- After muddling through last year, the global economy is set for another year of unspectacular growth in 2013. Our call for just 3.3% world GDP growth is based on our anticipation that advanced economies will once again tread water, in part due to fiscal drag in North America and the extension of recessions in Europe and Japan, at least in the early part of the year. Emerging economies could see a slight acceleration of growth although results are unlikely to be stellar given the adjustment to the rebalancing process currently underway in China.

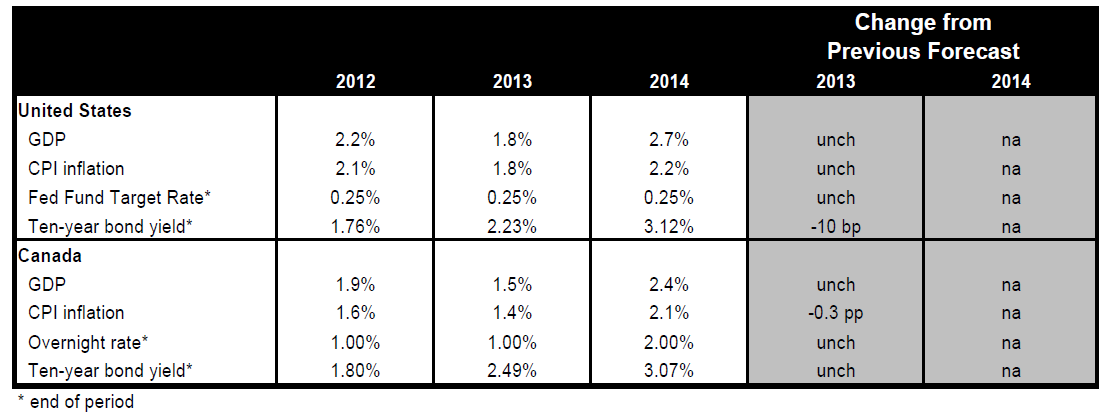

- The deal struck by Congress on the fiscal cliff in January may have prevented a US recession in the first quarter of the year, but it also translated in a debt-to-GDP ratio that won’t improve over the next decade. The debt outlook could worsen further if the sequester, now scheduled for March, is delayed once again without being replaced by an alternative/better plan, something that would test the patience of ratings agencies. Given the implications for the debt outlook, we do not expect the full sequester cuts to be postponed again. The associated fiscal drag explains why our call for US GDP growth is only 1.8% this year.

- Canada is set to underperform the US for the second year running. The negative impact on household disposable income isn’t just through the expected ramp down in government-related hiring, a major driver of job gains last year, but also via a heavier burden imposed on taxpayers. That isn’t good news for consumption spending, a segment that accounted for the bulk of the growth in domestic demand last year. Given the soft global economy and the lagged impacts of the strong Canadian dollar, trade is unlikely to provide a full offset, and together with a moderation in housing, should set up Canada for GDP growth of just 1.5% in 2013. Our below-consensus inflation forecasts have been adjusted even lower to reflect recent softness in prices, but also the expected additional weakness from home price deflation.

To Read the Entire Report Please Click on the pdf File Below.