As global equity markets have moved higher and higher since what was arguably the start of a new bull market in 2016, a number of concerns have surfaced, such as higher valuations, dependence on monetary policy, and a range of other worries like geopolitics.

But a key development has been the rebound in fundamentals, which have supported higher stock prices. I talked about this extensively in the latest weekly report.

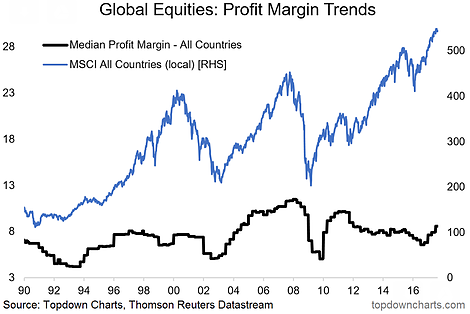

The chart below shows the median profit margin across all of the countries in the MSCI developed and emerging market universes. There is a clear rebound from what looked like either a near-miss global recession or a micro-recession.

Tracking the median profit margin helps give a guide to the broader, predominant trends, across the globe. Looking at the past there's a clear correlation with the level and trend in profit margins and stock prices. Generally higher and improving profit margins are supportive, and vice versa.

So what's driving it?

As I talked about in the Monthly Chartbook, the global economy is on a much stronger footing lately, following the rebound from the micro-recession in 2016. At a global level there was clear evidence in the charts of a slump in 2016 – I've previously talked about this as almost providing a sort of reset moment that has probably ended up extending the length of the current business cycle, certainly at least delayed the onset of some of the types of conditions you see late-cycle.

But even if the global economy didn't experience an actual recession, a number of countries and industries certainly did. For a number of reasons (e.g. base effects, economic stimulus), it's easier to record better growth and improved fundamentals coming out of a recession. So where to next from here?

I would say that there's some upside left, but 2018 looks set to bring more challenging economic conditions globally, so I'd expect to see ongoing strength in the fundamentals e.g. profit margin and return on equity short-medium term. However it's going to be increasingly important to track lead indicators of profitability and the cycle as some of the economic tailwinds currently in force begin to wane next year.