Investing.com’s stocks of the week

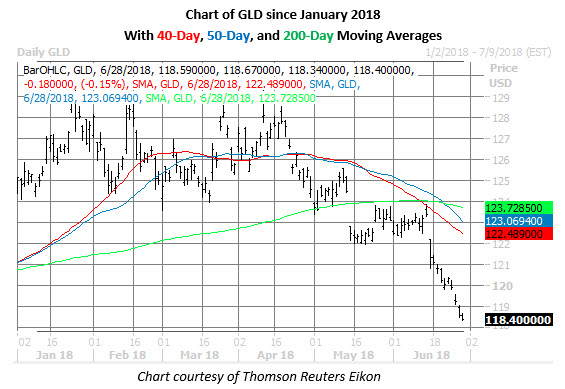

Gold prices have taken a hit since the Fed hiked interest rates earlier this month, with the SPDR Gold Shares) ETF (GLD) down more than 4% from its June 14 intraday peak at $123.86. Amid this decline, premium on the gold fund's put options has spiked -- a signal that could point to more volatility for the shares.

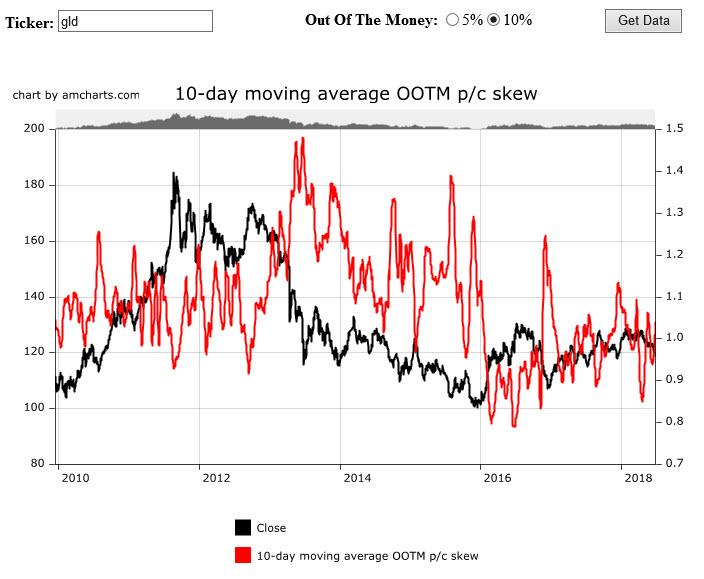

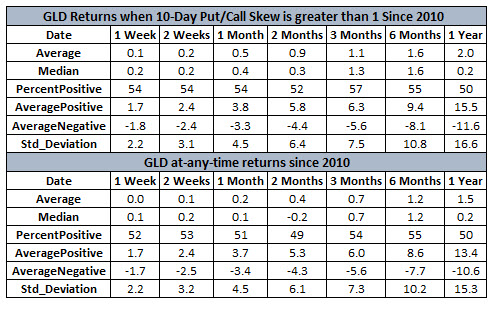

Specifically, the 10-day moving average of GLD's put/call skew on 10% out-of-the-money options recently topped 1.0, indicating puts are being priced higher than calls, last seen at 1.04. According to Schaeffer's Quantitative Analyst Chris Prybal, this has historically preceded periods of outperformance for the gold exchange-traded fund (ETF).

In the short term, returns are relatively muted, compared to GLD's anytime returns since 2010. However, the fund's average post-signal two-month return of 0.9% is more than double that of its anytime return of 0.4%. The gold fund also tends to be slightly more volatile starting two months after a signal, based on the standard deviation of returns since 2010.

In the near term, though, GLD has several layers of potential resistance to contend with. For starters, the start of the fund's recent sell-off coincided with a stiff rejection by its 40-day moving average. Plus, the ETF's 50- and 200-day moving averages recently flashed a "death cross" -- their first since just after the 2016 U.S. presidential election, which preceded a one-month, 6.4% drop in the fund, according to Schaeffer's Senior Quantitative Analyst Rocky White. At last check, GLD shares are down 0.2% at $118.40, pacing toward their ninth loss in 10 sessions.