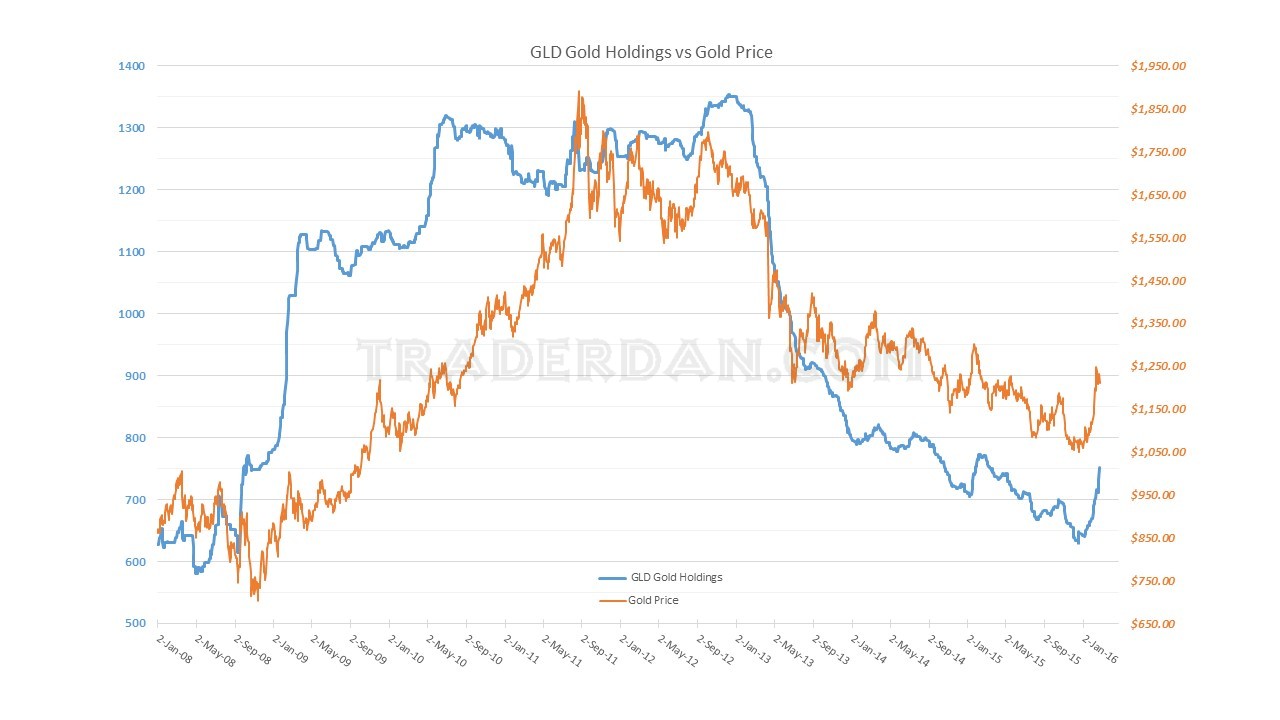

I can think of no better word except, “astounding”, when considering what is taking place with the giant gold ETF, SPDR Gold Shares (N:GLD) and its reported holdings increases.

Yesterday’s reported gold holdings showed an increase of exactly 19.33 tons to 752.29 tons. This is identical to the increase seen last Friday (19.33 tons). In two days time, we have seen almost 39 tons of gold added to the vaults of GLD. I am hard pressed to find anything similar in its past.

That this occurred on a day in which gold prices moved lower is even more interesting. The exact mechanism whereby the ETF adds or subtracts from its holdings is a bit more complex than exact mirroring of the moves in the price of the metal itself so what I am more interested in is the TREND.

That trend is moving higher and moving higher at a remarkable pace. Clearly, there are Western-based investors who are interested in getting exposure to gold in this current global economic environment. We do not necessarily need to know “WHY” they are doing so; all we need to know is that they are.

As long as this demand continues, gold is going to stay well supported in price.

John Brimelow’s “Gold Jottings” has pointed out the sharp fall in premiums for Indian gold sales which is noteworthy. I believe the two of us share the same conclusion, that this is a result of “sticker shock” coming on the heels of a near $200 increase in price in some four weeks time (John also notes the weakening rupee). India’s dealers are very price sensitive which is the reason that I believe this “pause” in the gold rally is both needed and constructive.

Gold buyers in India normally do not chase price higher. They like to buy on weakness. However, they also understand the pattern of Western-based buyers during gold price rallies well enough to know that these rallies do tend to experience periods in which price sets back and consolidates.

Indian buyers watch these movements closely. If they become of the opinion that price is STABILIZING at a higher level, they will begin to buy more aggressively. The reason: if they think prices are not going to set back significantly, they will then commit to purchases. They are all too well aware of the bouts of long liquidation which cause sharp falls in the price of gold. For these savvy buyers of the actual metal, they watch to see if that sort of thing will take place. After all, why buy now if they have a chance to buy more at a lower price?

This is why we watch to see how gold acts after a rally of this magnitude. If it does indeed garner buying support here in the West, and that buying reinforces downside price support levels, then Indian buyers will realize that the downside is limited and will step in. This will reinforce the downside in price for gold since you then get a combination of speculative buying of the COMEX futures at chart support levels alongside physical buying in the Asian marketplace. That helps cement a floor at a higher price level in the metal.

By the way, this is what has been missing for gold rallies beginning several years ago when gold was trapped in a vicious bear market. Now we want to see this sort of thing continue as it allows for a move higher, followed by a period of consolidation which allows Indian buyers time to become acclimated to the higher gold price, followed by a steady move higher in the price.

I am not predicting that this is what is going to happen. What I am saying is that is the pattern that is necessary to sustain a gold rally. It is what happened in the past when gold was in a trend higher. If we see this developing, that will be a very positive sign for the metal’s future prospects.