Just a quick update, with a few brief topics.

First, I have received emails regarding the price action of various financial markets over the last few days (in particular Gold). It seems to be the hot topic of the moment, with various bloggers forecasting the end of the Gold bull run. According to the price action, obviously they are right in the short term, as Gold just entered a cyclical bear market. However, I do not think the Gold run is over.

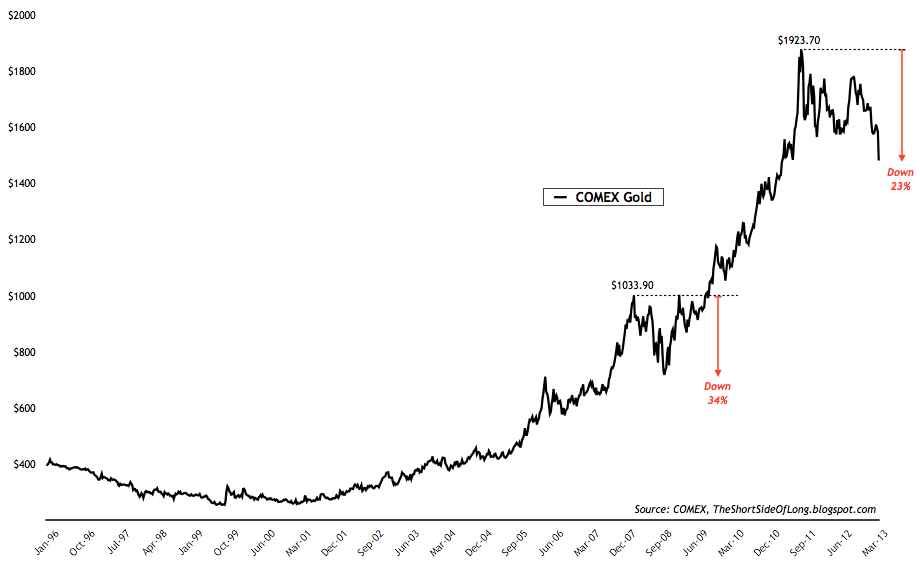

Chart 1: Gold finally moves into "20% bear market" territory

If we look at Chart 1, we can see that the recent Gold bull market has finally ended with an official correction of 23% from its record intra day highs. Personally, I am very glad Gold is finally correcting properly, as it has been almost 5 years since this asset fell by more than 20%. In all honesty, gains out of the October '08 lows have been tremendous and it is only normal for the price to pull back at least 20% to 30% (sometimes even more) before the bull market continues.

While many disagree, my view is that this is a buying opportunity, as I expect Gold to go much higher than the $1923.70 record, hit in September 2011.

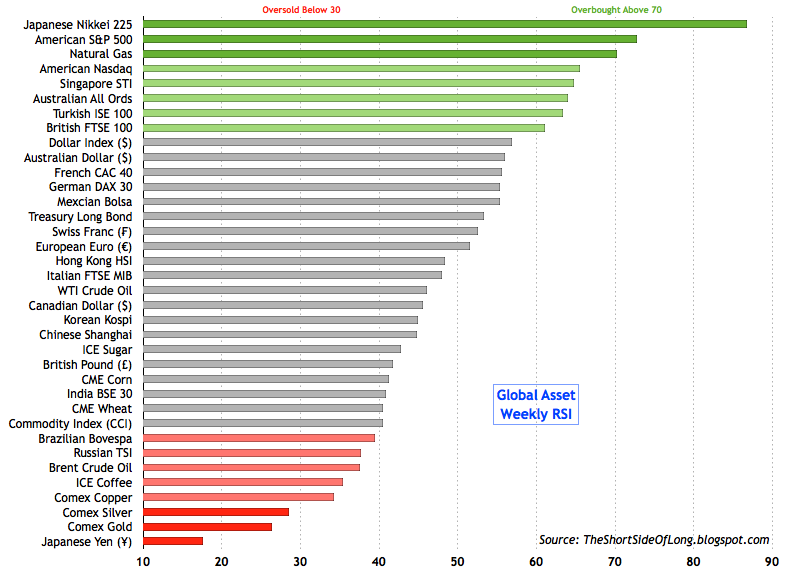

Chart 2: Overbought and oversold global financial assets

Second, the assets currently oversold both technically and according to various sentiment surveys (Public Opinion, DSI, COT, etc) are the Yen, Euro, Pound, Loonie, Franc, Gold, Silver, Copper, Coffee, Sugar and Wheat, as seen in Chart 2. As we can see in general, foreign currencies and commodities have suffered since 2011. Commodity linked stock markets such as Russia and Brazil have also underperformed for a while now.

Interestingly, Heating Oil (correlates very closely with Brent Crude) is also out of favour with investors while speculative positions in WTI Crude Oil are quite optimistic. This type of a diverging view does not help, but in general commodity liquidation continues. Last week it was the grain market, this past week it was the PMs sector and before the major low comes, we could see energy under pressure too.

Assets currently favoured by investors are US, German and Japanese equities. Rampant speculation is also seen in Mexico, Turkey, The Philippines, Thailand and Indonesia amongst the global stock markets. Apart from the more volatile AAII measure, various sentiment surveys on US equities are showing euphoric readings. US Dollar sentiment also remains frothy from the near term perspective. Finally, while Treasuries are extremely overvalued after a 31 year bull market, there might be further upside for a trade if the economy moves back into a recession.

I continue to urge investors to stay away from US equities. I think even a crash is now possible come the autumn months, especially if the market continues to rise vertically. Sectors such as Healthcare, Consumer Staples, Consumer Discretionary and Utilities are extremely overbought and in the terminal parabolic stage.

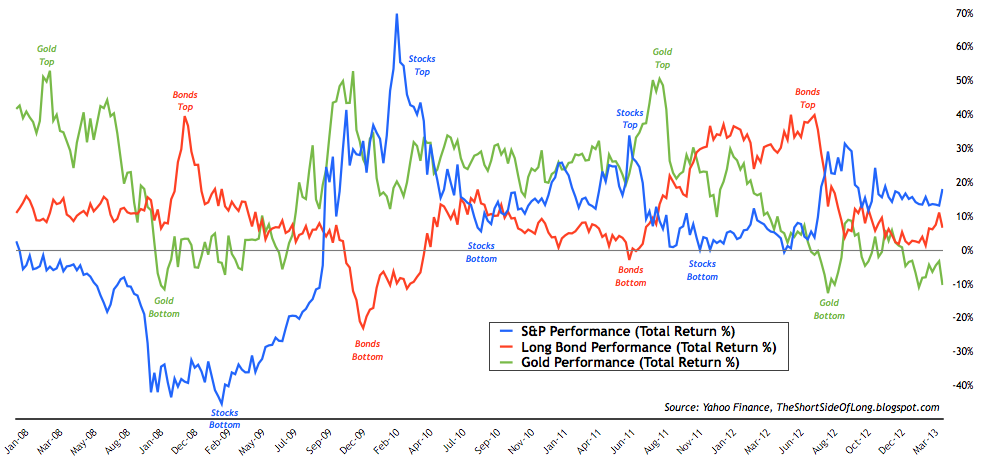

Chart 3: Stocks, Bonds & Gold annual performance

Finally, let us look at the general global macro asset class performance. Chart 3 displays the annual percentage return for Stocks, Bonds and Gold. If we observe the price since 2008, we can notice the following:

- Stocks have performed well in 2009, 2010, 2011, 2012 and 2013 with returns above 60% early on in the bull market and on two occasions with a 30% rally. No annual losses have occurred so far, when including dividend returns.

- Bonds have also performed well in 2010, 2011, 2012 and 2013 with an annualised return above 40% in the last year and half. Here too, annual losses have not occurred, especially when the interest yield is included.

- Finally, let us focus on Gold. The yellow metal has done great during 2009, 2010 and 2011 with solid returns and on two occasions with a 50% rally. However, Gold has been terrible in 2012 and 2013 with a rolling annual loss.

Since their relative peaks and troughs in 2011, US equities are up almost 48%, while Gold is down 23%. As an investor, I prefer to expose my capital to depressed assets such as Gold (even if it is only on relative basis), rather than chase the gains into the blue skies (S&P 500). I admit that equities could still continue to outperform Gold for awhile, but with Treasuries rising and Gold falling, I think the market could be signalling a deflationary bust around the corner.

What I Am Watching