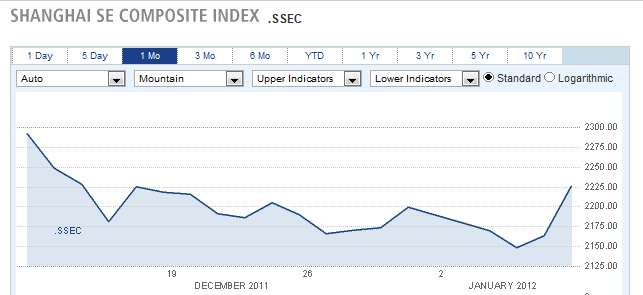

Asian markets traded mixed on Monday following last week’s losses. China’s Shanghai Composite spiked 2.9%, boosted by a rise in the money supply and loan growth, and the Hang Seng rallied 1.5% to 18866. The Kospi dropped .9%, and the ASX 200 eased .1%. Japanese markets were closed for a holiday.

Shanghai Composite Rallies Nearly 3% on Upbeat Data

European markets traded lower, led by banks which fell 2.2%. The FTSE and DAX dropped .7%, and the CAC40 fell .3%. Over the weekend, Hungary’s debt rating was downgraded to junk, and Der Spiegel reported that the IMF doubts that Greece can get its finances under control.

In the US, stocks closed modestly higher. The Dow edged up .3%, the S&P 500 rose .2%, and the Nasdaq eked out a .1% gain.

Economic Outlook

Consumer credit saw a massive expansion in November, climbing to $20.4 billion. Analysts had expected a gain of just $7 billion.

Upbeat Outlook from Alcoa Lifts Metals and Resource Stocks

Equities

Chinese stocks rallied for a second day, despite a drop in trade data, amid hopes the government would pursue a looser monetary policy. The Shanghai Composite climbed 2.7%, and Hong Kong’s Hang Seng advanced 1.8%. Australia’s ASX 200 gained 1.1%, and the Kospi settled up 1.5%. The Nikkei returned from a holiday to close up .4%, as Olympus shares soared 20% on news the company would not be delisted.

European markets surged, led by banks and materials stocks. Shares in Italy’s UniCredit jumped 7%, and the regional banking index climbed 4.5%. The CAC40 rallied 2.7%, the DAX advanced 2.4%, and the FTSE rose 1.5%. An upbeat outlook from Alcoa helped lift materials stocks by 3.4%.

US markets continued to rise, as the Dow gained 70 points to 12462, the Nasdaq climbed 1%, and the S&P 500 advanced .9%.

Currencies

The Dollar traded mostly lower against world currencies, as the market traded in a narrow range. The Australian Dollar and Canadian Dollar were the biggest gainers, climbing .7% to 1.0319 and 1.0168, respectively. The Euro inched up 10 pips to 1.2774, and the Pound gained .1% to 1.5478. The Yen and Swiss Franc settled little changed.

Economic Outlook

Wholesale inventories rose a mere .1%, less than the .5% forecast, which suggests buying is beginning to outstrip production. The small business optimism index rose to 47.5 from 42.8, exceeding forecasts.

Fitch Warns of Potential ‘Cataclysmic’ Euro Collapse

Equities

Asian markets traded mixed on Wednesday. Amongst the winners, the Nikkei edged up .3% to 8448, the ASX 200 rallied .9%, and the Hang Seng climbed .8%. On the losing side, the Kospi fell .4%, and the Shanghai Composite slipped .4%.

In Europe, stocks slipped, pressured by remarks from Fitch, saying the ECB must buy euro zone debt to prevent a collapse of the euro. The FTSE declined .5%, while the CAC40 and DAX eased .2%. UniCredit shares rallied for a second session, gaining 6%, after its recent 75% loss in value.

In the US, the Dow edged down 13 points to 12449, while the Nasdaq rose .3%. The broader S&P 500 closed flat.

Currencies

European currencies fell against the Dollar. The Pound slumped 1.1% to 1.5319, and the Swiss Franc shed .5% to 1.0480. The Euro settled down .6% to 1.2706, after trading as low as 1.2662 earlier in the day. The Yen and Australian Dollar both posted minor losses, and the Canadian Dollar eased .3% to 1.0191.

Economic Outlook

Oil inventories rose by 5 million barrels, much more than the .9 million forecast. Weekly mortgage applications rose, encouraged by low interest rates.

Successful Debt Auctions in Spain and Italy Lift Euro

Equities

Asian markets traded mostly lower, despite a report from China which showed inflation fell to 4.1%, its lowest level in 15 months. The Shanghai Composite eased fractionally, settling at 2275. Hong Kong’s Hang Send slid .3%, rhe Nikkei lost .7%, and the ASX 200 edged down .2%. Bucking the downtrend, South Korea’s Kospi rallied 1%,

In Europe, the ECB held rates steady, and ECB chairman, Mario Draghi, said there are signs the region is stabilizing. The FTSE and CAC40 declined .2%, while the DAX rose .4%. Auctions in short-term debt in Spain and Italy were wildly successful, but their ability to sell longer term debt may prove more challenging.

US stocks posted modest gains, despite weak economic data. The Dow inched up 22 points to 12471, the Nasdaq advanced .5%, and the S&P 500 rose .2%.

Currencies

The Euro rallied .9% to 1.2826, and the Swiss Franc gained 1.1% to 1.0595, as the successful bond auctions in Europe relieved some anxiety. The Pound and Candian Dollar both rose .1%, and the Australian Dollar settled up .3% at 1.0340. EUR/USD" title="EUR/USD" width="804" height="373">

EUR/USD" title="EUR/USD" width="804" height="373">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Global Equities Mixed, Consumer Credit Surges

Published 01/13/2012, 06:26 AM

Updated 05/14/2017, 06:45 AM

Global Equities Mixed, Consumer Credit Surges

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.