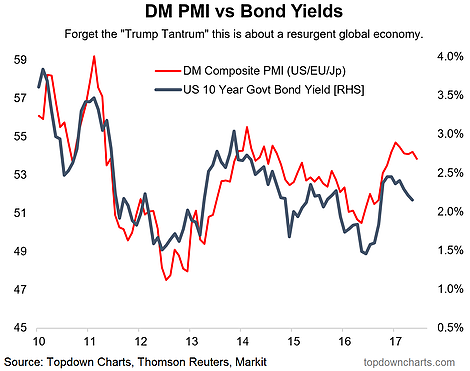

The latest round of flash manufacturing PMIs saw the "global composite" that we put together fall -0.40 to 53.8 which places it down -0.9pts from the peak in January this year. Within the results there was the ongoing divergence between America and Europe, with the Eurozone flash PMI +0.3 to 57.3 and the US flash manufacturing PMI -0.6 to 52.1 and Japan ranging along -2.1 to 52.0.

The results continue that ever so slight downtrend that began since the peak in January and helps reconcile the trading in the US 10-year government bond yield, although there does seem to be a bit of a gap opening up between the two series. If the DM composite PMI can hold up or even regain some momentum it would provide a fundamental catalyst to rising bond yields or at least open up a notable mispricing for bonds.

My view is that global growth should be able to hold up given strengthening global trade growth, rising consumer confidence, rising property prices in the major economies, improving industrial production and corporate earnings growth, and still broadly accommodate monetary policy. However you need to pay attention to the data and the leading indicators, particularly ones like this.

The "global flash manufacturing PMI" dropped slightly in June, which continues the slight but noticeable downtrend that began from the peak in January this year. It highlights the concerns I recently noted about the risks to the global growth outlook.

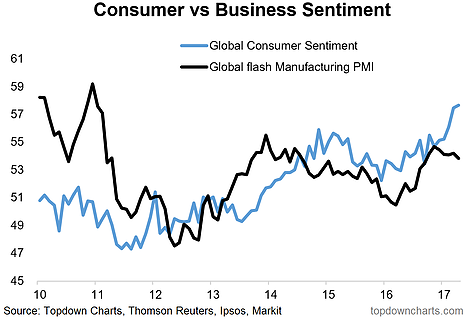

As noted in a previous post, consumer sentiment is on the rise, and here's how it compares to the global flash manufacturing PMI. Note the divergence (albeit they don't always move together).