Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Consumers often gripe that government price data understate the true nature of inflation.

Nonetheless, it’s safe to say that the cost of goods and services has been rising at a steadily slower rate in most countries.

In fact, according to GaveKal Capital, global inflation just hit a 59-month low.

And the recent, steep decline in the price of oil is going to cause further disinflation – a declining rate of inflation.

Sounds like a good thing, right?

In fact, this is actually a nightmare for central bankers who are actively fighting gargantuan deflationary pressures…

Central bankers would like to see a moderately high rate of inflation because this would decrease the real value of debt (and there happens to be a lot of debt).

As we know, inflation rates and interest rates are very closely linked.

Coupled with slowing global economic growth, disinflationary trends are pushing government bond yields down to never-before-seen levels.

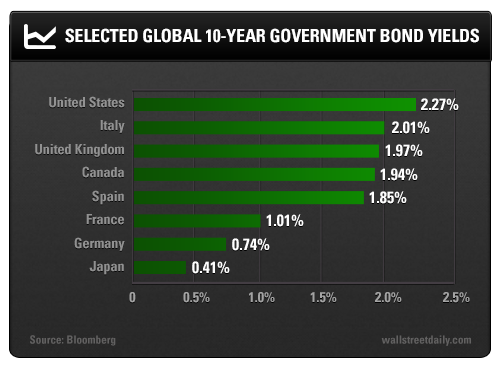

The following table shows selected global bond yields below that of U.S. 10-Year: Treasuries.

The belief that the Federal Reserve is solely responsible for low interest rates in the U.S. is a common fallacy.

After all, the European Central Bank (ECB) hasn’t bought a single German Bund, and yet the German 10-year rate is a miniscule 0.74%.

This is because long-term government bond yields are fundamentally driven by growth and inflation expectations (at least for countries with a low risk of default).

Since much of Europe is on the brink of outright deflation, European sovereign yields continue to trend lower.

There’s a real risk that the eurozone becomes mired in a prolonged no-growth, deflationary malaise – the so-called “Japanification” of Europe.

This is why many policymakers are calling for the ECB to aggressively expand its balance sheet, like the Federal Reserve and the Bank of Japan have done.

Ignoring The Trends

The eurozone certainly has a lot of problems to contend with, including high sovereign debt levels and a flawed currency system.

However, global demographic shifts are also putting downward pressure on growth and inflation rates.

Fertility rates have been declining, and small families are becoming the norm. Basically, the global workforce won’t be expanding as quickly as it did over the past several decades.

Indeed, demography may help to explain a significant amount of the world’s secular economic stagnation.

Unfortunately, these trends will persist.

Yet, I continue to see calls for higher long-term interest rates in the United States. Perhaps the table above will help put the situation into perspective.

As I’ve said before, long-term Treasury rates in the United States will stay low for much longer than most people anticipate.

Central banks are losing ground in the war against deflation, thanks in large part to collapsing commodity prices in the short term, and demographic shifts in the long term.

Eventually, everyone will stop forecasting higher interest rates and instead start to wonder how long low interest rates will persist.

In this environment, I continue to believe that preferred stocks are one of the most attractive asset class categories for income seekers.

Safe (and high-yield) investing,

BY Alan Gula, CFA