This article was written exclusively for Investing.com

- New generation of leadership faces climate change

- Reviewing assets, eyeing acquisitions

- Recently hired strategists direct from Wall Street

- Bullish trading pattern since March 2020

- An attractive dividend and the potential for a new all-time high in GLNCY

Glencore (OTC:GLNCY), the Switzerland-based basic materials miner and marketer is unique as it is both a producer and merchant.

Founded in 1974 by Marc Rich, a controversial character who began his career at Philipp Brothers, the world’s leading commodity dealer, Rich learned the raw materials business from the ground up. He received his training from some of the most profitable traders in those years and ultimately became Philipp Brothers's biggest revenue producer.

With a co-worker, Pincus Green, Rich left Philipp Brothers in 1974 to set up their own business, Marc Rich and Co. AG in Switzerland. Though Rich ran into problems with the US government after trading oil with Iran during the hostage crisis in the late 1970s, his company flourished. It ultimately morphed from being just a commodity merchant to a company that not only traded but owned commodity assets worldwide. In 2013 Glencore purchased Xstrata, a producer of many raw materials and became an international commodity powerhouse selling metals and minerals, oil, gas, coal and oil products as well as agricultural products to customers worldwide.

The current inflationary environment puts Glencore in a perfect position to profit over the coming years, and GLNCY is adjusting its strategy accordingly, to deliver optimal results to shareholders.

New generation of leadership faces climate change

In late June of this year, Gary Nagle took over as CEO of Glencore. With his roots in the coal business, Nagel defended the company’s role in the industry as activist investors called for the resources company to focus more on metals used in a decarbonized global economy. Bluebell Capital Partners said:

“Glencore is not an investable company for investors who place sustainability at the heart of their investment process.”

Nagle responded by saying:

“The commitment to phase down the use of fossil fuels is consistent with our strategy of responsibly depleting our coal portfolio over time, as we prioritize investment in metals needed for the transition. We are committed to reducing our total emissions by 15% by 2026 and 50% by 2035, both on 2019 levels. Post 2035, our ambition is to achieve net zero total emissions by 2050, with a supportive policy environment.”

Nevertheless, Glencore remains a critical player in the global coal markets, which has added to the company's earnings in 2021. China and India remain substantial coal consumers, as the fossil fuel is far less expensive than other fossil fuels and alternative energy sources.

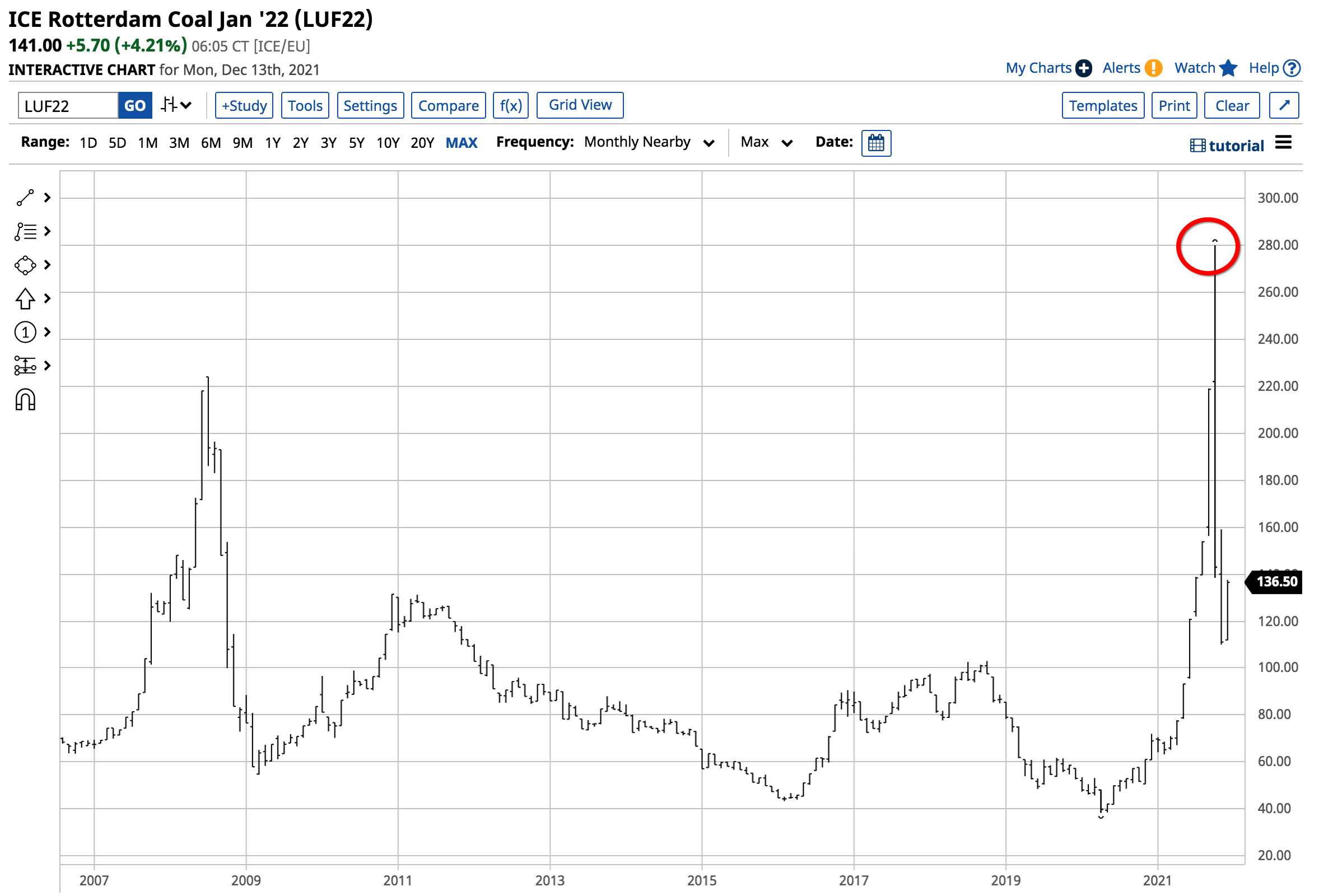

Meanwhile, the price action in coal in 2021 has been explosive.

Source: Barchart

The chart highlights the price action in thermal coal for delivery in Rotterdam, the Netherlands. In October 2021, the price rose above the 2008 $224 per ton high, reaching $280. At over $140 per ton on Dec. 15, coal was still trading at the highest price since October 2008.

Many energy companies exited the coal business because of pressure from activist investors. But Glencore has a dominant position in the worldwide coal arena. The price action has likely caused profits to roll into the company over the past months.

Reviewing assets, eyeing acquisitions

Aside from coal, GLNCY has moved to simplify its strategy under Gary Nagle.

“We have certain assets in our business that are sub-scale. As we’ve grown and developed longer life, tier-one assets, some assets are not fit for purpose.”

The new CEO wants to ensure that “management time is focused on the right assets in the right jurisdictions in the right commodities.”

Glencore’s unique position as a commodity merchant and producer allows the company to see the flows from production to consumption. Glencore is the first to notice price pressure points that lead to trend changes when gluts or deficits occur. Proprietary trading positions on the long or short side of markets allow the business to enhance earnings with speculative profits.

Recently hired strategists direct from Wall Street

GLNCY hired two Morgan Stanley executives to grow its franchise in late September. Cyrus Behbehani ran Morgan Stanley’s investment banking business in the Middle East. He will likely expand his profile with the Saudi Investment Fund and other Middle Eastern pools of capital, looking to diversify sovereign wealth funds.

The relationship could help Glencore move or swap some of its underperforming assets through M&A deals.

The company also hired Morgan Stanley’s commodity research analyst Susan Bates. Her position at the merchant and producer will allow Ms. Bates to see far more of the global flows that lead to price trends. The company also hired a Morgan Stanley trader to start an electricity desk in Europe.

John Mack, Morgan Stanley’s former CEO, was a long-time Glencore board member when Ivan Glasenberg ran the company from 2013 until he retired in 2020. Even after Glasenberg's departure, Glencore continues to have a close relationship with the US-based financial services giant.

Bullish trading pattern since March 2020

In March 2020, as the global pandemic gripped markets across all asset classes, GLNCY shares fell to a low of $2.51.

Source: Barchart

The chart shows the move from the March low to a high of $10.79 per share in October 2021. GLNCY shares more than quadrupled in value. Closing at $9.625 on Dec. 14, the stock remains not far below the high. Technical resistance is at the 2018 $11.68 high and the 2012 $15.70 peak.

At $9.625, GLNCY has a $63.71 billion market cap. An average of around 342,000 shares change hands each day.

Attractive dividend, potential for a new all-time high

Glencore pays its shareholders a 29.0 cents dividend, which translates to a 3.15% yield at the current share price. Along with its position in energy and other commodity markets worldwide, GLNCY is a leading copper producer, which bodes well for revenue growth and additional shareholder value.

Indeed, Goldman Sachs calls copper “the new oil.”

The top three copper-producing companies are Codelco, Glencore, and BHP (NYSE:BHP). Codelco is the Chilean state-owned copper producer that leads the world with 1.76 million tons of output. BHP is the Australian mining giant that produces 1.21 million tons of the red metal.

Glencore’s production is 1.26 million tons. With copper at the $4.2 per pound level on Dec. 15, the company is making money hand over fist from its copper output. Goldman Sachs has said that decarbonization does not occur without copper and has forecast the price to rise to the $15,000 per ton level by 2025. As the demand increases, supplies will not keep pace as it takes nearly a decade to bring new production on stream.

Meanwhile, $15,000 per ton equates to a copper price above $6.80 per pound, or over 50% above the current price. GLNCY is perfectly positioned to benefit from higher copper prices over the coming years. Moreover, copper is the leader among the nonferrous and other metals that are critical for battery production. With ownership of significant production assets for copper along with its position as a leading metals merchant, Glencore is well positioned to profit from any escalating demand.

I expect GLNCY to rise to new all-time highs over the coming years, surpassing its 2012 $15.70 high. Glencore's recent hires show the company is looking at strategic sales and acquisitions, while fortifying its analytical capabilities in order to profit during a commodities supercycle that began in 2020, continued in 2021, and looks set to continue taking raw material prices to higher highs in 2022 and beyond.