Frequent readers in this space know that I focus on technicals. Quite often to the point that nothing else matters. But for the record, I live in the real world and I do see what is going on. Oh, I don’t care for all the hype and noise from television pundits and the uninformed or biased views from the financial media. But I do see what is going on in the world. And those views can often help shape a trading strategy.

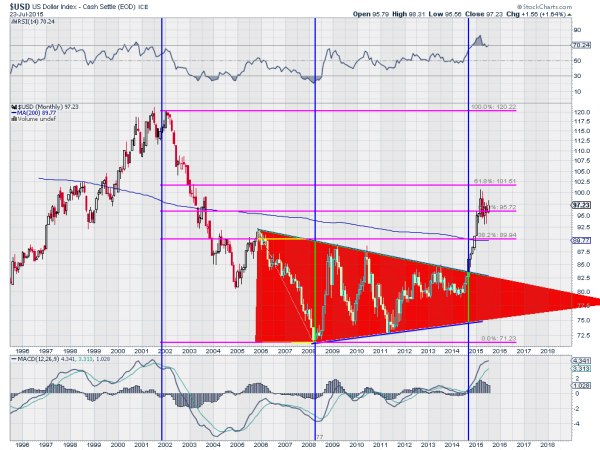

One big theme that has been in play since 1 year ago is the strong dollar. Everyone saw it rise over the back half of 2014, going up over 20%. The chart below shows a consolidation at a 50% retracement of the down leg from the 2002 high. A break out from here could have a lot of room to run. There are many factors that led to this rise and they are important to understand to correctly trade in their wake.

First is the view that the US will raise interest rates sometime soon. I do not care if it is September, December or 2016. Just knowing that the shift is toward looking at raising rates some time gives an upward bias to the US Dollar. Of course the fallout of this also creates a potential opportunity in US Treasuries on the short side. As rates rise eventually bond prices will fall.

The next is the weak economies in China, Europe and Japan. Each of these countries or blocks is looking to support heir economies fiscally. So each has been letting their currency depreciate. This of course also puts an upward bias on the US Dollar. but it also presents opportunities to participate in the local market returns of the European, Chinese and Japanese markets. And as an equity investor this has become much easier with the creation of currency hedged ETF’s.

Finally there is the deflationary commodity environment. You have seen it most closely in crude oil but metals, corn and coffee among other commodities are also falling in price. This is actually the wild card that could end this theme. I do not believe it will, but a total global crush in all commodities could pull the Federal Reserve away from the stance that their next move in interest rates is higher. Just something to keep in mind for now. Until that happens the world is lining up to continue to push the US Dollar higher. Play along.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.