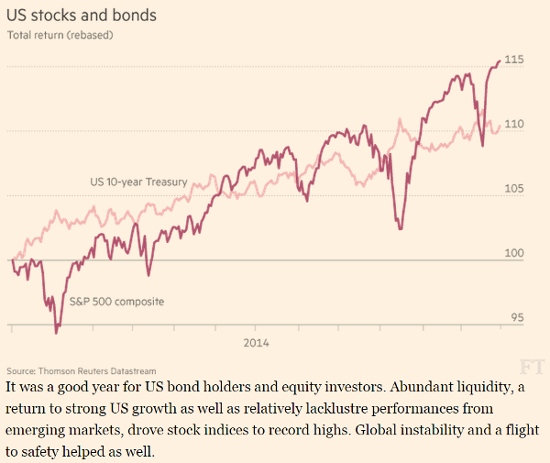

2014 was a good year for U.S. investors who stayed in U.S. based assets…

If you ventured outside of the U.S. or into U.S. Dollar impacted commodities, then it was a struggle, but worth staying invested…

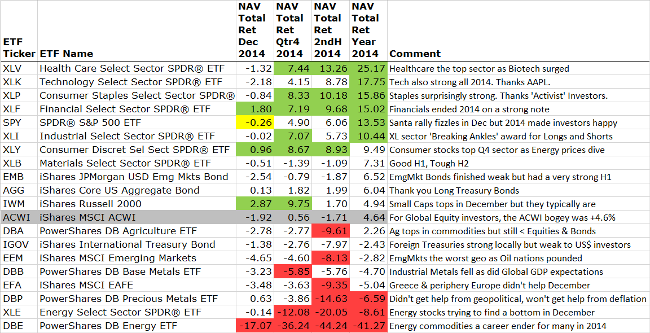

I believe global diversification is still necessary though, and the chart below is the performance sheet for how we look at the global asset classes. The ACWI bogey is a good benchmark for Global Equity. Right now there are plenty of asset classes that are working to spend time on and get interested in for any short term dislocations in the markets.

U.S. Small Caps were a top broad asset class in December, which is its seasonal tendency, but might also help confirm broader Equity risk sentiment. Surprisingly, the big Santa Claus rally fizzled once the tree was taken down, the cookies were eaten, and as the last few days of December cost the market its gains. EAFE and Emerging Markets were hit by a combo of the strong US dollar, weak energy prices hurting oil rich nations, and finally, worry over the upcoming Greece elections and whether or not it could make an EU exit.

Besides the Utility sector (which is small in size and correlates highly to Bonds), December ended a strong Q4 for both the Financials and Consumer Discretionary sectors. Falling energy prices were a big benefit to the entire Retail space, while Financials got help from rising short term yields. For the full year, Healthcare remained the sector to own. December was kinder to Energy stock investors, but with the Energy commodity group still in free fall, it will be tough to attract buyers for now. Remember that the next OPEC meeting is not until June so plenty of time to observe the investor action here.

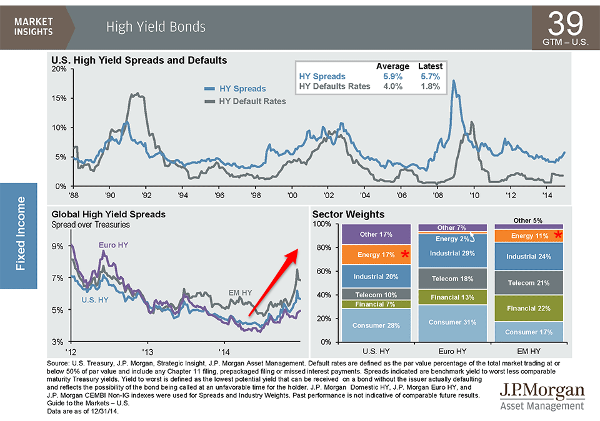

As for fixed income, higher quality and U.S.$ based is the place to be as the AGG ETF outperforms for December, the Q3, and 6 months. We’ll likely need energy commodities to find a bottom before Emerging Market bonds can also find buyers. In the commodity asset class, it was a year to sit on the sidelines; U.S.$ strength and bumper crop harvests did little to fire up any of the hard asset pits in Chicago or New York.

Breakable v. Unbreakable…

If M. Night Shyamalan was going to remake Unbreakable and needed 2 charts, Crude Oil would be cast as Samuel Jackson and Airline stocks would get the nod for Bruce Willis. Good movie – incredible charts.

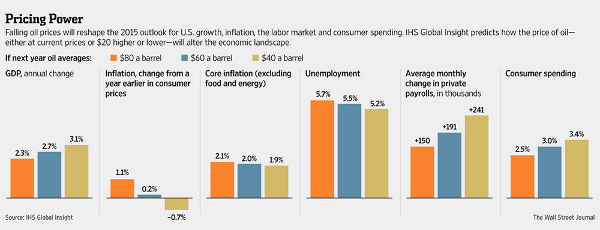

So much to think through for the FOMC, as well as all Asset Allocators, as Crude Oil moves toward $50…

Will the economy fire higher as fuel costs plunge? What will global deflation do to the value of hard assets? Are banks reserved enough in their Energy and Emerging Market loan books? Do you own energy stocks or bonds in your investment book?

Speaking of Energy and Emerging Market credit, the current trend is worrisome…

The most talked about piece over the weekend was Barron’s interview with the new Bond king…

Per usual, Gundlach has an idiosyncratic view of where markets are headed in 2015. Like virtually everyone, he expects the Federal Reserve to begin raising the federal-funds rate this year, but he predicts that the impact will be the opposite of the conventional wisdom. To wit, longer-term bond yields will, in fact, decline rather than rise as a result of a surprising flattening of the yield curve, he argues.

Where the median economic forecast tabulated by Bloomberg for the U.S. 10-Year Treasury Bond yield for year-end 2015 currently stands at 3.24%, Gundlach thinks the 10-year that finished 2014 at 2.17% could potentially take out its modern-era low of 1.38% yield hit in 2012. This would particularly be the case if Crude Oil prices keep falling to, say, $40 a barrel from their 2014 year-end level of about $55. This further drop from the 46% decline suffered by crude in 2014 would only accentuate deflationary forces he sees at work globally that continue to drop long-bond yields…

Likewise weighing on U.S. bond yields will be brisk foreign buying from investors in Japan and Europe, where long-term sovereign debt bond yields are mostly lower than U.S. rates and economic growth prospects are less bright. “Everybody worried about what would happen to the U.S. government [bond] market when the Fed ended [its third round of quantitative easing] last fall and stopped its heavy monthly government bond purchases,” he points out. “The answer, of course, is that foreign buying easily replaced declining government support of the market. And the strengthening dollar, which we think will continue, only makes U.S. bonds all the more attractive, for not only do foreign investors benefit from higher relative rates, but they also win on currency translation profits.

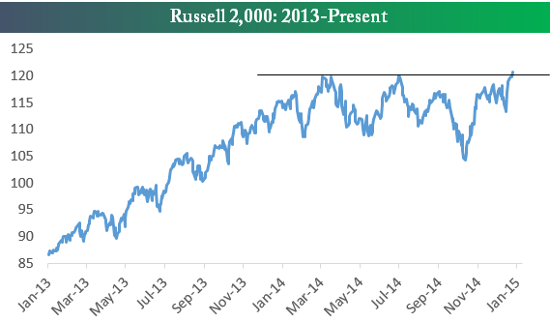

Small Caps finally broke out to All Time New Highs over the Winter break; it will be important to see if they can hold their outperformance…

I found this tip helpful over the break while in the various family and rental cars that I was driving. Thanks Meb…

@MebFaber: Probably the most significant thing I learned in 2014: the fuel gauge on your car points to side the gas tank is on.

Disclaimer: The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful.