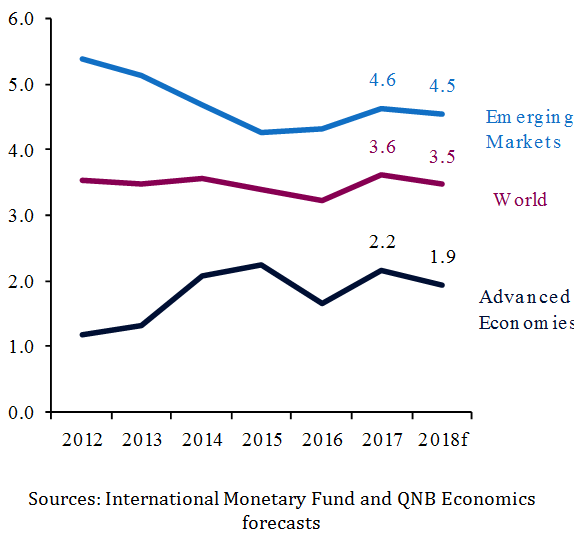

In 2018, global growth is expected to be 3.5%,just above the average for the post-financial crisis era but slightly down from 3.6% in 2017.The three main factors that drove the acceleration in growth in 2017 are now expected to fade. In 2017, accommodative global monetary policy, sustained high growth in China and lower oil prices kept the wind in the sails of the global economy. In 2018, the positive effects of all of these drivers are likely to soften.

First, accommodative global monetary policy is likely to be scaled back in 2018, even if inflation does not pick up as expected. Unemployment in a number of major economies is expected to fall below the targeted levels of their central banks. The unemployment rate in advanced economies in 2018 is expected to fall to its lowest rate since 1980. This has already prompted the world’s largest central banks to announce plans to reduce the level of monetary accommodation. The US Federal Reserve plans three rate hikes in 2018 as well as a USD400bn reduction in the size of its balance sheet. The European Central Bank has announced plans to reduce the size of its monthly asset purchases. The Bank of Japan targets long term yields and the pace of asset purchases required for this has slowed in recent months. In total, the balance sheets of the Fed, ECB, Bank of Japan and Bank of England are only expected to increase by USD235bn in 2018, compared with an increase of USD2.1tn in 2017. As a result, global financial conditions are likely to tighten slightly and long-term bond yields could rise, restraining growth.

Second, the Chinese economy is likely to slow from the sustained high levels achieved in 2017. The authorities have tightened regulations on property purchases and the shadow banking sector and also plan to cut excess capacity in the economy, deleverage the corporate sector and shift to “greener” growth. Total credit growth has already slowed from over 20% to the low teens and this is expected to continue in 2018. All these will be a drag on growth, which we expect to slow from 6.8% in 2017 to 6.4% in 2018. China was responsible for over a third of global growth in 2017 so this slowdown will have a direct impact on the world’s real GDP. Additionally, Chinese demand is an important driver of economies globally, but particularly in much of emerging Asia, resulting in significant indirect knock-on effects on growth in other economies.

Real GDP Growth (% change)

Sources: International Monetary Fund and QNB Economics forecasts

Third, higher oil prices are beginning to bite on the pockets of consumers. Although it took some time, the drop in oil prices in 2014 increased household purchasing power and did, eventually, lead to a pickup in growth of consumer spending in 2016-17. However, oil prices have risen sharply since the middle of 2017, up 33% year on year in November. We expect oil prices to remain high in 2018 at around the USD60/barrel level (see our recent commentary, Oil prices to average around USD60/b in 2018). Additionally, real wage growth has remained relatively weak and is expected to remain so in 2018 with gradually rising inflation. The impact is that consumers’ pockets are going to feel the pinch in 2018, which will be a drag on growth. Retail sales growth in the Euro Area, Japan and China has slowed in recent months, although retail sales growth in the US remains high. However, this effect could be partly offset by higher investment as oil companies respond to higher prices.

As a result of the unwinding of the predominant drivers of global growth, we expect the global economy to slow from its 3.6% clip in 2017 to 3.5% in 2018. The slowdown is expected to be relatively broad based with advanced economies easing from 2.2% to 1.9% and emerging markets from 4.6% to 4.5%. There are some upside risks to this forecast: low inflation could persist, leading to easier monetary policy; the Chinese authorities could reverse direction and add stimulus; or oil prices could fall back. However, given that the main drivers of growth in 2017 all look likely to moderate in 2018, we see a repeat performance of 2017 growth as unlikely.