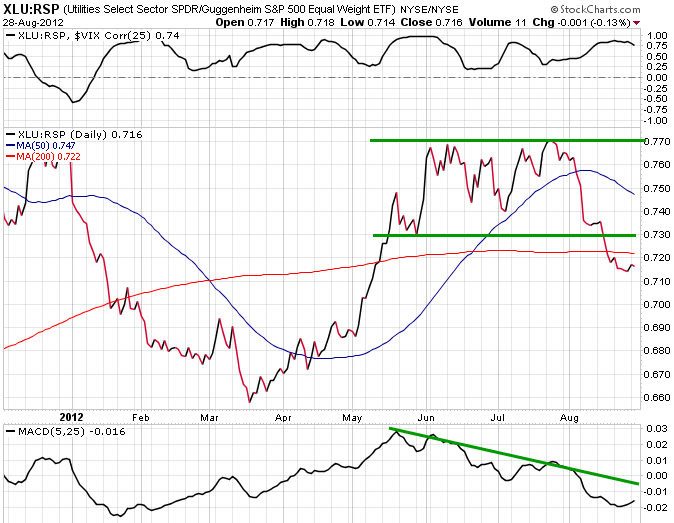

With the overhang of uncertainty, the call for volatility is valid. The VIX (VXX) has been silent as of late, but a swift return remains. An indicator that highly correlates with VIX is utility stocks (XLU) over equity markets (RSP). It and VIX trade near a .75 correlation, yet their charts vary. What is clear in the image below is that the ratio looks ready for a pullback. Its MACD is fairly below the downtrend line and the price action in general looks to be rounding back. This could foretell the coming weeks of announcements, and a move lower in equities.

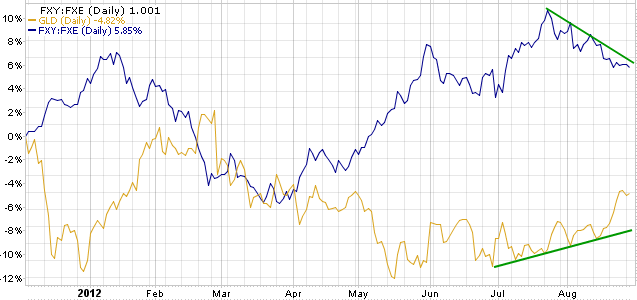

The next look is gold (GLD) over the JPY/EUR cross (FXY)(FXE). The JPY/EUR is another asset that has been trading alongside volatility recently. By comparing its move to inflation linked gold, one can measure market sentiment toward riskier assets. Gold has gotten a footing, but fear must sufficiently leave the markets for the yen to experience selling pressure. If both assets can sustain their respective trends, then risk should avoid a drastic sell off.

Spanish equities have similarly been in the spotlight recently, and their future direction speaks volumes for the markets as a whole. Spain equities (EWP) over world equities (VT) is the indicator below, and it shows a compelling story. With the paradox being that the ECB won't initiate bond buying until Spain agrees to their measures and the other way around, Spanish equities are at a standstill till a decision is made.

Spain has been leading as of late, with a steep slope, the indicator is primed for consolidation. Within the broader framework of the chart, the price action's next move has strong implications. If it continues higher with vigor, the chart has bottomed; but if it bounces off resistance, the downtrend becomes stronger. The next few weeks should give a sense of direction to this sideways indicator.

With the various indicators above each telling a story of their own, they all inherently reflect a bigger picture. The markets have been moving on an idea, but this idea has yet to manifest itself. If one is to believe that we have priced in easing, then the lack thereof should ignite selling. The money that now resides in the market is playing a guessing game with central banks. In other words, their premises are pure speculation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Global Macro: A Volatile Environment

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.