Equities

Asian markets tumbled on Wednesday, as hopes for another round of easing by the Fed faded. The Nikkei tanked 2.3% to 9820, its steepest drop in 5 months. The Kospi slumped 1.% to 2019, while the ASX 200 managed to ease just .1%, as a slide in the Australian dollar helped exporters. In China, the Shanghai Composite and Hang Seng were closed for a holiday.

Selling pressure intensified in Europe following a weak Spanish bond auction. The DAX plunged 2.8%, the CAC40 tumbled 2.7%, and the FTSE skidded 2.3. Spain sold just 2.6 billion euros in short-term debt, an amount which was at the bottom of its target range, and yields on Spanish 10-year notes climbed to 5.61%.

US stocks fared modestly better, but still closed sharply lower. The Dow dropped 125 points to 13075, the S&P 500 fell 1% to 1399, and the Nasdaq shed 1.5% to 3068.

Currencies

The US dollar benefited from the shift away from risk, climbing .7% against the euro, Swiss franc, and Australian dollar. The yen climbed .5% to 82.42 as traders unwound carry trade positions. The Canadian dollar declined .6% to .9966, while the pound eased .2% to 1.5888.

Economic Outlook

The ADP payroll report indicated the economy added 209K jobs last month, slightly more than forecast, but a smaller gain than last month’s 230K jump. On Friday, the government will release the official nonfarm payroll report, which is expected to show a gain of 211K jobs. ISM non-manufacturing PMI slid to 56.0 from 57.2, slightly below forecasts.

China’s Shanghai Composite returned from a 3-day holiday to rally 1.7%, while most Asian markets traded lower. The Hang Seng fell 1% , the Nikkei slid .5%, and the ASX 200 declined .3%. Sharp gains in car makers lifted the Kospi .5%, as Hyundai Motors rallied more than 4%.

European markets recovered from early losses after the weekly US jobless claims report showed modest progress. The FTSE gained .4%, the CAC40 rose .2%, while the DAX lagged behind, easing .1%.

US stocks closed mixed after a quiet session. The Dow slipped 15 points to 13060, the S&P 500 eased 1 point to 1398, while the Nasdaq gained .4% to 3081. The VIX rose 1.6% to 16.70, up 7.8% for the week.

Volatile Week Ends On A Quiet Note

On the earnings front, beverage maker, Constellation Brands tumbled 12.5% after lowering its outlook, while Bed Bath & Beyond jumped 8.5% after beating earnings forecasts.

Currencies

European currencies retreated, as the euro skidded .6% to 1.3067, while the pound and Swiss franc declined .4%. The Australian dollar and Canadian dollar both rose .3%, and the yen inched up .1% to 82.36.

Economic Outlook

Weekly unemployment claims declined by 6000 to 357K, slightly weaker than the 355K forecast by analysts. Overseas, Canada’s payroll report showed the economy staged a sharp upswing last month, adding 82.3K jobs. The figure blew past forecasts for a modest 11.3K.

Asian markets gained on Friday, as investors disregarded a North Korean rocket launch and disappointing growth data from China. GDP data from the first quarter showed the Chinese economy grew at 8.1%, down from 8.9% in the previous quarter. The Shanghai Composite rose .4%, amid hopes that signs of a slowdown will prompt more easing from the government. The Hang Seng jumped 1.8% to 20701, the ASX 200 climbed 1%, and the Nikkei advanced 1.2% to 9638. Korea’s Kospi snapped a 3-day losing streak, bouncing 1.1%.

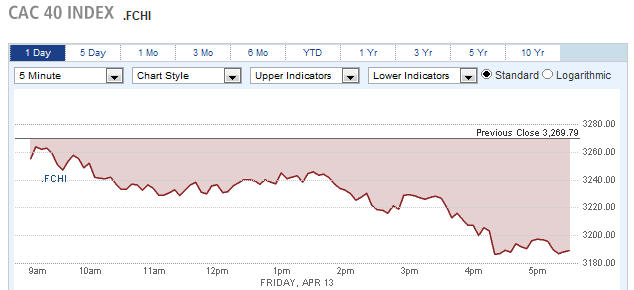

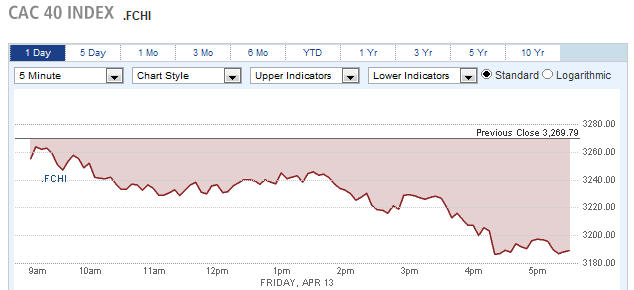

Meanwhile, European markets tanked amid growing debt concerns, and selling accelerated in the afternoon after US consumer sentiment data disappointed. The CAC40 sank 2.5%, the DAX slumped 2.4%, while the FTSE fell 1%. Markets in Spain and Italy plunged more than 3% after data showed Spanish banks were borrowing extensively from the ECB.

France's CAC40 Tumbles 2.5%

US markets closed at the low of the session, dropping more than 1%. The Dow shed 137 points to 12850, the Nasdaq declined 1.5% to 3011, and the S&P 500 fell 1.3% to 1370.

Currencies

The US dollar benefited from the switch to “risk off” mode, particularly against its European counterparts. The euro fell .8% to 1.3078, the Swiss franc skidded .9% to 1.0877, and the pound dropped .6% to 1.5856. The Canadian dollar declined .5% to .9996, and the Australian dollar lost .6% to 1.0378. The yen eased fractionally to 80.93.

Economic Outlook

Consumer sentiment data from the University of Michigan disappointed, unexpectedly sliding to 75.7 from last month’s 76.2 reading. CPI data showed prices rose .3%, above forecasts, but the less volatile core CPI was in line with estimates, rising .2%.

Asian markets skidded on Monday, following Friday’s slide in the West. The Nikkei tanked 1.7% to 9471, the Kospi dropped .8%, and the ASX 200 declined .5%. In greater China, the Hang Seng fell .4% and the Shanghai Composite eased .1%, ending a 4-day winning streak.

European markets rebounded from early losses thanks to strong US sales data. The DAX advanced .6%, CAC40 gained .5%, and the FTSE rose .3%. Yields on 10-year Spanish debt crossed above 6%, hitting their highest level this year, and the cost to insure Spanish debt spiked to a record high.

US stocks ended mixed, as the Dow climbed 72 points to 12921, while the Nasdaq slumped .8% to 2988, and the S&P 500 eased less than 1 point to 1370.

Apple Shares Drop For 5 Straight Days

Toy maker, Mattel Corp., tumbled 9.1% after earnings fell short of forecasts.

Currencies

The euro briefly fell below the 1.30 mark but recovered to close up .3% to 1.3116. The pound rose .2% to 1.5887, the Swiss franc gained .3% to 1.0877, and the yen climbed .6% to 80.46. The Australian dollar dropped .4% to 1.0333, and the Canadian dollar settled down fractionally at 1.0001.

Economic Outlook

Monday’s economic data was mixed. Retail sales blew past forecasts, rising .8% vs. forecasts for a .4% gain. On the negative side, the Empire State manufacturing index tumbled to 6.6 from 20.1, way below estimates. The NAHB housing market index unexpectedly fell to 25 from 28, the first drop in 7 months.

Asian markets continued to slide on Tuesday, as concerns over Spain’s debt burden escalated. The Nikkei eased .1% to 9465, the Kospi fell .4% and the ASX 200 declined .3%. China’s Shanghai Composite slumped .9%, and the Hang Seng slipped .2% as Chinese financial shares struggled.

European markets soared as a dose of good economic data and a successful Spanish debt auction triggered a buying spree. The DAX and CAC40 surged 2.7% and the DTSE climbed 1.8%. European banks led the gains, as the sector jumped 4.1%. Germany’s ZEW economic sentiment index climbed to its highest level since June 2010, blowing past analyst forecasts.

US stocks advanced as well, but the gains were slightly less impressive. The Nasdaq spiked 1.8% to 3043, the S&P 500 rallied 1.6% to 1391, and the Dow rocketed up 194 points to 13116.

Nasdaq Soars 1.8%

Apple shares jumped 5.1%, snapping a 5-day losing streak. Citigroup climbed 3.2% after earning an upgrade from Meredith Whitney.

Currencies

The dollar traded mostly lower on Tuesday as money flowed back into risk. The Canadian dollar jumped .9% to .9903, the pound rose .2% to 1.5934, and the Australian dollar gained .4% to 1.0394. The euro and Swiss franc closed flat, while the yen declined .6% to 80.90.

Economic Outlook

Building permits rose to .75M, up from .72M last month hitting their highest level since September 2008, but housing starts unexpectedly dropped to .65M from last month’s .69M.

Asian markets tumbled on Wednesday, as hopes for another round of easing by the Fed faded. The Nikkei tanked 2.3% to 9820, its steepest drop in 5 months. The Kospi slumped 1.% to 2019, while the ASX 200 managed to ease just .1%, as a slide in the Australian dollar helped exporters. In China, the Shanghai Composite and Hang Seng were closed for a holiday.

Selling pressure intensified in Europe following a weak Spanish bond auction. The DAX plunged 2.8%, the CAC40 tumbled 2.7%, and the FTSE skidded 2.3. Spain sold just 2.6 billion euros in short-term debt, an amount which was at the bottom of its target range, and yields on Spanish 10-year notes climbed to 5.61%.

US stocks fared modestly better, but still closed sharply lower. The Dow dropped 125 points to 13075, the S&P 500 fell 1% to 1399, and the Nasdaq shed 1.5% to 3068.

Currencies

The US dollar benefited from the shift away from risk, climbing .7% against the euro, Swiss franc, and Australian dollar. The yen climbed .5% to 82.42 as traders unwound carry trade positions. The Canadian dollar declined .6% to .9966, while the pound eased .2% to 1.5888.

Economic Outlook

The ADP payroll report indicated the economy added 209K jobs last month, slightly more than forecast, but a smaller gain than last month’s 230K jump. On Friday, the government will release the official nonfarm payroll report, which is expected to show a gain of 211K jobs. ISM non-manufacturing PMI slid to 56.0 from 57.2, slightly below forecasts.

US Weekly Jobless Claims Continue To Drop

EquitiesChina’s Shanghai Composite returned from a 3-day holiday to rally 1.7%, while most Asian markets traded lower. The Hang Seng fell 1% , the Nikkei slid .5%, and the ASX 200 declined .3%. Sharp gains in car makers lifted the Kospi .5%, as Hyundai Motors rallied more than 4%.

European markets recovered from early losses after the weekly US jobless claims report showed modest progress. The FTSE gained .4%, the CAC40 rose .2%, while the DAX lagged behind, easing .1%.

US stocks closed mixed after a quiet session. The Dow slipped 15 points to 13060, the S&P 500 eased 1 point to 1398, while the Nasdaq gained .4% to 3081. The VIX rose 1.6% to 16.70, up 7.8% for the week.

Volatile Week Ends On A Quiet Note

On the earnings front, beverage maker, Constellation Brands tumbled 12.5% after lowering its outlook, while Bed Bath & Beyond jumped 8.5% after beating earnings forecasts.

Currencies

European currencies retreated, as the euro skidded .6% to 1.3067, while the pound and Swiss franc declined .4%. The Australian dollar and Canadian dollar both rose .3%, and the yen inched up .1% to 82.36.

Economic Outlook

Weekly unemployment claims declined by 6000 to 357K, slightly weaker than the 355K forecast by analysts. Overseas, Canada’s payroll report showed the economy staged a sharp upswing last month, adding 82.3K jobs. The figure blew past forecasts for a modest 11.3K.

Western Markets Tumble As Data Disappoints

EquitiesAsian markets gained on Friday, as investors disregarded a North Korean rocket launch and disappointing growth data from China. GDP data from the first quarter showed the Chinese economy grew at 8.1%, down from 8.9% in the previous quarter. The Shanghai Composite rose .4%, amid hopes that signs of a slowdown will prompt more easing from the government. The Hang Seng jumped 1.8% to 20701, the ASX 200 climbed 1%, and the Nikkei advanced 1.2% to 9638. Korea’s Kospi snapped a 3-day losing streak, bouncing 1.1%.

Meanwhile, European markets tanked amid growing debt concerns, and selling accelerated in the afternoon after US consumer sentiment data disappointed. The CAC40 sank 2.5%, the DAX slumped 2.4%, while the FTSE fell 1%. Markets in Spain and Italy plunged more than 3% after data showed Spanish banks were borrowing extensively from the ECB.

France's CAC40 Tumbles 2.5%

US markets closed at the low of the session, dropping more than 1%. The Dow shed 137 points to 12850, the Nasdaq declined 1.5% to 3011, and the S&P 500 fell 1.3% to 1370.

Currencies

The US dollar benefited from the switch to “risk off” mode, particularly against its European counterparts. The euro fell .8% to 1.3078, the Swiss franc skidded .9% to 1.0877, and the pound dropped .6% to 1.5856. The Canadian dollar declined .5% to .9996, and the Australian dollar lost .6% to 1.0378. The yen eased fractionally to 80.93.

Economic Outlook

Consumer sentiment data from the University of Michigan disappointed, unexpectedly sliding to 75.7 from last month’s 76.2 reading. CPI data showed prices rose .3%, above forecasts, but the less volatile core CPI was in line with estimates, rising .2%.

Spanish Debt Fears Grow, As Yields Cross 6%

EquitiesAsian markets skidded on Monday, following Friday’s slide in the West. The Nikkei tanked 1.7% to 9471, the Kospi dropped .8%, and the ASX 200 declined .5%. In greater China, the Hang Seng fell .4% and the Shanghai Composite eased .1%, ending a 4-day winning streak.

European markets rebounded from early losses thanks to strong US sales data. The DAX advanced .6%, CAC40 gained .5%, and the FTSE rose .3%. Yields on 10-year Spanish debt crossed above 6%, hitting their highest level this year, and the cost to insure Spanish debt spiked to a record high.

US stocks ended mixed, as the Dow climbed 72 points to 12921, while the Nasdaq slumped .8% to 2988, and the S&P 500 eased less than 1 point to 1370.

Apple Shares Drop For 5 Straight Days

Toy maker, Mattel Corp., tumbled 9.1% after earnings fell short of forecasts.

Currencies

The euro briefly fell below the 1.30 mark but recovered to close up .3% to 1.3116. The pound rose .2% to 1.5887, the Swiss franc gained .3% to 1.0877, and the yen climbed .6% to 80.46. The Australian dollar dropped .4% to 1.0333, and the Canadian dollar settled down fractionally at 1.0001.

Economic Outlook

Monday’s economic data was mixed. Retail sales blew past forecasts, rising .8% vs. forecasts for a .4% gain. On the negative side, the Empire State manufacturing index tumbled to 6.6 from 20.1, way below estimates. The NAHB housing market index unexpectedly fell to 25 from 28, the first drop in 7 months.

European And US Stocks Soar

EquitiesAsian markets continued to slide on Tuesday, as concerns over Spain’s debt burden escalated. The Nikkei eased .1% to 9465, the Kospi fell .4% and the ASX 200 declined .3%. China’s Shanghai Composite slumped .9%, and the Hang Seng slipped .2% as Chinese financial shares struggled.

European markets soared as a dose of good economic data and a successful Spanish debt auction triggered a buying spree. The DAX and CAC40 surged 2.7% and the DTSE climbed 1.8%. European banks led the gains, as the sector jumped 4.1%. Germany’s ZEW economic sentiment index climbed to its highest level since June 2010, blowing past analyst forecasts.

US stocks advanced as well, but the gains were slightly less impressive. The Nasdaq spiked 1.8% to 3043, the S&P 500 rallied 1.6% to 1391, and the Dow rocketed up 194 points to 13116.

Nasdaq Soars 1.8%

Apple shares jumped 5.1%, snapping a 5-day losing streak. Citigroup climbed 3.2% after earning an upgrade from Meredith Whitney.

Currencies

The dollar traded mostly lower on Tuesday as money flowed back into risk. The Canadian dollar jumped .9% to .9903, the pound rose .2% to 1.5934, and the Australian dollar gained .4% to 1.0394. The euro and Swiss franc closed flat, while the yen declined .6% to 80.90.

Economic Outlook

Building permits rose to .75M, up from .72M last month hitting their highest level since September 2008, but housing starts unexpectedly dropped to .65M from last month’s .69M.